Answered step by step

Verified Expert Solution

Question

1 Approved Answer

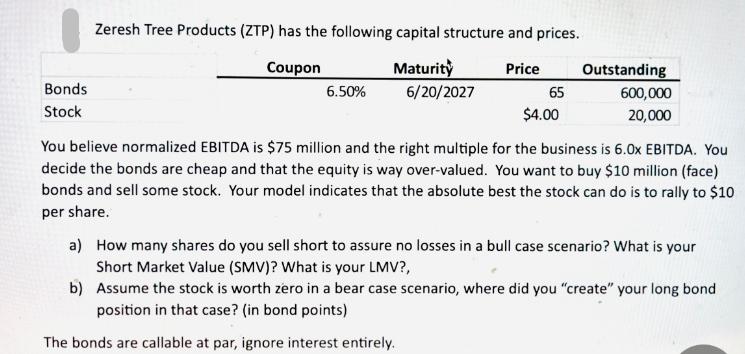

Bonds Stock Zeresh Tree Products (ZTP) has the following capital structure and prices. Coupon Maturity Price 6.50% 6/20/2027 65 $4.00 Outstanding 600,000 20,000 You

Bonds Stock Zeresh Tree Products (ZTP) has the following capital structure and prices. Coupon Maturity Price 6.50% 6/20/2027 65 $4.00 Outstanding 600,000 20,000 You believe normalized EBITDA is $75 million and the right multiple for the business is 6.0x EBITDA. You decide the bonds are cheap and that the equity is way over-valued. You want to buy $10 million (face) bonds and sell some stock. Your model indicates that the absolute best the stock can do is to rally to $10 per share. a) How many shares do you sell short to assure no losses in a bull case scenario? What is your Short Market Value (SMV)? What is your LMV?, b) Assume the stock is worth zero in a bear case scenario, where did you "create" your long bond position in that case? (in bond points) The bonds are callable at par, ignore interest entirely.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Bonds Information Coupon 650 Maturity 6202027 Price 6500 Outstanding 600000 Face value 400 Equity In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started