Answered step by step

Verified Expert Solution

Question

1 Approved Answer

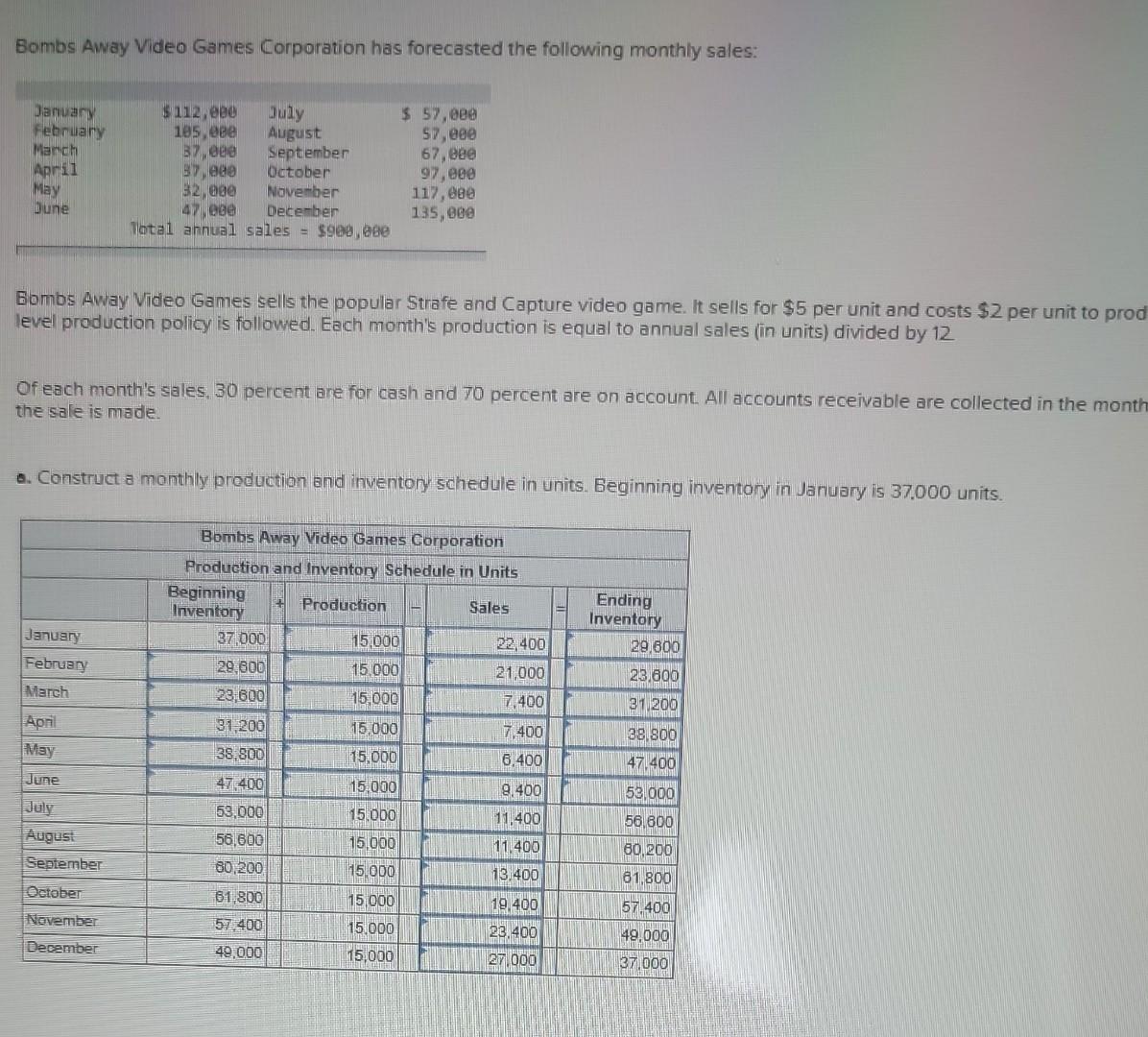

Bombs Away Video Games Corporation has forecasted the following monthly sales: January February $112,000 July $ 57,000 105,088 August 57,000 March April 37,000 September

