Question

Boeing (American company) has sold 1 airplane to Air France (EU). The price of an airplane is the equivalent of 10 million USD today, but

Boeing (American company) has sold 1 airplane to Air France (EU). The price of an airplane is the equivalent of 10 million USD today, but the invoice currency is that of the airlines home currency. The payment is due 1 year from now.

Boeing should buy/sell _________ Euros forward

How much will Boeing receive, 1 year from now, if it hedges using the Forward contract?

If Boeing decides not to hedge, how much will the EUR payment made by Air France be worth if the spot exchange rate 1 year from now is S(EUR/USD) = 1.05? What if it is S(EUR/USD) = 0.8?

Please show work

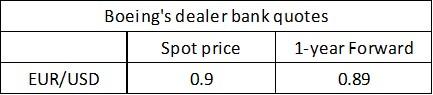

EUR/USD Boeing's dealer bank quotes Spot price 0.9 1-year Forward 0.89Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started