Answered step by step

Verified Expert Solution

Question

1 Approved Answer

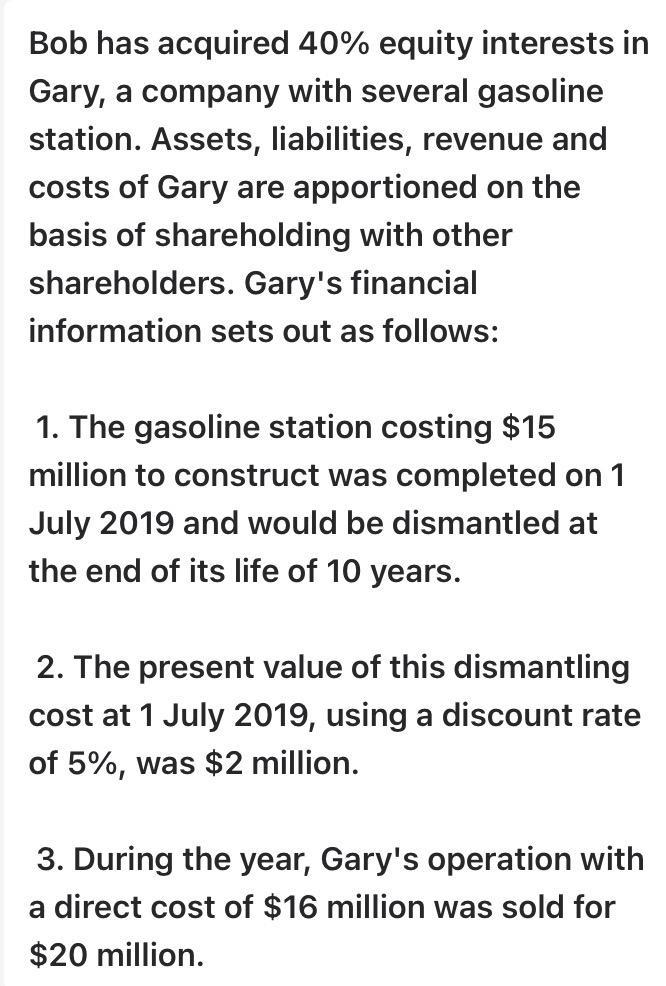

Bob has acquired 40% equity interests in Gary, a company with several gasoline station. Assets, liabilities, revenue and costs of Gary are apportioned on

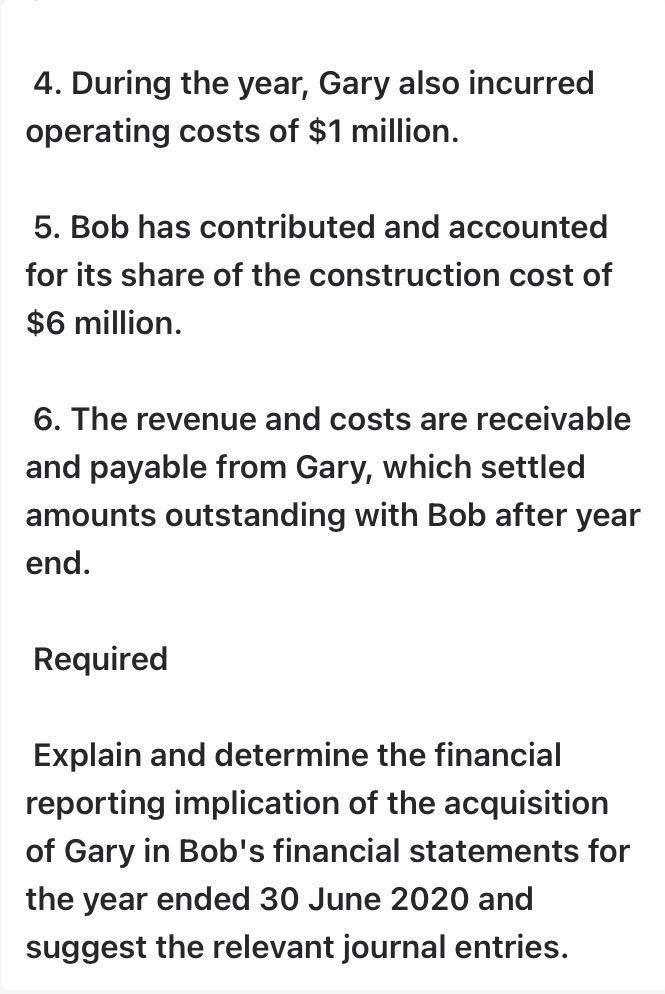

Bob has acquired 40% equity interests in Gary, a company with several gasoline station. Assets, liabilities, revenue and costs of Gary are apportioned on the basis of shareholding with other shareholders. Gary's financial information sets out as follows: 1. The gasoline station costing $15 million to construct was completed on 1 July 2019 and would be dismantled at the end of its life of 10 years. 2. The present value of this dismantling cost at 1 July 2019, using a discount rate of 5%, was $2 million. 3. During the year, Gary's operation with a direct cost of $16 million was sold for $20 million. 4. During the year, Gary also incurred operating costs of $1 million. 5. Bob has contributed and accounted for its share of the construction cost of $6 million. 6. The revenue and costs are receivable and payable from Gary, which settled amounts outstanding with Bob after year end. Required Explain and determine the financial reporting implication of the acquisition of Gary in Bob's financial statements for the year ended 30 June 2020 and suggest the relevant journal entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started