Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BondTerrier Inc., a publicly listed company, issues 15 year convertible (at the holder's option) bonds with a face value of $1,000,000 and a coupon

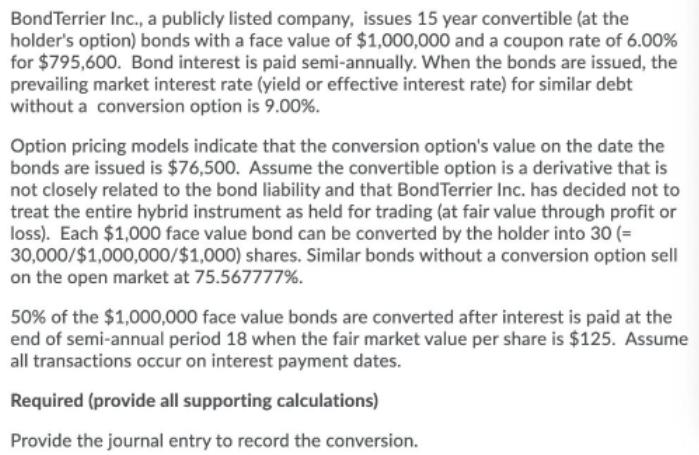

BondTerrier Inc., a publicly listed company, issues 15 year convertible (at the holder's option) bonds with a face value of $1,000,000 and a coupon rate of 6.00% for $795,600. Bond interest is paid semi-annually. When the bonds are issued, the prevailing market interest rate (yield or effective interest rate) for similar debt without a conversion option is 9.00%. Option pricing models indicate that the conversion option's value on the date the bonds are issued is $76,500. Assume the convertible option is a derivative that is not closely related to the bond liability and that BondTerrier Inc. has decided not to treat the entire hybrid instrument as held for trading (at fair value through profit or loss). Each $1,000 face value bond can be converted by the holder into 30 (= 30,000/$1,000,000/$1,000) shares. Similar bonds without a conversion option sell on the open market at 75.567777%. 50% of the $1,000,000 face value bonds are converted after interest is paid at the end of semi-annual period 18 when the fair market value per share is $125. Assume all transactions occur on interest payment dates. Required (provide all supporting calculations) Provide the journal entry to record the conversion.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entry Account Title Debit Credit Cash 60000 Bonds Payable 60000 To record the issuance of Bo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started