Answered step by step

Verified Expert Solution

Question

1 Approved Answer

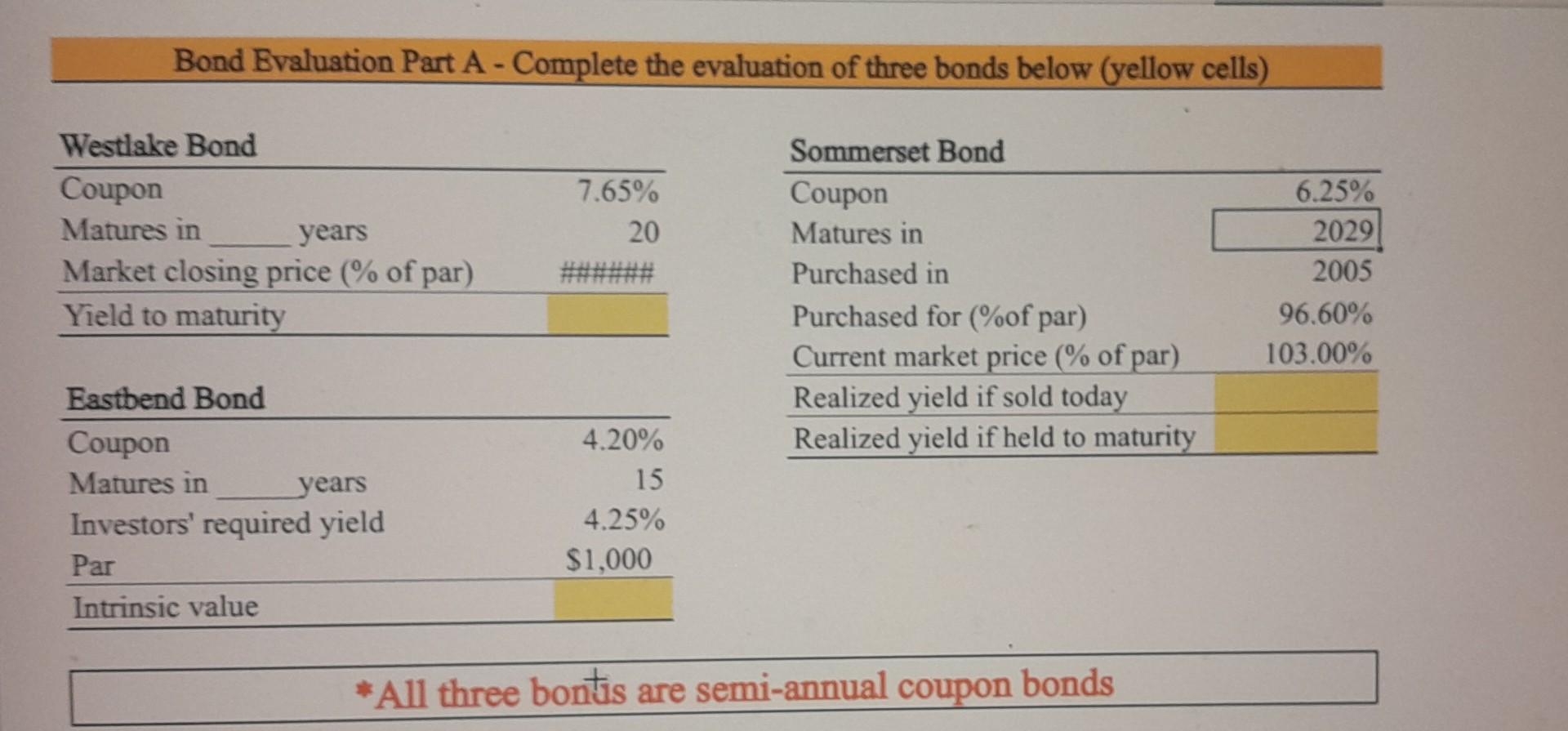

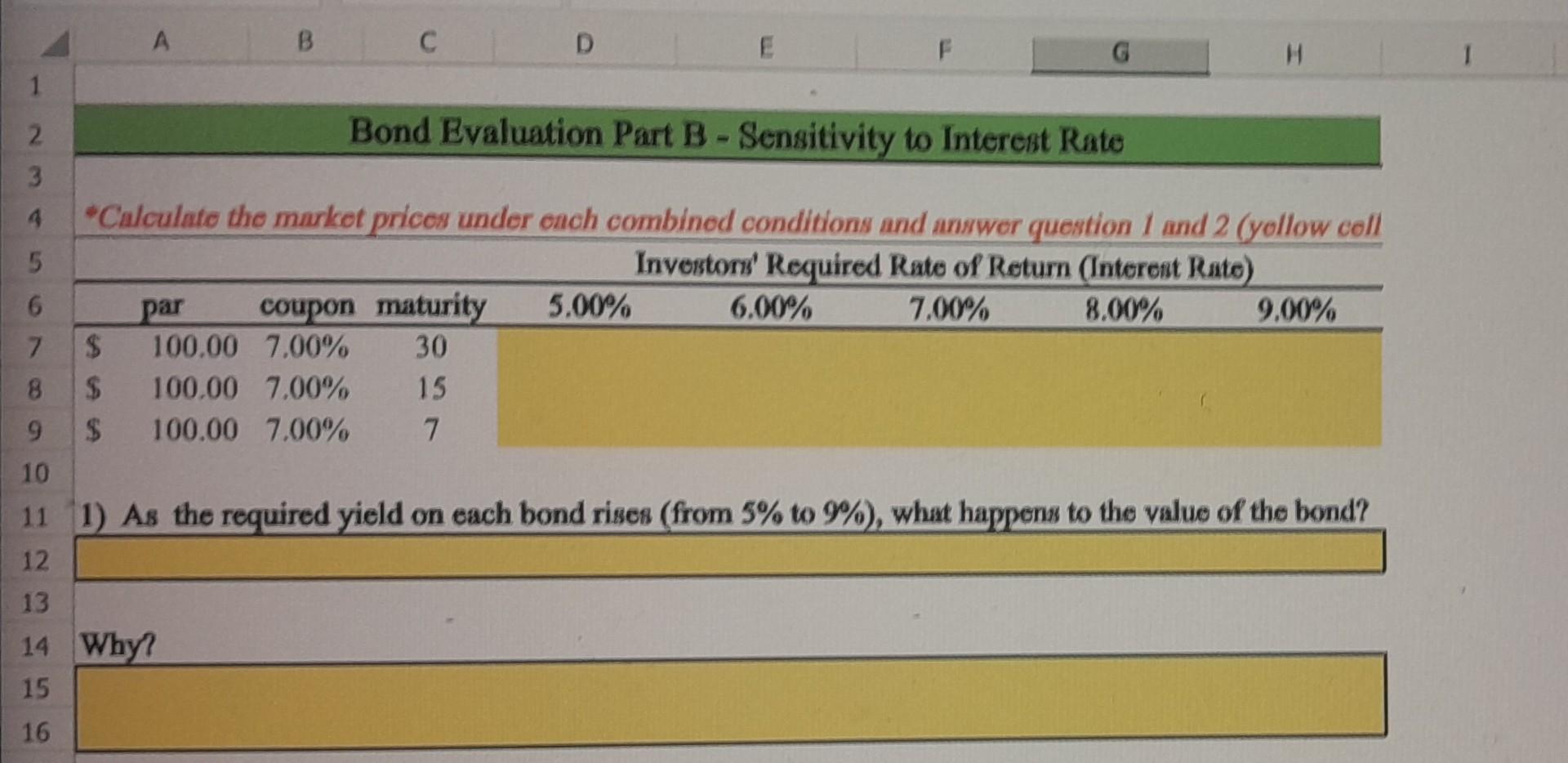

Bond Evaluation Part A - Complete the evaluation of three bonds below (yellow cells) * All three bontis are semi-annual coupon bonds 1) As the

