Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bobby and Whitney are husband and wife, and Whitney operates a sole proprietorship. They expect their joint taxable income next year to be $ 2

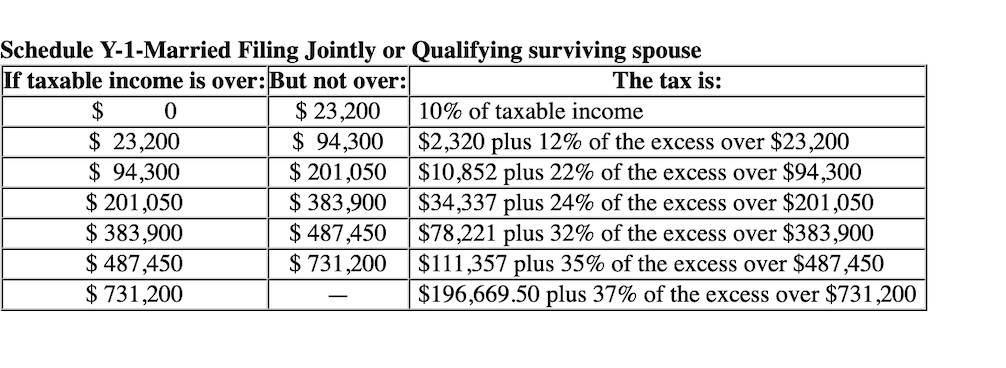

Bobby and Whitney are husband and wife, and Whitney operates a sole proprietorship. They expect their joint taxable income next year to be $ of which $ is attributed to the sole proprietorship. Whitney is contemplating incorporating the sole proprietorship. Using the married filing jointly tax brackets and the corporate tax brackets, how much current tax could this save Bobby and Whitney? How much income should be retained in the corporation?Schedule YMarried Filing Jointly or Qualifying surviving spouse

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started