Answered step by step

Verified Expert Solution

Question

1 Approved Answer

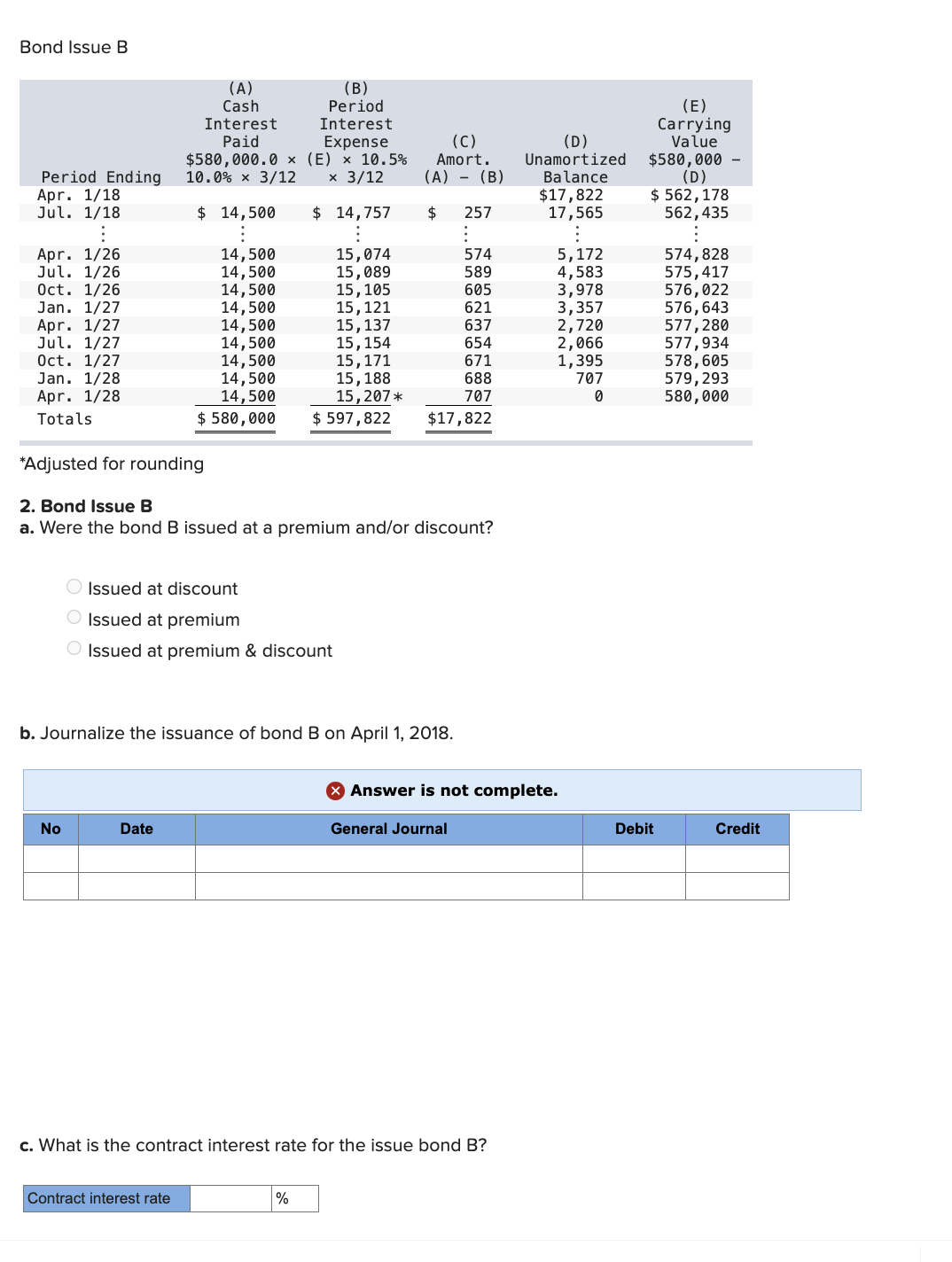

Bond Issue B (A) Period Ending Cash Interest Paid $580,000.0 10.0% x 3/12 (B) Period Interest Expense (E) 10.5% 3/12 (C) Amort. (D) (E)

Bond Issue B (A) Period Ending Cash Interest Paid $580,000.0 10.0% x 3/12 (B) Period Interest Expense (E) 10.5% 3/12 (C) Amort. (D) (E) Carrying Value Unamortized $580,000 - (A) - (B) Balance (D) Apr. 1/18 $17,822 $562,178 Jul. 1/18 $ 14,500 $ 14,757 $ 257 17,565 562,435 Apr. 1/26 14,500 15,074 574 5,172 574,828 Jul. 1/26 14,500 15,089 589 4,583 575,417 Oct. 1/26 14,500 15,105 605 3,978 576,022 Jan. 1/27 14,500 15,121 621 3,357 576,643 Apr. 1/27 14,500 15,137 637 2,720 577,280 Jul. 1/27 14,500 15,154 654 2,066 577,934 Oct. 1/27 14,500 15,171 671 1,395 578,605 Jan. 1/28 14,500 15,188 688 707 579,293 Apr. 1/28 14,500 15,207* 707 0 580,000 Totals $580,000 $ 597,822 $17,822 *Adjusted for rounding 2. Bond Issue B a. Were the bond B issued at a premium and/or discount? Issued at discount Issued at premium Issued at premium & discount b. Journalize the issuance of bond B on April 1, 2018. No Date Answer is not complete. General Journal Debit Credit c. What is the contract interest rate for the issue bond B? Contract interest rate %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started