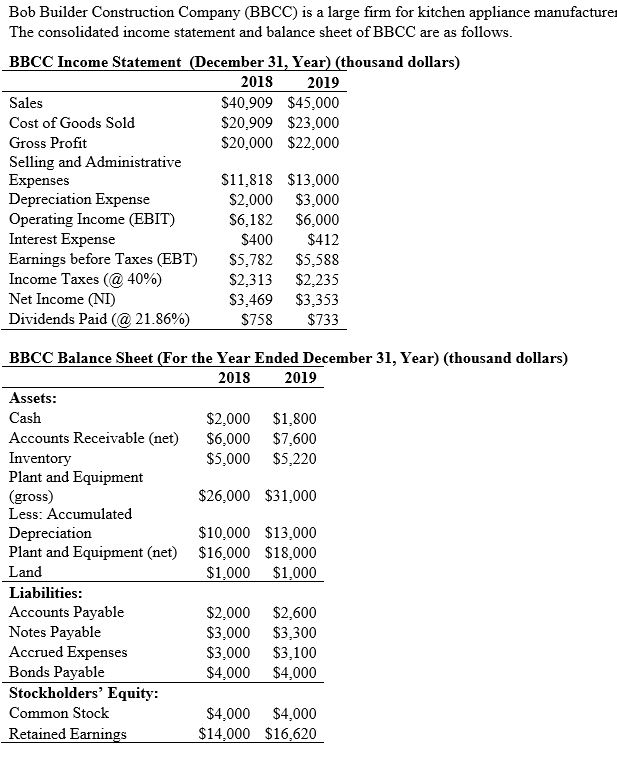

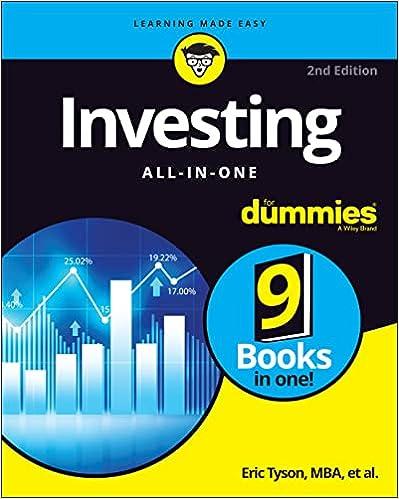

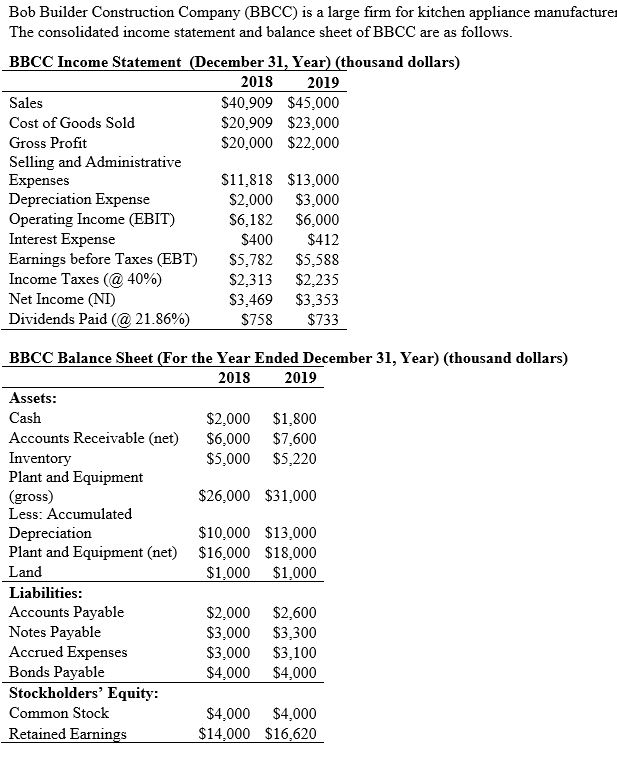

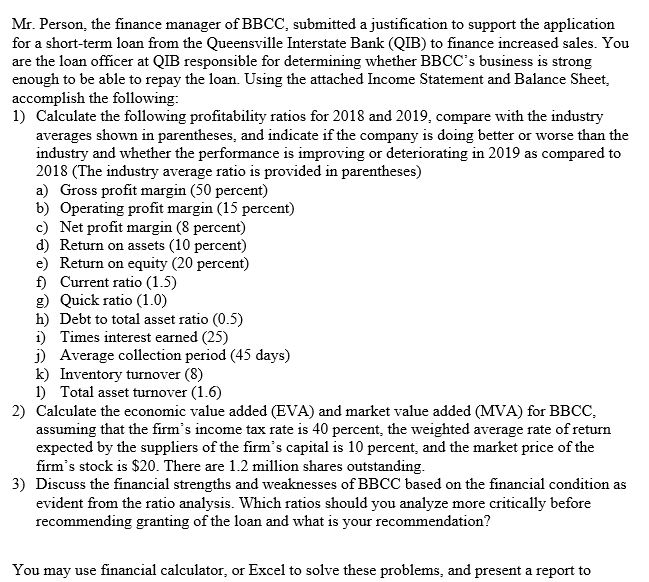

Bob Builder Construction Company (BBCC) is a large firm for kitchen appliance manufacturer The consolidated income statement and balance sheet of BBCC are as follows. BBCC Income Statement (December 31, Year) (thousand dollars) 2018 2019 Sales $40.909 $45,000 Cost of Goods Sold $20,909 $23,000 Gross Profit $20,000 $22.000 Selling and Administrative Expenses $11.818 $13,000 Depreciation Expense $2,000 $3,000 Operating Income (EBIT) $6.182 $6,000 Interest Expense $400 $412 Earnings before Taxes (EBT) $5,782 $5,588 Income Taxes @ 40%) $2,313 $2,235 Net Income (NI) $3,469 $3,353 Dividends Paid @ 21.86%) $758 $733 BBCC Balance Sheet (For the Year Ended December 31, Year) (thousand dollars) 2018 2019 Assets: Cash $2,000 $1,800 Accounts Receivable (net) $6,000 $7,600 Inventory $5,000 $5,220 Plant and Equipment (gross) $26.000 $31,000 Less: Accumulated Depreciation $10,000 $13,000 Plant and Equipment (net) $16,000 $18,000 Land $1,000 $1,000 Liabilities: Accounts Payable $2,000 $2,600 Notes Payable $3,000 $3,300 Accrued Expenses $3,000 $3,100 Bonds Payable $4,000 $4,000 Stockholders' Equity: Common Stock $4,000 $4,000 Retained Earnings $14,000 $16,620 Mr. Person, the finance manager of BBCC, submitted a justification to support the application for a short-term loan from the Queensville Interstate Bank (QIB) to finance increased sales. You are the loan officer at QIB responsible