Answered step by step

Verified Expert Solution

Question

1 Approved Answer

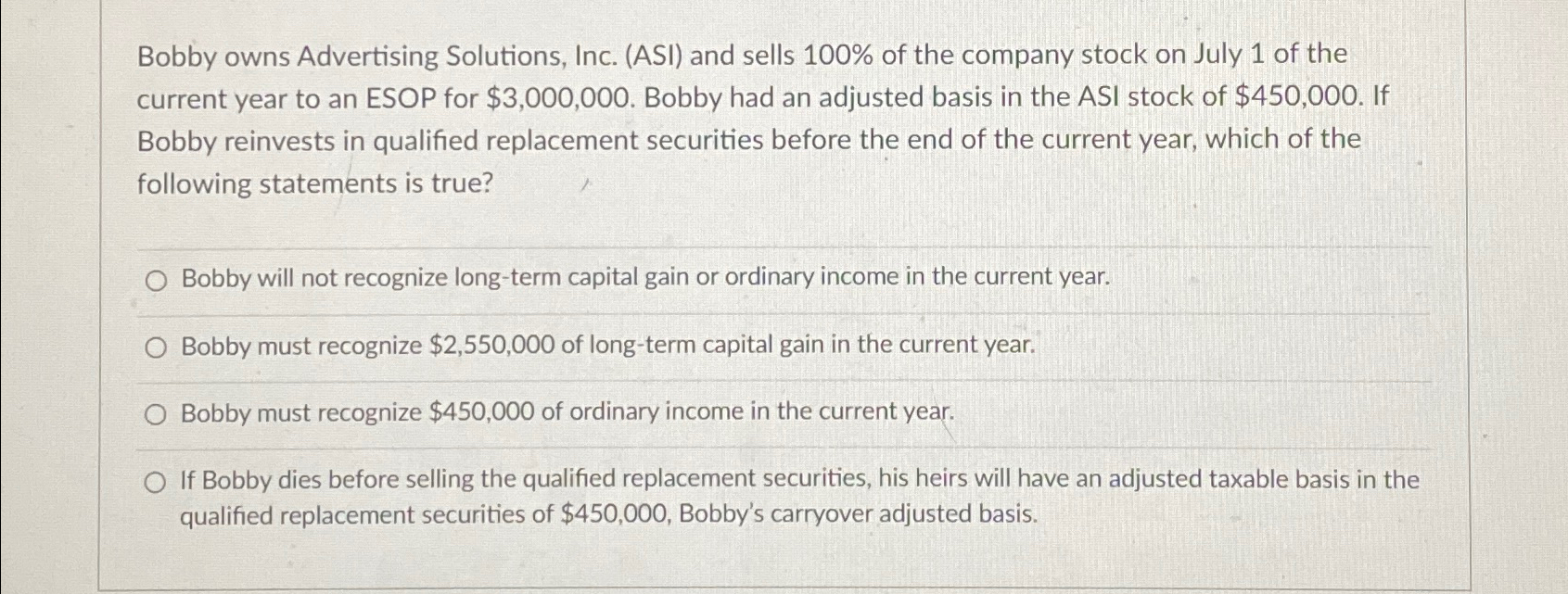

Bobby owns Advertising Solutions, Inc. ( ASI ) and sells 1 0 0 % of the company stock on July 1 of the current year

Bobby owns Advertising Solutions, Inc. ASI and sells of the company stock on July of the current year to an ESOP for $ Bobby had an adjusted basis in the ASI stock of $ If Bobby reinvests in qualified replacement securities before the end of the current year, which of the following statements is true?

Bobby will not recognize longterm capital gain or ordinary income in the current year.

Bobby must recognize $ of longterm capital gain in the current year.

Bobby must recognize $ of ordinary income in the current year.

If Bobby dies before selling the qualified replacement securities his heirs will have an adjusted taxable basis in the qualified replacement securities of $ Bobby's carryover adjusted basis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started