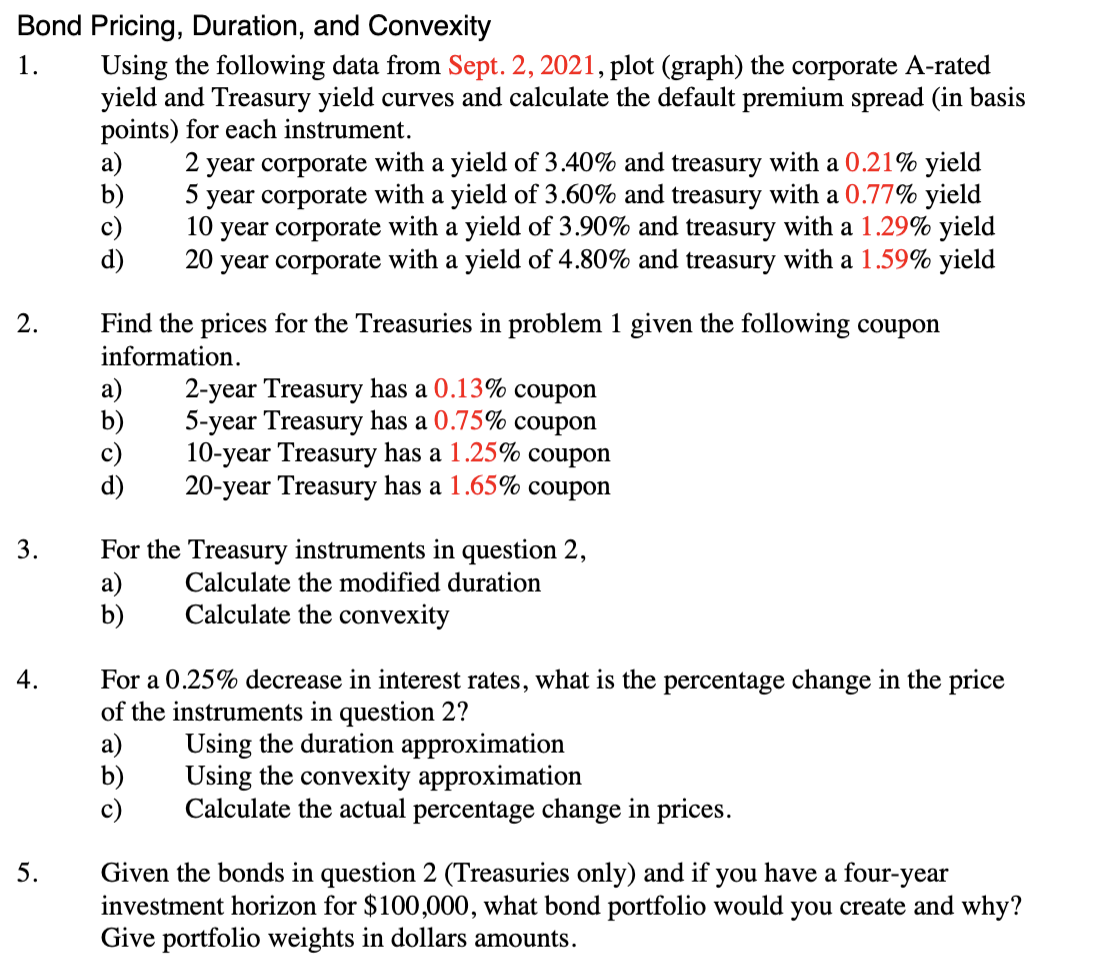

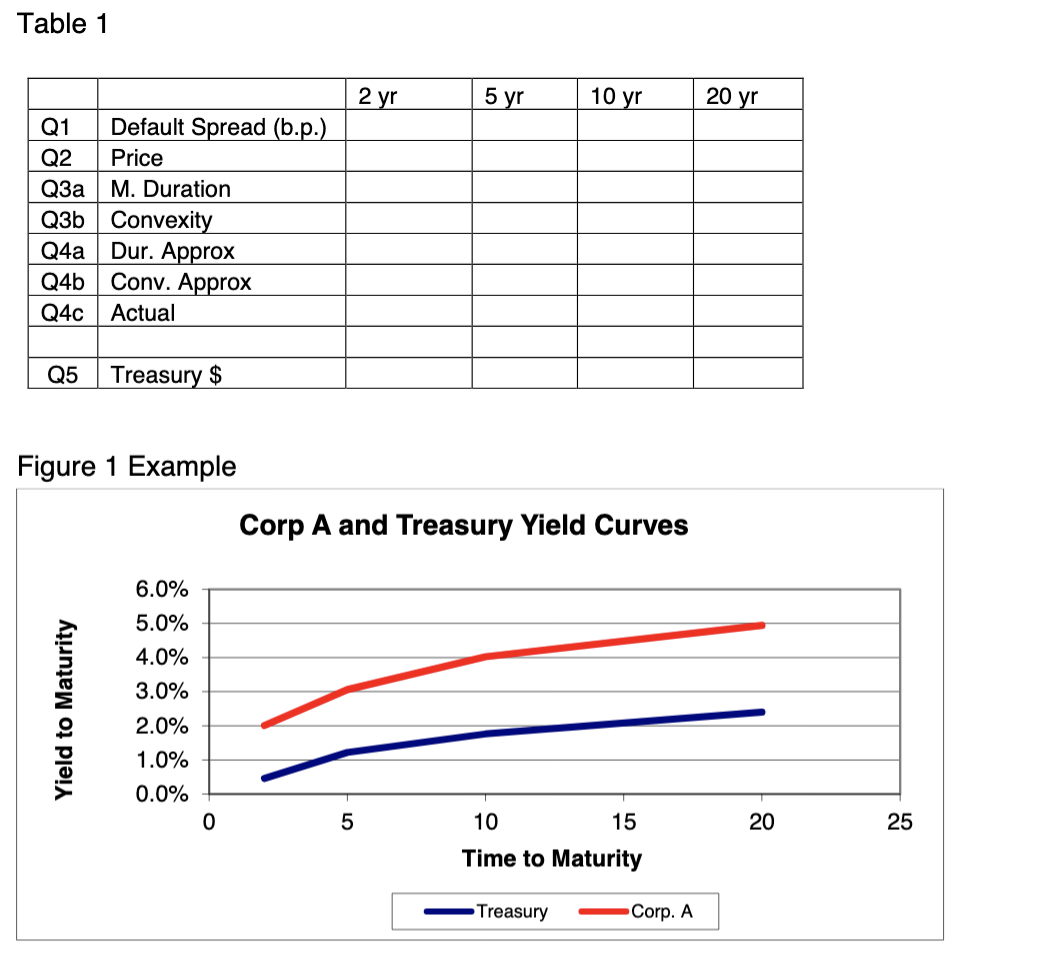

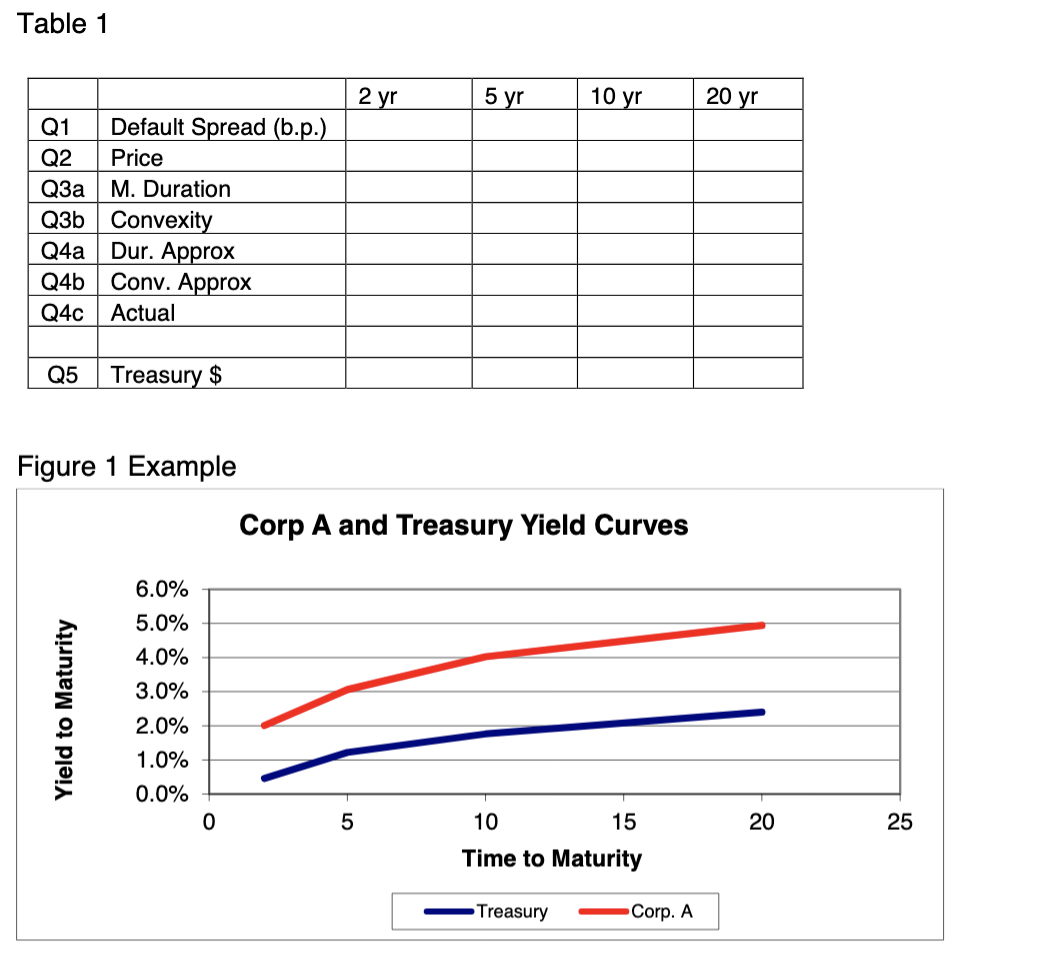

Bond Pricing, Duration, and Convexity 1. Using the following data from Sept. 2, 2021, plot (graph) the corporate A-rated yield and Treasury yield curves and calculate the default premium spread (in basis points) for each instrument. 2 year corporate with a yield of 3.40% and treasury with a 0.21% yield b) 5 year corporate with a yield of 3.60% and treasury with a 0.77% yield c) 10 year corporate with a yield of 3.90% and treasury with a 1.29% yield d) 20 year corporate with a yield of 4.80% and treasury with a 1.59% yield 2. Find the prices for the Treasuries in problem 1 given the following coupon information. a) 2-year Treasury has a 0.13% coupon b) 5-year Treasury has a 0.75% coupon c) 10-year Treasury has a 1.25% coupon d) 20-year Treasury has a 1.65% coupon 3. For the Treasury instruments in question 2, a) Calculate the modified duration b) Calculate the convexity 4. For a 0.25% decrease in interest rates, what is the percentage change in the price of the instruments in question 2? a) Using the duration approximation b) Using the convexity approximation c) Calculate the actual percentage change in prices. 