Answered step by step

Verified Expert Solution

Question

1 Approved Answer

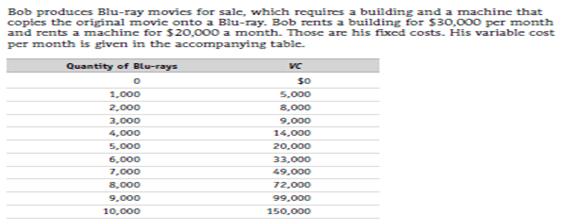

Bob produces Blu-ray movies for sale, which requires a building and a machine that copies the original movie onto a Blu-ray. Bob rents a

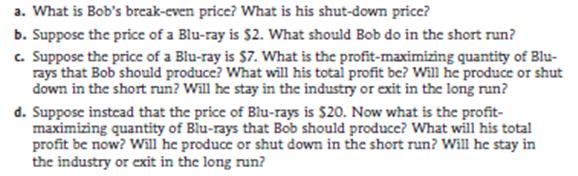

Bob produces Blu-ray movies for sale, which requires a building and a machine that copies the original movie onto a Blu-ray. Bob rents a building for S30,000 per month and rents a machine for $20,000 a month. Those are his fixed costs. His variable cost per month is given in the accompanying tabie. Quantity of Blu-rays so 1,000 5,000 2,000 8,000 3,000 9,000 4,000 14,000 5,000 20,000 6,000 33,000 7,000 49.000 8,000 72,000 9,000 99,000 10,000 150,000 a. What is Bob's break-cven price? What is his shut-down price? b. Suppose the price of a Blu-ray is $2. What should Bob do in the short run? c. Suppose the price of a Blu-ray is $7. What is the profit-maximizing quantity of Blu- rays that Bob should produce? What will his total profit be? Will he produce or shut down in the short run? Will he stay in the industry or exit in the long run? d. Suppose instcad that the price of Blu-rays is $20. Now what is the profit- maximizing quantity of Blu-rays that Bob should produce? What will his total profit be now? Will he produce or shut down in the short run? Will he stay in the industry or exit in the long run?

Step by Step Solution

★★★★★

3.45 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

a The breakeven price is where profit is zero So it is where P ATCmin 1338 The sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635f619f3b223_231894.pdf

180 KBs PDF File

635f619f3b223_231894.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started