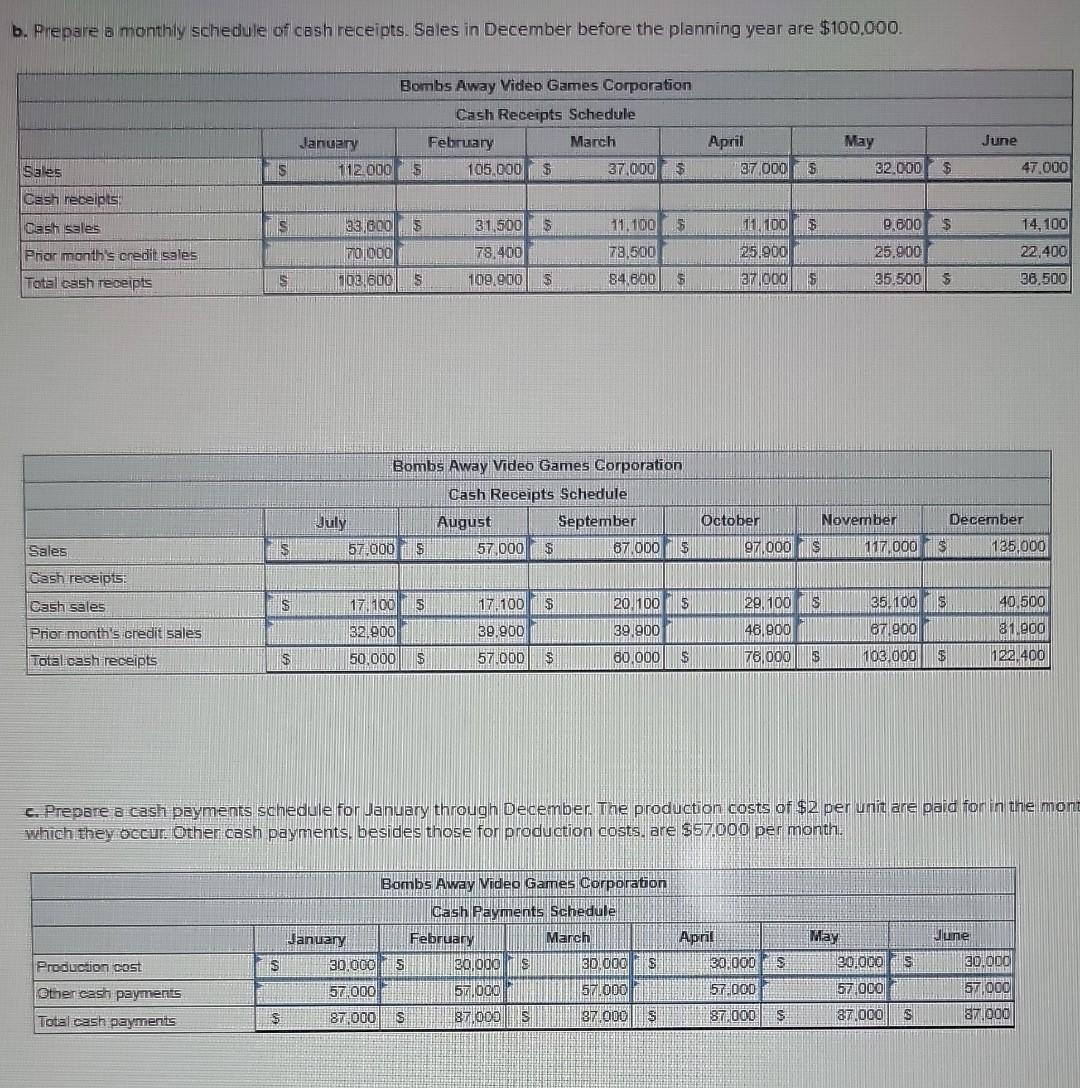

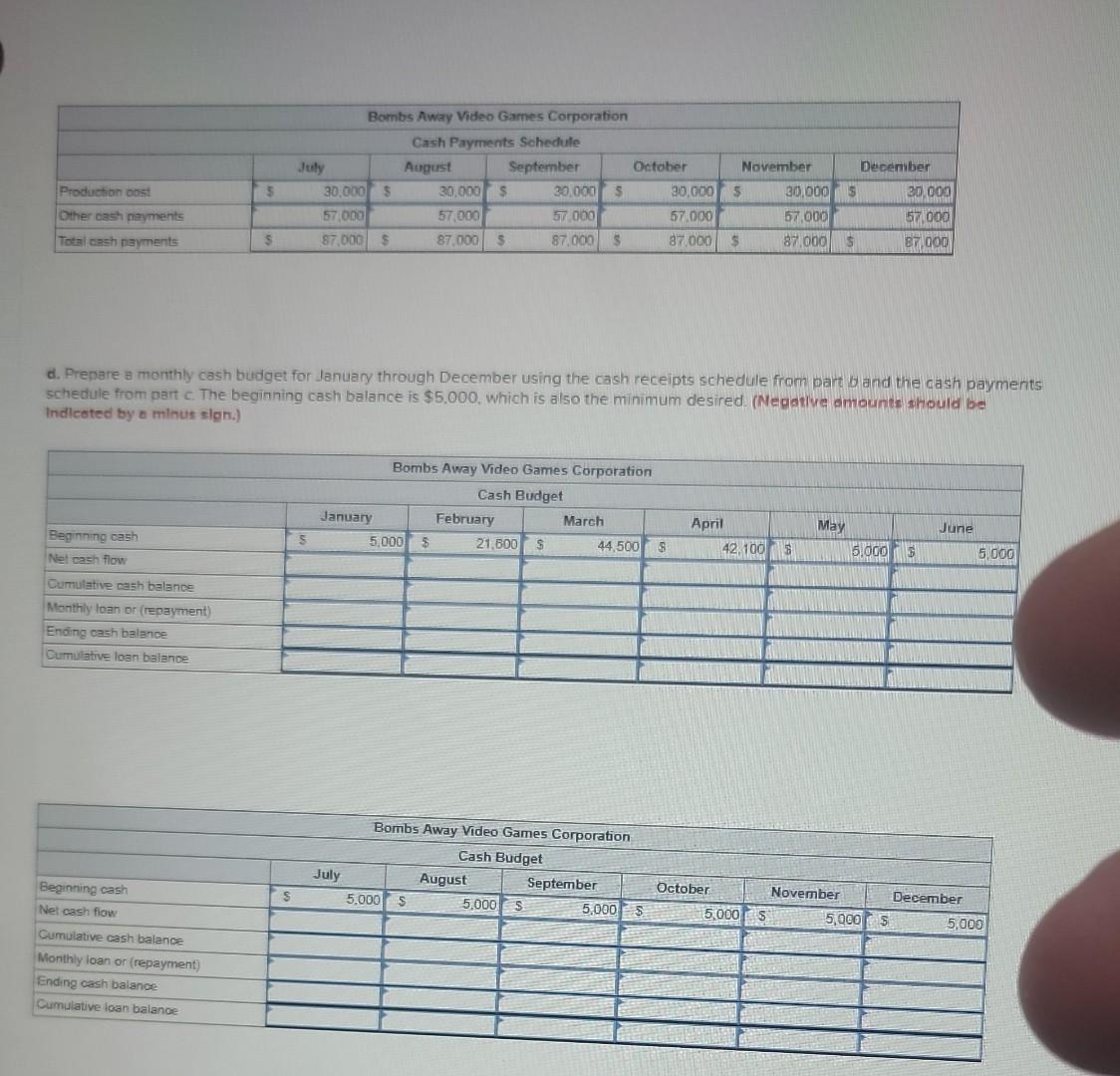

Bombs Away Video Games Corporation has forecasted the following monthly sales: January February $112,000 July $ 57,000 105,088 August 57,000 March April 37,000 September 67,000 37,000 October 97,000 May June 32,000 November 117,000 47,000 December 135,000 Total annual sales = $900,000 Bombs Away Video Games sells the popular Strafe and Capture video game. It sells for $5 per unit and costs $2 per unit to prod level production policy is followed. Each month's production is equal to annual sales (in units) divided by 12. Of each month's sales, 30 percent are for cash and 70 percent are on account. All accounts receivable are collected in the month the sale is made. a. Construct a monthly production and inventory schedule in units. Beginning inventory in January is 37,000 units. Bombs Away Video Games Corporation Production and Inventory Schedule in Units Beginning Production Sales Inventory Ending Inventory January February 37,000 15,000 22,400 29,600 29,600 15,000 21,000 23.600 March 23,600 15,000 7.400 31.200 April 31,200 15,000 7,400 38,800 May 38,800 15,000 6.400 47.400 June 47.400 15.000 9.400 53,000 July 53,000 15,000 11.400 56,600 August 56,600 15,000 11.400 60,200 September 60,200 15,000 13.400 61.800 October 