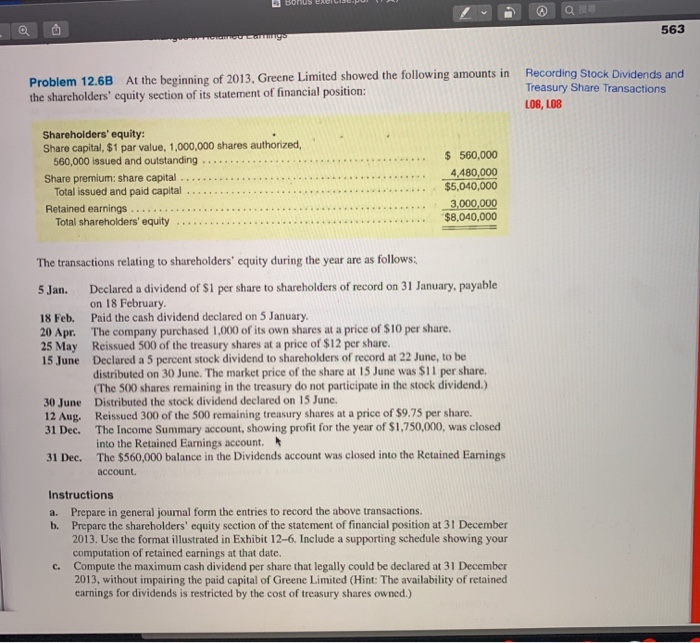

BONUS BILIS. U A 563 Problem 12.6B At the beginning of 2013, Greene Limited showed the following amounts in the shareholders' equity section of its statement of financial position: Recording Stock Dividends and Treasury Share Transactions LOB, LOS Shareholders' equity: Share capital, $1 par value, 1,000,000 shares authorized, 560,000 issued and outstanding Share premium: share capital Total issued and paid capital Retained earnings ......... Total shareholders' equity ......... $ 560,000 4,480,000 $5,040,000 3,000,000 $8,040,000 The transactions relating to shareholders' equity during the year are as follows: 5 Jan. Declared a dividend of $1 per share to shareholders of record on 31 January, payable on 18 February. 18 Feb. Paid the cash dividend declared on 5 January. 20 Apr. The company purchased 1,000 of its own shares at a price of $10 per share. 25 May Reissued 500 of the treasury shares at a price of $12 per share. 15 June Declared a 5 percent stock dividend to shareholders of record at 22 June, to be distributed on 30 June. The market price of the share at 15 June was $11 per share. (The 500 shares remaining in the treasury do not participate in the stock dividend.) 30 June Distributed the stock dividend declared on 15 June. 12 Aug, Reissued 300 of the 500 remaining treasury shares at a price of $9.75 per share. 31 Dec. The Income Summary account, showing profit for the year of $1,750,000, was closed into the Retained Earnings account. 31 Dec. The $560,000 balance in the Dividends account was closed into the Retained Eamings account. Instructions a. Prepare in general joumal form the entries to record the above transactions. b. Prepare the shareholders' equity section of the statement of financial position at 31 December 2013. Use the format illustrated in Exhibit 12-6. Include a supporting schedule showing your computation of retained earnings at that date. Compute the maximum cash dividend per share that legally could be declared at 31 December 2013, without impairing the paid capital of Greene Limited (Hint: The availability of retained carnings for dividends is restricted by the cost of treasury shares owned.)