Question

Bobcat Printing makes custom t---shirts and other promotional products for student organizations and businesses. It is beginning its first year of operations and needs to

Bobcat Printing makes custom t---shirts and other promotional products for student organizations and businesses. It is beginning its first year of operations and needs to plan for its first quarter of operations. They would like to maximize their profits, and understand that accurate budgeting can help achieve that goal. The budgets will be prepared based on the following information:

$4,500 per month. All SG&A expenses are paid in the month they are incurred.

Check Figures: |

|

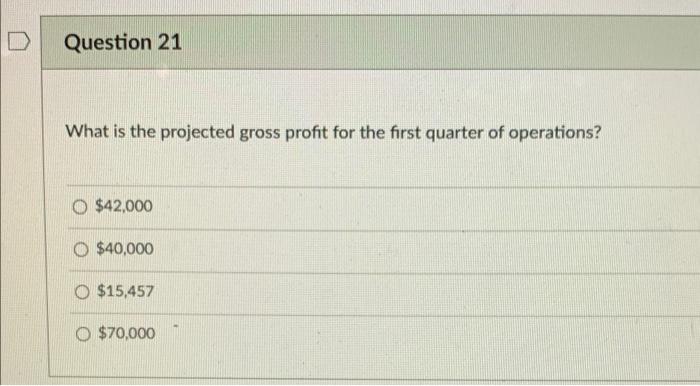

Gross Margin | $42,000 |

Total assets | $16,000 |

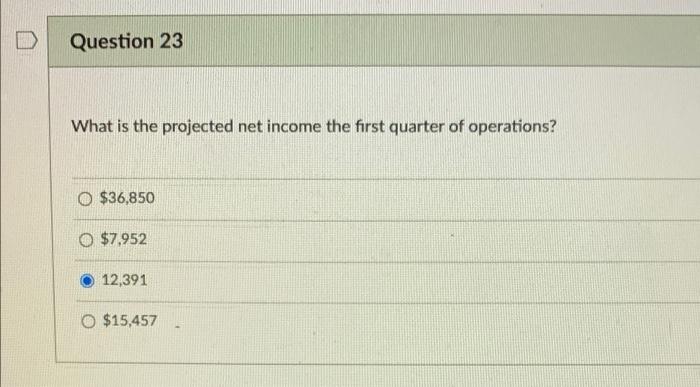

Ending Retained Earnings | $3,391 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started