61,800 15,000 19.400 57.400 November 57.400 15,000 23.400 49.000 December 49,000 15,000 27,000 37,000 b. Prepare a monthly schedule of cash receipts. Sales in December before the planning year are $100,000. Bombs Away Video Games Corporation Cash Receipts Schedule Sales Cash receipts: Cash sales Phar month's credit sales Total cash receipts January February March April May June 112.000 $ 105,000 $ 37,000 $ 37.000 32.000 $ 47.000 33,600 31,500 11,100 11,100 9.600 $ 14,100 70000 78,400 73.500 25.900 25,900 22,400 103,600 $ 109,900 $ 84.600 37,000 35.500 $ 36.500 Bombs Away Video Games Corporation Cash Receipts Schedule July August September October November December Sales Cash receipts: 57.000 57,000 $ 67.000 $ 97,000 $ 117,000 $ 135,000 Cash sales $ Prior month's credit sales 17.100 5 32.900 Total cash receipts $ 50.000 $ 17.100 $ 39,900 57.000 $ 20.100 5 39,900 60,000 $ 29,100 S 35,100 40,500 46,900 67.900 81.900 76,000 103,000 122.400 c. Prepare a cash payments schedule for January through December. The production costs of $2 per unit are paid for in the mont which they occur. Other cash payments, besides those for production costs, are $57,000 per month. Bombs Away Video Games Corporation Cash Payments Schedule January February March April May June Production cost 30,000 20,000 30,000 6 Other