Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BM151: Financial Services - Portfolio Project 2 TAX 15 % Portfolio Project Overview For each course of the BFN Program, you will complete two tasks

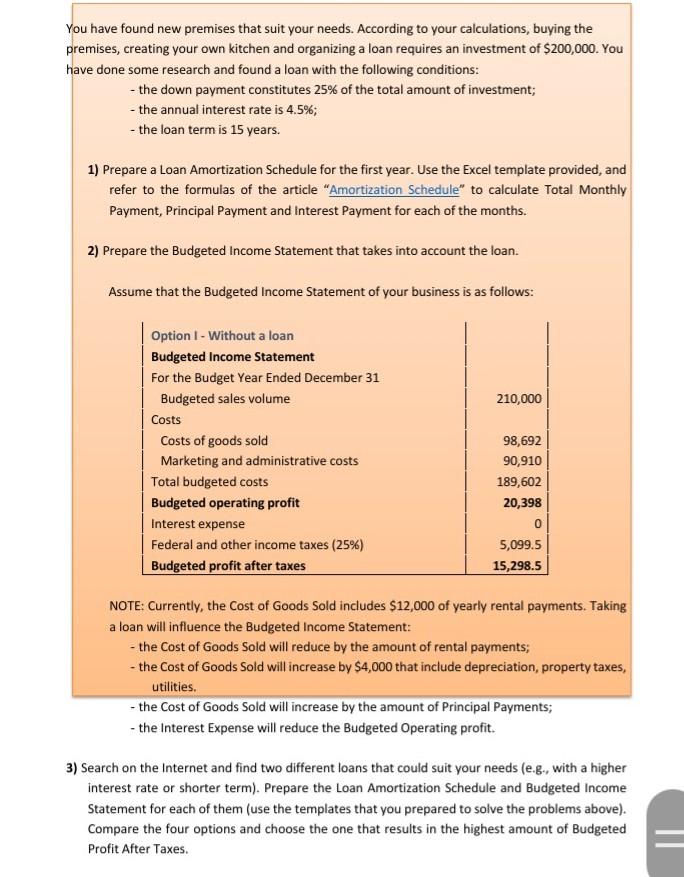

BM151: Financial Services - Portfolio Project 2 TAX 15 % Portfolio Project Overview For each course of the BFN Program, you will complete two tasks related to creating an online vegetarian catering business, which will constitute as part of your business plan. The purpose of the portfolio projects is to consider various aspects of small business activities, thereby demonstrating the application of knowledge, skills, and abilities acquired in each of your courses throughout the program. Your Portfolio Project will consist of 2 parts and will culminate in a presentation to the class showing the progress made during your business development and planning. Remember - both parts of the Portfolio Project are related, with each part building on the next part. Below is a list of topics that will be included in your portfolio from this course: BM151 Financial Services Taxes in Your Financial Plan Selecting and Financing Property Portfolio Project 1 Description: Taking a loan is one of the most important business decisions that a businessperson should make sooner or later. When you have an opportunity to grow, and the lack of financial resources is a factor that does not allow you to do so, you should definitely consider attracting investments to let your business develop. Taking a loan could be a relatively cheap and beneficial way to gain extra resources. Selecting and Financing Property For your online vegetarian catering business, you rent a commercial kitchen, which requires monthly payments of $1,000. On the one hand, you do not have to think about depreciation, repairs, property taxes and utility bills. On the other hand, the kitchen is too small, and you are not satisfied with how it is equipped. Additionally, you have found yourself in conflict with the owner and are concerned that he can terminate your contract unexpectedly. With an increased number of orders, you have decided to consider a loan to extend your business. You have found new premises that suit your needs. According to your calculations, buying the premises, creating your own kitchen and organizing a loan requires an investment of $200,000. You have done some research and found a loan with the following conditions: - the down payment constitutes 25% of the total amount of investment; - the annual interest rate is 4.5%; - the loan term is 15 years. 1) Prepare a Loan Amortization Schedule for the first year. Use the Excel template provided, and refer to the formulas of the article "Amortization Schedule" to calculate Total Monthly Payment, Principal Payment and Interest Payment for each of the months. 2) Prepare the Budgeted Income Statement that takes into account the loan. Assume that the Budgeted Income Statement of your business is as follows: 210,000 Option I - Without a loan Budgeted Income Statement For the Budget Year Ended December 31 Budgeted sales volume Costs Costs of goods sold Marketing and administrative costs Total budgeted costs Budgeted operating profit Interest expense Federal and other income taxes (25%) Budgeted profit after taxes 98,692 90,910 189,602 20,398 0 5,099.5 15,298.5 NOTE: Currently, the cost of Goods Sold includes $12,000 of yearly rental payments. Taking a loan will influence the Budgeted Income Statement: - the cost of Goods Sold will reduce by the amount of rental payments; - the Cost of Goods Sold will increase by $4,000 that include depreciation, property taxes, utilities. - the cost of Goods Sold will increase by the amount of Principal Payments; - the Interest Expense will reduce the Budgeted Operating profit. 