Answered step by step

Verified Expert Solution

Question

1 Approved Answer

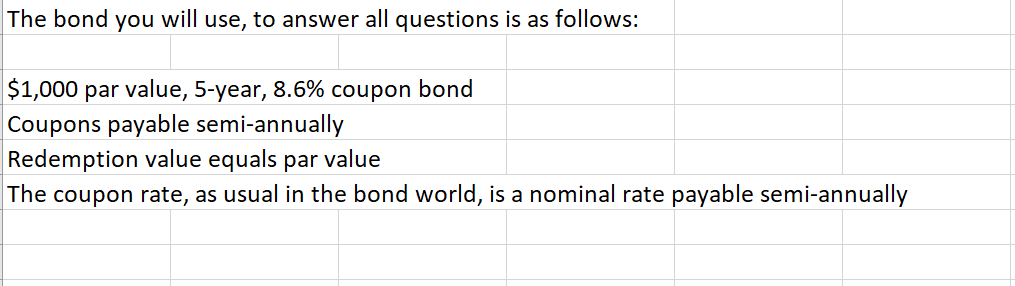

Bond info is given in the first photo if needed. Answers can be given as excel formulas The bond you will use, to answer all

Bond info is given in the first photo if needed. Answers can be given as excel formulas

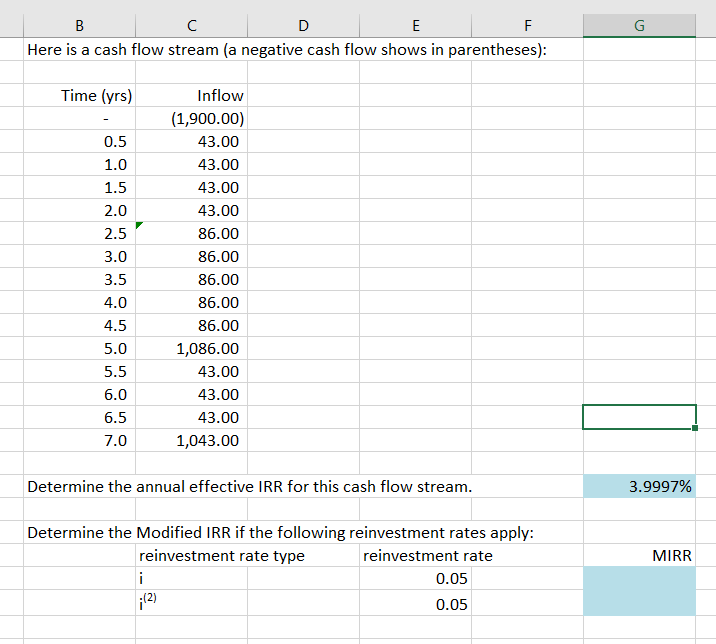

The bond you will use, to answer all questions is as follows: $1,000 par value, 5-year, 8.6% coupon bond Coupons payable semi-annually Redemption value equals par value The coupon rate, as usual in the bond world, is a nominal rate payable semi-annually G B C D E F Here is a cash flow stream (a negative cash flow shows in parentheses): Time (yrs) 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 Inflow (1,900.00) 43.00 43.00 43.00 43.00 86.00 86.00 86.00 86.00 86.00 1,086.00 43.00 43.00 43.00 1,043.00 Determine the annual effective IRR for this cash flow stream. 3.9997% MIRR Determine the Modified IRR if the following reinvestment rates apply: reinvestment rate type reinvestment rate i 0.05 (2) 0.05Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started