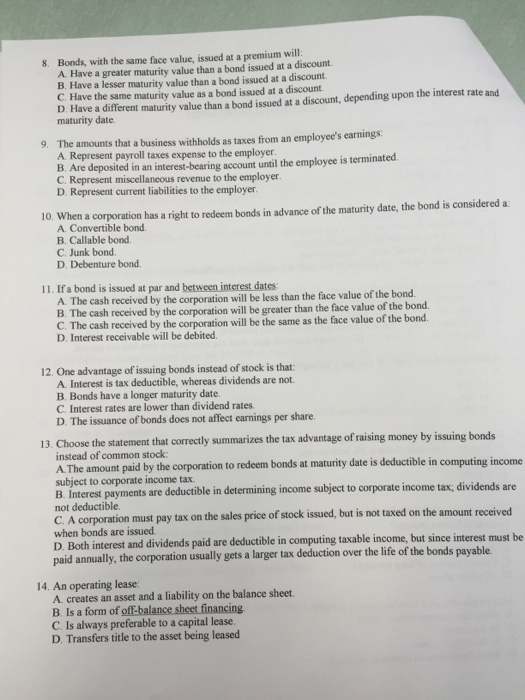

Bonds, with the umc face value, issued at a premium will A I lave a greater maturity value than a bond issued at a discount B I lave a lesser maturity value than a bond issued at a discount C Have I he same maturity value as a bond issued at a discount D Have a different maturity value than a bond issued at a discount, depending upon the interest rate am maturity dale 9 The amounts that a business withholds as taxes from an employee s earnings A Represent payroll taxes expense to the employer H Arc deposited in an interest-bearing account until the employee is terminated C Represent miscellaneous revenue to the employer D Represent currctu liabilities to the employer 10 When a corporation has a right to redeem bonds in advance of the maturity date, the bond is considered a A Convertible bond B Callable bond C Junk bond D Debenture bond II [fa bond is issued at par and bcterauntcrest dates A I he cash received by the corporation will be less than the face value of the bond B The cash received by the corporatio will be greater than the face value of the bond C The cash received by the corporation will be the same as the face value of the bond D Interest receivable will be debited 12 One advantage of issuing bonds instead of stock is that A Interest is tax deductible, whereas dividends arc not B Bonds have a longer maturity date C Interest rates arc lower than dividend rates D The issuance of bonds docs not affect earnings per share 13 Choose the statement that correctly summarizes the tax advantage of laising moocy by issuing bonds instead of common stock: A The amount paid by the corporation to redeem bonds at maturity date is deductible in computing income subject to corporate income tax B Interest payments are deductible in determining income subject to corporate income tax. dividends arc not deductible C A corporation must pay tax on the sales price of stock issued, but is not taxed on the amount received when bonds arc issued D Both interest and dividends paid arc deductible in computing taxable income, but sincc interest must \x paid annually, the corporation usually gets a larger tax deduction over the life of the bonds payable 14 An operating lease: A creates an asset and a liability on the balance sheet. B Is a form of off-balancc sheetJlnaQCin* C Is always preferable to a capital lease D Transfers title to the asset being leased