Answered step by step

Verified Expert Solution

Question

1 Approved Answer

bond valuation, semiannual interest (second photo is an example problem) Bond valuation-semiannual interest Find the value of a band maturing in years, with a $1,000

bond valuation, semiannual interest

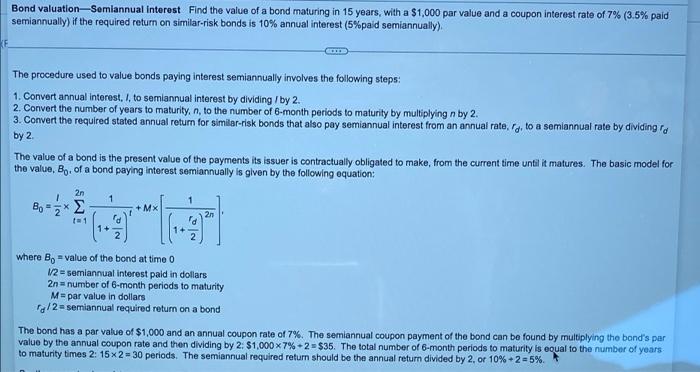

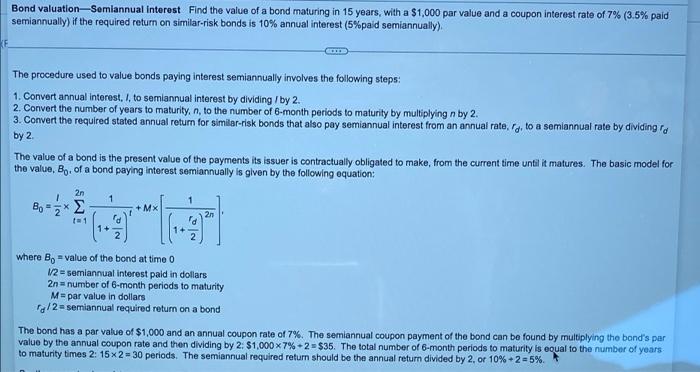

Bond valuation-semiannual interest Find the value of a band maturing in years, with a $1,000 per value and a coupon interest rate of ins (45 padomly if the roured return on mais bonds is 1965 pimus The prontal of the brands Round to the nearest cont.) Bond valuation-Semiannual interest Find the value of a bond maturing in 15 years, with a $1,000 par value and a coupon interest rate of 7% (3.5% paid semiannually) if the required return on similar-risk bonds is 10% annual interest (5%paid semiannually) The procedure used to value bonds paying interest semiannually involves the following steps: 1. Convert annual interest. I. to semiannual interest by dividing / by 2. 2. Convert the number of years to maturity, n, to the number of 6-month periods to maturity by multiplying n by 2. 3. Convert the required stated annual return for similar-risk bonds that also pay semiannual interest from an annual rate. Id to a semiannual rate by dividing a by 2 The value of a bond is the present value of the payments its issuer is contractually obligated to make, from the current time until it matures. The basic model for the value, Bo, of a bond paying interest semiannually is given by the following equation: 2n 1 1 Bo" * +MX 2 d 1+ 1+ where Bo - value of the bond at time 0 12 = semiannual interest paid in dollars 2n number of 6-month periods to maturity M=par value in dollars 1/2 semiannual required return on a bond The bond has a par value of $1,000 and an annual coupon rate of 7%. The semiannual coupon payment of the bond can be found by multiplying the band's par value by the annual coupon rate and then dividing by 2. $1,000 x 7%+2= $35. The total number of 6-month periods to maturity is equal to the number of years to maturity times 2: 152-30 periods. The semiannual required return should be the annual return divided by 2 or 10%+2-5% (second photo is an example problem)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started