Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Boeing Corp. is considering building a new short-range commuter jet. The project is code named 'Sky Streak'. The plane is based on a new

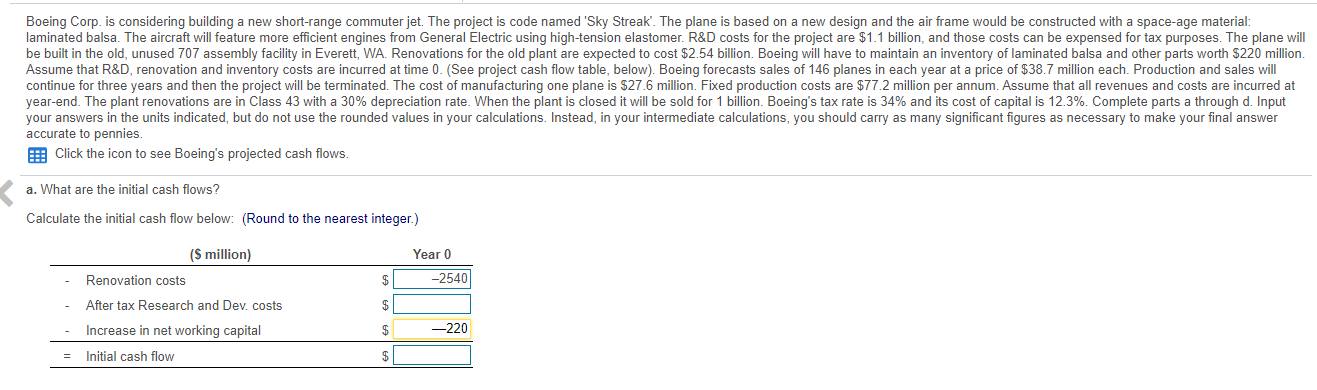

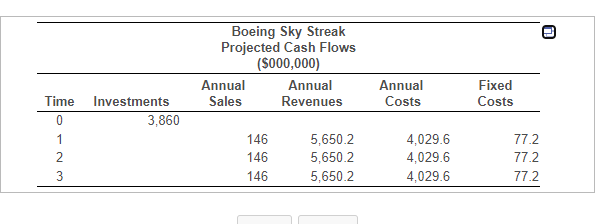

Boeing Corp. is considering building a new short-range commuter jet. The project is code named 'Sky Streak'. The plane is based on a new design and the air frame would be constructed with a space-age material: laminated balsa. The aircraft will feature more efficient engines from General Electric using high-tension elastomer. R&D costs for the project are $1.1 billion, and those costs can be expensed for tax purposes. The plane will be built in the old, unused 707 assembly facility in Everett, WA. Renovations for the old plant are expected to cost $2.54 billion. Boeing will have to maintain an inventory of laminated balsa and other parts worth $220 million. Assume that R&D, renovation and inventory costs are incurred at time 0. (See project cash flow table, below). Boeing forecasts sales of 146 planes in each year at a price of $38.7 million each. Production and sales will continue for three years and then the project will be terminated. The cost of manufacturing one plane is $27.6 million. Fixed production costs are $77.2 million per annum. Assume that all revenues and costs are incurred at year-end. The plant renovations are in Class 43 with a 30% depreciation rate. When the plant is closed it will be sold for 1 billion. Boeing's tax rate is 34% and its cost of capital is 12.3%. Complete parts a through d. Input your answers in the units indicated, but do not use the rounded values in your calculations. Instead, in your intermediate calculations, you should carry as many significant figures as necessary to make your final answer accurate to pennies. Click the icon to see Boeing's projected cash flows. a. What are the initial cash flows? Calculate the initial cash flow below: (Round to the nearest integer.) ($ million) Renovation costs After tax Research and Dev. costs Increase in net working capital Initial cash flow $ $ $ $ Year 0 -2540 -220 Time 0 WN O 2 3 Investments 3,860 Boeing Sky Streak Projected Cash Flows ($000,000) Annual Sales 146 146 146 Annual Revenues 5,650.2 5,650.2 5,650.2 Annual Costs 4,029.6 4,029.6 4,029.6 Fixed Costs 77.2 77.2 77.2 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the initial cash flows for the Boeing Sky Stre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started