Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bonds A , B , and C all have a maturity of 1 0 years and a yield to maturity of 7 % . Bond

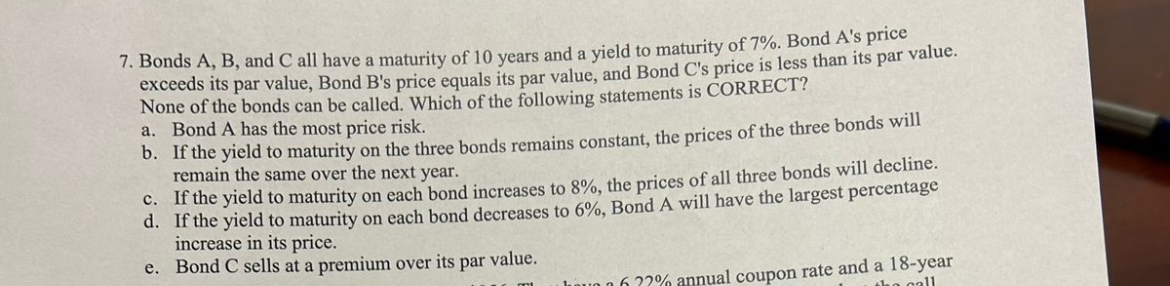

Bonds and all have a maturity of years and a yield to maturity of Bond As price exceeds its par value, Bond Bs price equals its par value, and Bond Cs price is less than its par value. None of the bonds can be called. Which of the following statements is CORRECT?

a Bond A has the most price risk.

b If the yield to maturity on the three bonds remains constant, the prices of the three bonds will remain the same over the next year.

c If the yield to maturity on each bond increases to the prices of all three bonds will decline.

d If the yield to maturity on each bond decreases to Bond A will have the largest percentage increase in its price.

e Bond sells at a premium over its par value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started