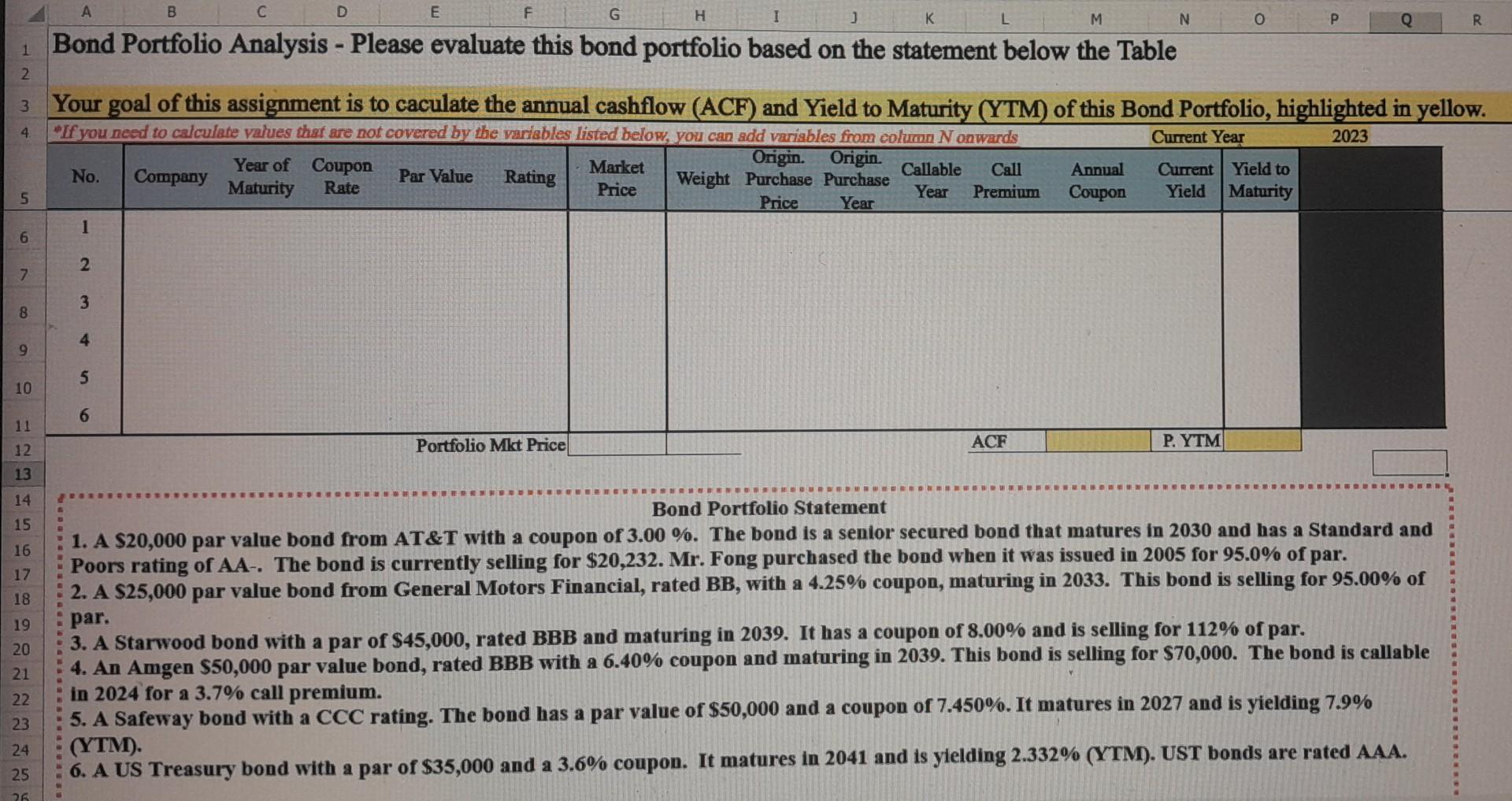

Bond Evaluation Part A - Complete the evaluation of three bonds below (yellow cells) * All three bontis are semi-annual coupon bonds 1) As the required yield on each bond rises (from 5% to 9% ), what happens to the value of the bond? Bond Portfolio Analysis - Please evaluate this bond portfolio based on the statement below the Table Your goal of this assignment is to caculate the annual cashflow (ACF) and Yield to Maturity (YTM) of this Bond Portfolio, highlighted in yellow Bond Portfolio Statement 1. A $20,000 par value bond from AT\&T with a coupon of 3.00%. The bond is a senior secured bond that matures in 2030 and has a Standard and Poors rating of AA-. The bond is currently selling for $20,232. Mr. Fong purchased the bond when it was issued in 2005 for 95.0% of par. 2. A $25,000 par value bond from General Motors Financial, rated BB, with a 4.25% coupon, maturing in 2033. This bond is selling for 95.00% of par. 3. A Starwood bond with a par of $45,000, rated BBB and maturing in 2039. It has a coupon of 8.00% and is selling for 112% of par. 4. An Amgen $50,000 par value bond, rated BBB with a 6.40% coupon and maturing in 2039 . This bond is selling for $70,000. The bond is callable in 2024 for a 3.7% call premium. 5. A Safeway bond with a CCC rating. The bond has a par value of $50,000 and a coupon of 7.450%. It matures in 2027 and is yielding 7.9% 6. A US Treasury bond with a par of $35,000 and a 3.6% coupon. It matures in 2041 and is ylelding 2.332% (YTM). UST bonds are rated AAA. (YTM). Bond Evaluation Part A - Complete the evaluation of three bonds below (yellow cells) * All three bontis are semi-annual coupon bonds 1) As the required yield on each bond rises (from 5% to 9% ), what happens to the value of the bond? Bond Portfolio Analysis - Please evaluate this bond portfolio based on the statement below the Table Your goal of this assignment is to caculate the annual cashflow (ACF) and Yield to Maturity (YTM) of this Bond Portfolio, highlighted in yellow Bond Portfolio Statement 1. A $20,000 par value bond from AT\&T with a coupon of 3.00%. The bond is a senior secured bond that matures in 2030 and has a Standard and Poors rating of AA-. The bond is currently selling for $20,232. Mr. Fong purchased the bond when it was issued in 2005 for 95.0% of par. 2. A $25,000 par value bond from General Motors Financial, rated BB, with a 4.25% coupon, maturing in 2033. This bond is selling for 95.00% of par. 3. A Starwood bond with a par of $45,000, rated BBB and maturing in 2039. It has a coupon of 8.00% and is selling for 112% of par. 4. An Amgen $50,000 par value bond, rated BBB with a 6.40% coupon and maturing in 2039 . This bond is selling for $70,000. The bond is callable in 2024 for a 3.7% call premium. 5. A Safeway bond with a CCC rating. The bond has a par value of $50,000 and a coupon of 7.450%. It matures in 2027 and is yielding 7.9% 6. A US Treasury bond with a par of $35,000 and a 3.6% coupon. It matures in 2041 and is ylelding 2.332% (YTM). UST bonds are rated AAA. (YTM)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started