cash payments 57,000 57.000 57.000 30,000 57.000 20,000 30.000 57.000 57,000 Total cash payments $ 87,000 S 87,000 S 87.000 87,000 $ 87.000 87.000 Bombs Away Video Games Corporation Cash Payments Schedule July August September October November December Production cost 30,000 $ 30,000 $ Other cash payments 57,000 57,000 30,000 $ 57,000 30,000 $ 57.000 30,000 $ 30,000 57.000 57,000 Total cash payments $ 87,000 $ 87,000 $ 87,000 $ 87,000 $ 87,000 $ 87,000 d. Prepare a monthly cash budget for January through December using the cash receipts schedule from part b and the cash payments schedule from part c. The beginning cash balance is $5,000, which is also the minimum desired. (Negative amounts should be Indicated by a minus sign.) Beginning cash Net cash flow Cumulative cash balance Monthly loan or (repayment) Ending cash balance Cumulative loan balance Beginning cash Net cash flow Cumulative cash balance Monthly loan or (repayment) Ending cash balance Cumulative loan balance Bombs Away Video Games Corporation Cash Budget January February March April May June 5 5,000 $ 21,600 $ 44,500 42,100 5.000 G 5,000 Bombs Away Video Games Corporation Cash Budget July August September 5,000 $ 5,000 S 5,000 $ October November December 5,000 5 5,000 S 5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started