3) Search on the Internet and find two different loans that could suit your needs (e.g., with a higher interest rate or shorter term). Prepare the Loan Amortization Schedule and Budgeted Income Statement for each of them (use the templates that you prepared to solve the problems above). Compare the four options and choose the one that results in the highest amount of Budgeted Profit After Taxes. BM151: Financial Services - Portfolio Project 2 TAX 15 % Portfolio Project Overview For each course of the BFN Program, you will complete two tasks related to creating an online vegetarian catering business, which will constitute as part of your business plan. The purpose of the portfolio projects is to consider various aspects of small business activities, thereby demonstrating the application of knowledge, skills, and abilities acquired in each of your courses throughout the program. Your Portfolio Project will consist of 2 parts and will culminate in a presentation to the class showing the progress made during your business development and planning. Remember - both parts of the Portfolio Project are related, with each part building on the next part. Below is a list of topics that will be included in your portfolio from this course: BM151 Financial Services Taxes in Your Financial Plan Selecting and Financing Property Portfolio Project 1 Description: Taking a loan is one of the most important business decisions that a businessperson should make sooner or later. When you have an opportunity to grow, and the lack of financial resources is a factor that does not allow you to do so, you should definitely consider attracting investments to let your business develop. Taking a loan could be a relatively cheap and beneficial way to gain extra resources. Selecting and Financing Property For your online vegetarian catering business, you rent a commercial kitchen, which requires monthly payments of $1,000. On the one hand, you do not have to think about depreciation, repairs, property taxes and utility bills. On the other hand, the kitchen is too small, and you are not satisfied with how it is equipped. Additionally, you have found yourself in conflict with the owner and are concerned that he can terminate your contract unexpectedly. With an increased number of orders, you have decided to consider a loan to extend your business. You have found new premises that suit your needs. According to your calculations, buying the premises, creating your own kitchen and organizing a loan requires an investment of $200,000. You have done some research and found a loan with the following conditions: - the down payment constitutes 25% of the total amount of investment; - the annual interest rate is 4.5%; - the loan term is 15 years. 1) Prepare a Loan Amortization Schedule for the first year. Use the Excel template provided, and refer to the formulas of the article "Amortization Schedule" to calculate Total Monthly Payment, Principal Payment and Interest Payment for each of the months. 2) Prepare the Budgeted Income Statement that takes into account the loan. Assume that the Budgeted Income Statement of your business is as follows: 210,000 Option I - Without a loan Budgeted Income Statement For the Budget Year Ended December 31 Budgeted sales volume Costs Costs of goods sold Marketing and administrative costs Total budgeted costs Budgeted operating profit Interest expense Federal and other income taxes (25%) Budgeted profit after taxes 98,692 90,910 189,602 20,398 0 5,099.5 15,298.5 NOTE: Currently, the cost of Goods Sold includes $12,000 of yearly rental payments. Taking a loan will influence the Budgeted Income Statement: - the cost of Goods Sold will reduce by the amount of rental payments; - the Cost of Goods Sold will increase by $4,000 that include depreciation, property taxes, utilities. - the cost of Goods Sold will increase by the amount of Principal Payments; - the Interest Expense will reduce the Budgeted Operating profit. 3) Search on the Internet and find two different loans that could suit your needs (e.g., with a higher interest rate or shorter term). Prepare the Loan Amortization Schedule and Budgeted Income Statement for each of them (use the templates that you prepared to solve the problems above). Compare the four options and choose the one that results in the highest amount of Budgeted Profit After Taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started