Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bonds Issued at a Discount (Effective Interest) Crafty Corporation received $378,443 of cash upon issuance of 400, $1,000 par value bonds. Each bond has a

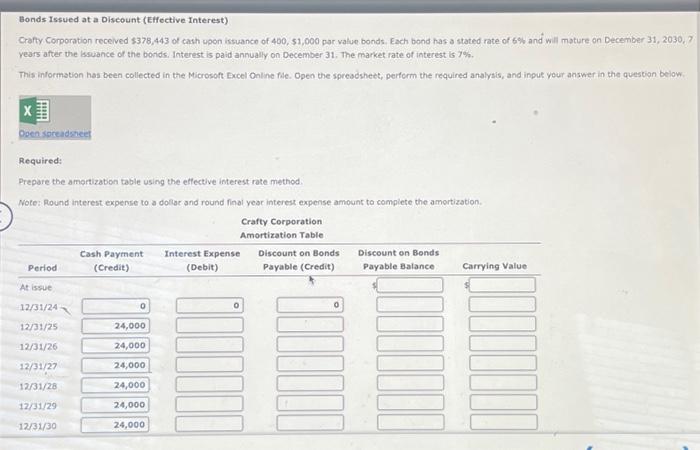

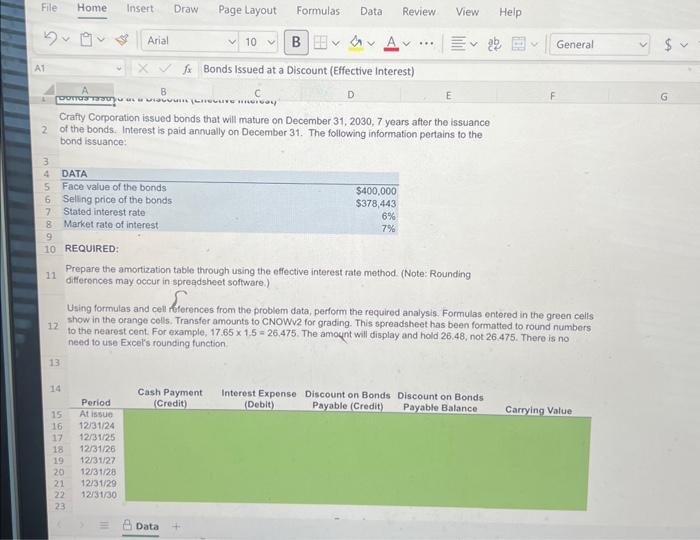

Bonds Issued at a Discount (Effective Interest) Crafty Corporation received $378,443 of cash upon issuance of 400, $1,000 par value bonds. Each bond has a stated rate of 6% and will mature on December 31, 2030, 7 years after the issuance of the bonds. Interest is paid annually on December 31. The market rate of interest is 7%. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answer in the question below. X Open spreadsheet Required: Prepare the amortization table using the effective interest rate method. Note: Round interest expense to a dollar and round final year interest expense amount to complete the amortization. Crafty Corporation Amortization Table Period At issue 12/31/24 12/31/25 12/31/26 12/31/27 12/31/28 12/31/29 12/31/30 Cash Payment Interest Expense (Credit) (Debit) 0 24,000 24,000 24,000 24,000 24,000 24,000 0 Discount on Bonds Payable (Credit) 0 Discount on Bonds Payable Balance Carrying Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started