Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BOA originates 100 Fully Amortizing Fixed Rate Mortgages, each has a $1,000 balance, 5% interest rate (no fees), 25-year term, and annual payments. BOA

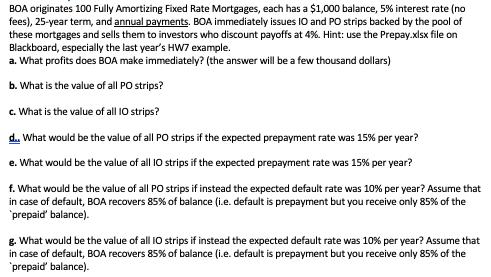

BOA originates 100 Fully Amortizing Fixed Rate Mortgages, each has a $1,000 balance, 5% interest rate (no fees), 25-year term, and annual payments. BOA immediately issues IO and PO strips backed by the pool of these mortgages and sells them to investors who discount payoffs at 4%. Hint: use the Prepay.xlsx file on Blackboard, especially the last year's HW7 example. a. What profits does BOA make immediately? (the answer will be a few thousand dollars) b. What is the value of all PO strips? c. What is the value of all 10 strips? d... What would be the value of all PO strips if the expected prepayment rate was 15% per year? e. What would be the value of all 10 strips if the expected prepayment rate was 15% per year? f. What would be the value of all PO strips if instead the expected default rate was 10% per year? Assume that in case of default, BOA recovers 85% of balance (i.e. default is prepayment but you receive only 85% of the prepaid' balance). g. What would be the value of all IO strips if instead the expected default rate was 10% per year? Assume that in case of default, BOA recovers 85% of balance (i.e. default is prepayment but you receive only 85% of the prepaid' balance).

Step by Step Solution

★★★★★

3.54 Rating (178 Votes )

There are 3 Steps involved in it

Step: 1

a2000 The original mortgage pool has a total balance of 100000 The IO strip has a face value of 50000 and the PO strip has a face value of 25000 The IO strip will pay interest only for the first 25 ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started