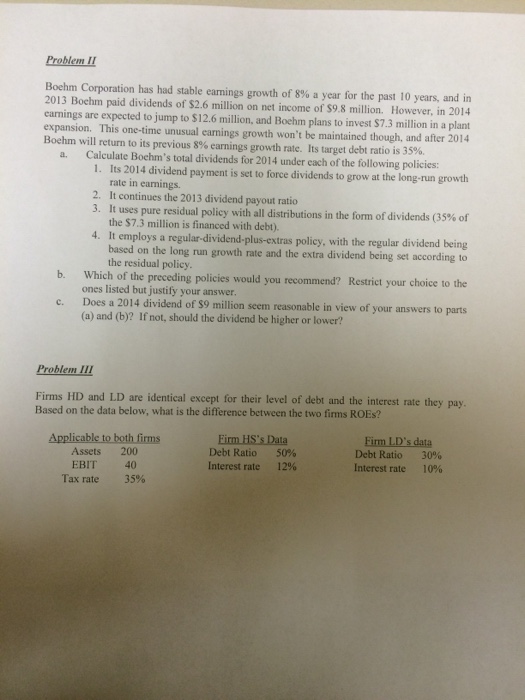

Boehm Corporation has had stable earnings growth of 8% a year for the past 10 years, and in 2013 Boehm paid dividends of $2.6 million on net income of $9.8 million. However, in 2014 earnings are expected to jump to $12.6 million, and Boehm plans to invest $7.3 million in a plant expansion. This one-time unusual comings growth won't be maintained though, and after 2014 Boehm will return to its previous 8% earnings growth rate. Its target debt ratio is 35%. a. Calculate Boehm's total dividends for 2014 under each of the following policies: 1. Its 2014 dividend payment is set to force dividends to grow at the long-run growth rate in earnings. 2. It continues the 2013 dividend payout ratio 3. It uses pure residual policy with all distributions in the form of dividends (35% of the $7.3 million is financed with debt) 4. It employs a regular-dividend-plus-extras policy, with the regular dividend being based on the long run growth rate and the extra dividend being set according to the residual policy. b. Which of the preceding policies would you recommend? Restrict your choice to the Ones listed but justify your answer. c. Does a 2014 dividend of $9 million seem reasonable in view of your answers to parts (a) and (b)? If not, should the dividend be higher or lower? Firms HD and LD are identical except for their level of debt and the interest rate they pay. Based on the data below, what is the difference between the two lions ROEs? Boehm Corporation has had stable earnings growth of 8% a year for the past 10 years, and in 2013 Boehm paid dividends of $2.6 million on net income of $9.8 million. However, in 2014 earnings are expected to jump to $12.6 million, and Boehm plans to invest $7.3 million in a plant expansion. This one-time unusual comings growth won't be maintained though, and after 2014 Boehm will return to its previous 8% earnings growth rate. Its target debt ratio is 35%. a. Calculate Boehm's total dividends for 2014 under each of the following policies: 1. Its 2014 dividend payment is set to force dividends to grow at the long-run growth rate in earnings. 2. It continues the 2013 dividend payout ratio 3. It uses pure residual policy with all distributions in the form of dividends (35% of the $7.3 million is financed with debt) 4. It employs a regular-dividend-plus-extras policy, with the regular dividend being based on the long run growth rate and the extra dividend being set according to the residual policy. b. Which of the preceding policies would you recommend? Restrict your choice to the Ones listed but justify your answer. c. Does a 2014 dividend of $9 million seem reasonable in view of your answers to parts (a) and (b)? If not, should the dividend be higher or lower? Firms HD and LD are identical except for their level of debt and the interest rate they pay. Based on the data below, what is the difference between the two lions ROEs