for determining whether BBCC's business is strong enough to be able to repay the loan. Using the attached Income Statement and Balance Sheet, accomplish the following: 1) Calculate the following profitability ratios for 2018 and 2019, compare with the industry averages shown in parentheses, and indicate if the company is doing better or worse than the industry and whether the performance is improving or deteriorating in 2019 as compared to 2018 (The industry average ratio is provided in parentheses) a) Gross profit margin (50 percent) b) Operating profit margin (15 percent) c) Net profit margin (8 percent) d) Return on assets (10 percent) e) Return on equity (20 percent) f) Current ratio (1.5) g) Quick ratio (1.0) h) Debt to total asset ratio (0.5) i) Times interest earned (25) 1) Average collection period (45 days) k) Inventory turnover (8) 1) Total asset turnover (1.6) 2) Calculate the economic value added (EVA) and market value added (MVA) for BBCC, assuming that the firm's income tax rate is 40 percent, the weighted average rate of return expected by the suppliers of the firm's capital is 10 percent, and the market price of the firm's stock is $20. There are 1.2 million shares outstanding. 3) Discuss the financial strengths and weaknesses of BBCC based on the financial condition as evident from the ratio analysis. Which ratios should you analyze more critically before recommending granting of the loan and what is your recommendation? You may use financial calculator, or Excel to solve these problems, and present a report to