Answered step by step

Verified Expert Solution

Question

1 Approved Answer

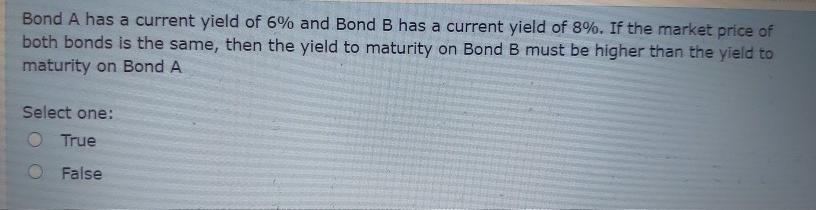

Bond A has a current yield of 6% and Bond B has a current yield of 8%. If the market price of both bonds is

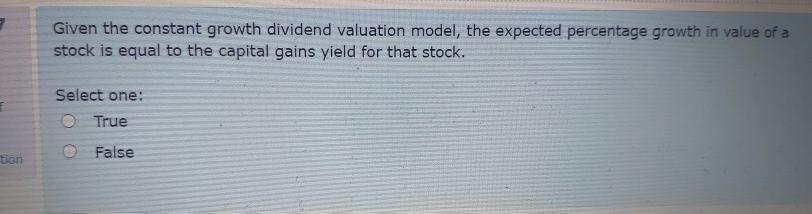

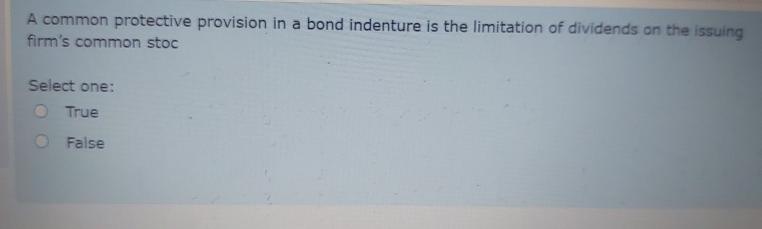

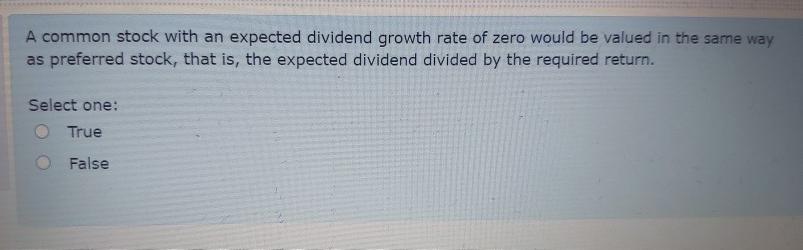

Bond A has a current yield of 6% and Bond B has a current yield of 8%. If the market price of both bonds is the same, then the yield to maturity on Bond B must be higher than the yield to maturity on Bond A Select one: True False Given the constant growth dividend valuation model, the expected percentage growth in value of a stock is equal to the capital gains yield for that stock. Select one: O True tion False A common protective provision in a bond indenture is the limitation of dividends on the issuing firm's common stoc Select one: True False A common stock with an expected dividend growth rate of zero would be valued in the same way as preferred stock, that is, the expected dividend divided by the required return. Select one: True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started