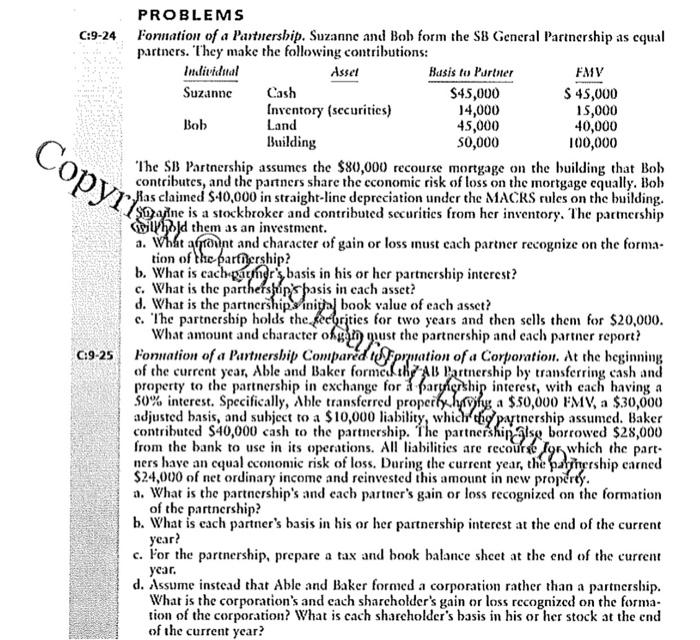

Bob Copyri PROBLEMS C:9-24 Formation of a Partnership. Suzanne and Bob form the S8 General Partnership as cqual partners. They make the following contributions: Individual Asset Busis to Purister FMV Suzanne Cash $45,000 $ 45,000 Inventory (securitics) 14,000 15,000 Land 45,000 40,000 Building 50,000 100,000 'The SB Partnership assumes the $80,000 recourse mortgage on the building that Bob contributes, and the partners share the economic risk of loss on the mortgage cqually, Bob Mas claimed $40,000 in straight-line depreciation under the MACRS rules on the building. Soaline is a stockbroker and contributed securities from her inventory. The partnership willhold them as an investment. a. What agrant and character of gain or loss inust cach partner recognize on the forma- tion of the partiership? b. What is cach patner's basis in his or her partnership interest? c. What is the parthetstin's basis in each asset? d. What is the partnerships initial book value of each asset? c. The partnership holds the geeyrities for two years and then sells them for $20,000. What amount and character of gause the partnership and each partner report? 6:9-25 Formation of a Partnership Compared ippation of a Corporation. At the beginning of the current year, Able and Baker formeliza Partnership by transferring cash and property to the partnership in exchange for a partnership interest, with each having a som interest. Specifically, Able transferred properly.hyrwya $50,000 FMV, a $30,000 adjusted basis, and subject to a $10,000 liability, which the partnership assumed. Baker contributed $40,000 cash to the partnership. The partnership also borrowed $28,000 from the bank to use in its operations. All liabilities are recours 195 which the part. ners have an equal economic risk of loss. During the current year, the partitership earned $24,000 of net ordinary income and reinvested this amount in new property. a. What is the partnership's and each partner's gain or loss recognized on the formation of the partnership? b. What is cach partner's basis in his or her partnership interest at the end of the current year? c. For the partnership, prepare a tax and book balance sheet at the end of the current year. d. Assume instead that Able and Baker formed a corporation rather than a partnership. What is the corporation's and cach sharcholder's gain or loss recognized on the forma tion of the corporation? What is cach shareholder's basis in his or her stock at the end of the current year