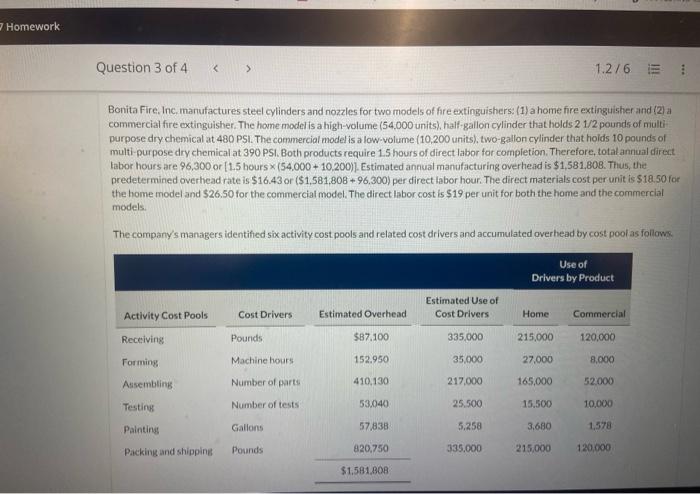

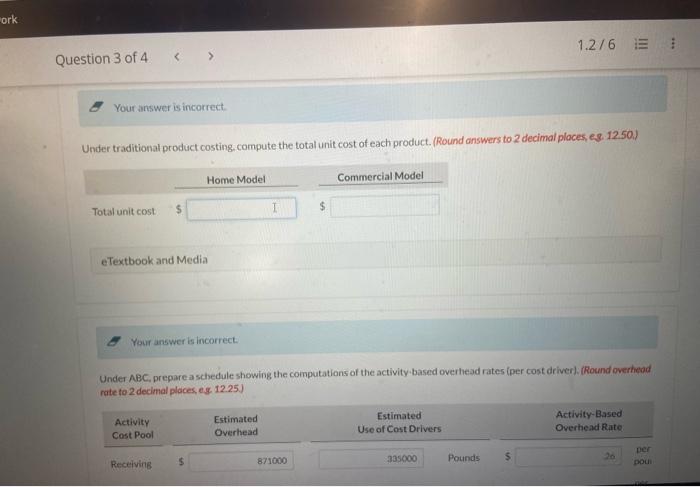

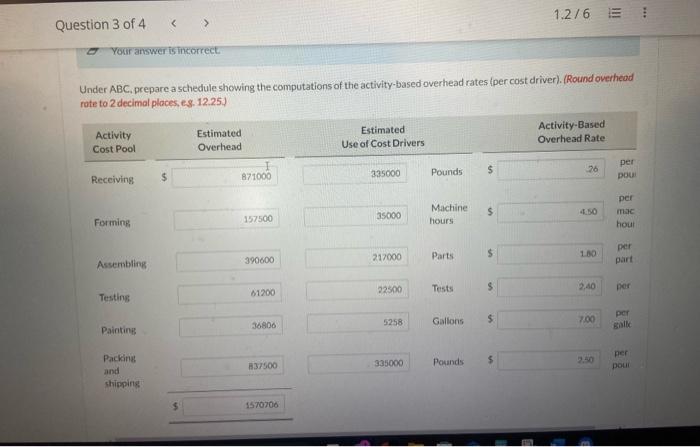

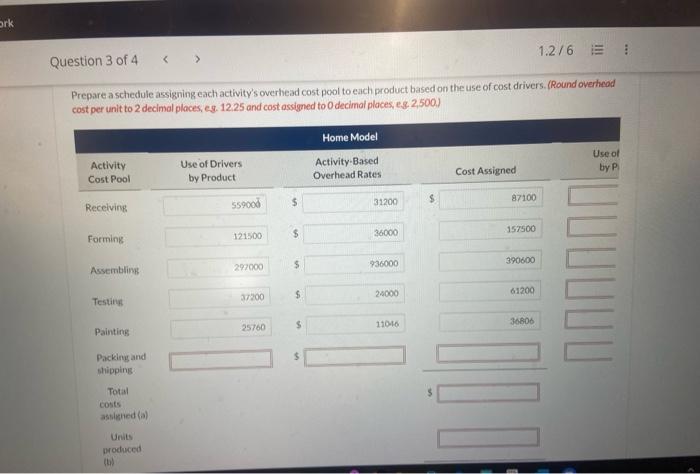

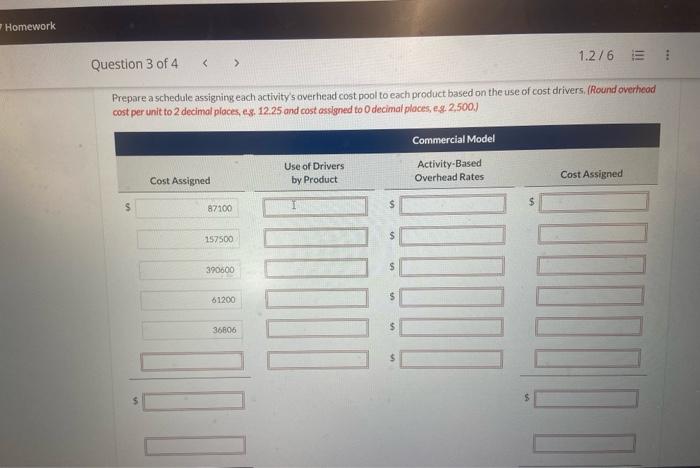

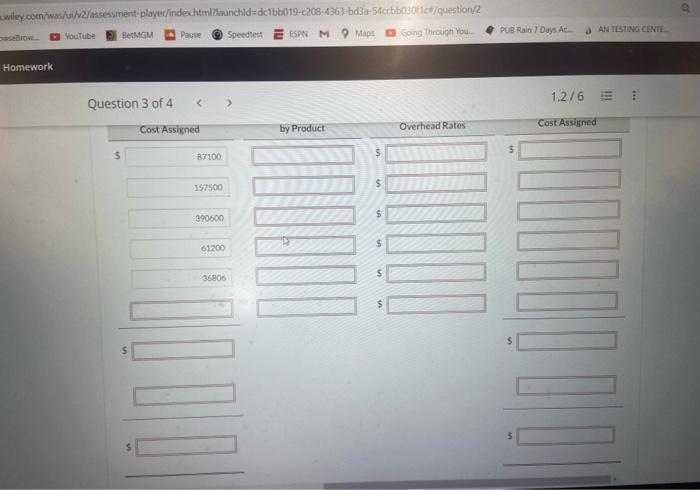

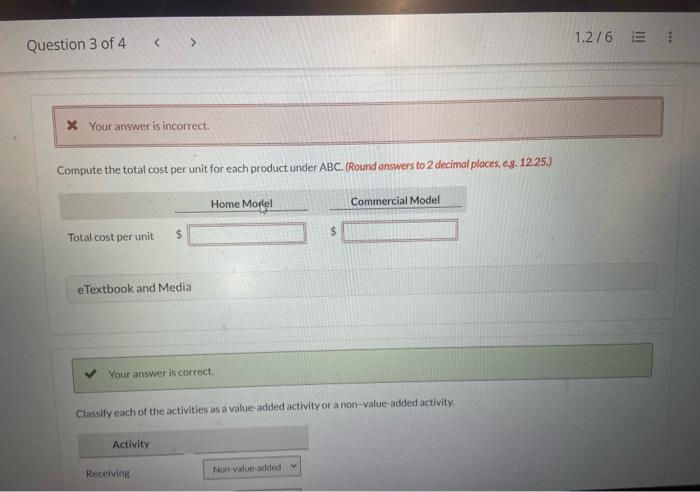

Bonita Fire. Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 21/2 pounds of multi purpose dry chemical at 480 PSI. The commercial model is a low-volume ( 10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1,5 hours (54,000+10,200)]. Estimated annual manufacturing overhead is $1,581,808. Thus, the predetermined overhead rate is $16.43 or ($1,581,808+96.300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related cost drivers and accumulated overhead by cost pool as follows. - Your answer is incorrect. Under traditional product costing, compute the total unit cost of each product. (Round answers to 2 decimal ploces, es. 12.50 ). eTextbook and Media 2 Your answer is incorrect. Under ABC, preparea schedule showing the compotations of the activity-based overhead rates iper cost driver): (Round overhead rate to 2 decimal places, eg, 12.25. Under ABC, prepare a schedule showing the computations of the activity-based overhead rates (per cost driver). (Round overheod rote to 2 decimal ploces, es. 12.25) Prepare a schedule assigning each activity's overhead cost pool to each product based on the use of cost drivers. (Round overheod cost per unit to 2 decimal places, e9. 12.25 and cost assigned to 0 decimal places, es. 2, 500. Prepare a schedule assigning each activity's overhead cost pool to each product based on the use of cost drivers, (Round overheod cost per unit to 2 decimal ploces, es. 12.25 and cost ossigned to 0 decimal ploces, es. 2,500.1 YouTube E) Resmom Pause Speedest E ESPN M 9 Maps PUB Rain 7 Dogs AC O AN TBSTivacentL Question 3 of 4 1.2/6 \begin{tabular}{ll} by Product & \\ \hline & $ \\ \hline \end{tabular} Overhend Rates Cost Assigned s 5 5 $ 5 Compute the total cost per unit for each product under ABC. (Round answers to 2 decimal places, eg. 12.25.) efextbook and Media Your answer is correct Classify each of the activities as a value-added activity of a non-value-added activity: Bonita Fire. Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 21/2 pounds of multi purpose dry chemical at 480 PSI. The commercial model is a low-volume ( 10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1,5 hours (54,000+10,200)]. Estimated annual manufacturing overhead is $1,581,808. Thus, the predetermined overhead rate is $16.43 or ($1,581,808+96.300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related cost drivers and accumulated overhead by cost pool as follows. - Your answer is incorrect. Under traditional product costing, compute the total unit cost of each product. (Round answers to 2 decimal ploces, es. 12.50 ). eTextbook and Media 2 Your answer is incorrect. Under ABC, preparea schedule showing the compotations of the activity-based overhead rates iper cost driver): (Round overhead rate to 2 decimal places, eg, 12.25. Under ABC, prepare a schedule showing the computations of the activity-based overhead rates (per cost driver). (Round overheod rote to 2 decimal ploces, es. 12.25) Prepare a schedule assigning each activity's overhead cost pool to each product based on the use of cost drivers. (Round overheod cost per unit to 2 decimal places, e9. 12.25 and cost assigned to 0 decimal places, es. 2, 500. Prepare a schedule assigning each activity's overhead cost pool to each product based on the use of cost drivers, (Round overheod cost per unit to 2 decimal ploces, es. 12.25 and cost ossigned to 0 decimal ploces, es. 2,500.1 YouTube E) Resmom Pause Speedest E ESPN M 9 Maps PUB Rain 7 Dogs AC O AN TBSTivacentL Question 3 of 4 1.2/6 \begin{tabular}{ll} by Product & \\ \hline & $ \\ \hline \end{tabular} Overhend Rates Cost Assigned s 5 5 $ 5 Compute the total cost per unit for each product under ABC. (Round answers to 2 decimal places, eg. 12.25.) efextbook and Media Your answer is correct Classify each of the activities as a value-added activity of a non-value-added activity