5. Given the bonds in question 2 (Treasuries only) and if you have a four-year investment horizon for $100,000, what bond portfolio would you create and why? Give portfolio weights in dollars amounts. Table 1 2 yr 5 yr 10 yr 20 yr Q1 Default Spread (b.p.) Q2 Price Q3a M. Duration Q3b Convexity Q4a Dur. Approx Q4b Conv. Approx Q4c Actual Q5 Treasury $ Figure 1 Example Corp A and Treasury Yield Curves Yield to Maturity 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% 5 20 25 10 15 Time to Maturity - Treasury Corp. A Bond Pricing, Duration, and Convexity 1. Using the following data from Sept. 2, 2021, plot (graph) the corporate A-rated yield and Treasury yield curves and calculate the default premium spread (in basis points) for each instrument. 2 year corporate with a yield of 3.40% and treasury with a 0.21% yield b) 5 year corporate with a yield of 3.60% and treasury with a 0.77% yield c) 10 year corporate with a yield of 3.90% and treasury with a 1.29% yield d) 20 year corporate with a yield of 4.80% and treasury with a 1.59% yield 2. Find the prices for the Treasuries in problem 1 given the following coupon information. a) 2-year Treasury has a 0.13% coupon b) 5-year Treasury has a 0.75% coupon c) 10-year Treasury has a 1.25% coupon d) 20-year Treasury has a 1.65% coupon 3. For the Treasury instruments in question 2, a) Calculate the modified duration b) Calculate the convexity 4. For a 0.25% decrease in interest rates, what is the percentage change in the price of the instruments in question 2? a) Using the duration approximation b) Using the convexity approximation c) Calculate the actual percentage change in prices. 5. Given the bonds in question 2 (Treasuries only) and if you have a four-year investment horizon for $100,000, what bond portfolio would you create and why? Give portfolio weights in dollars amounts. Table 1 2 yr 5 yr 10 yr 20 yr Q1 Default Spread (b.p.) Q2 Price Q3a M. Duration Q3b Convexity Q4a Dur. Approx Q4b Conv. Approx Q4c Actual Q5 Treasury $ Figure 1 Example Corp A and Treasury Yield Curves Yield to Maturity 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% 5 20 25 10 15 Time to Maturity - Treasury Corp. A