Answered step by step

Verified Expert Solution

Question

1 Approved Answer

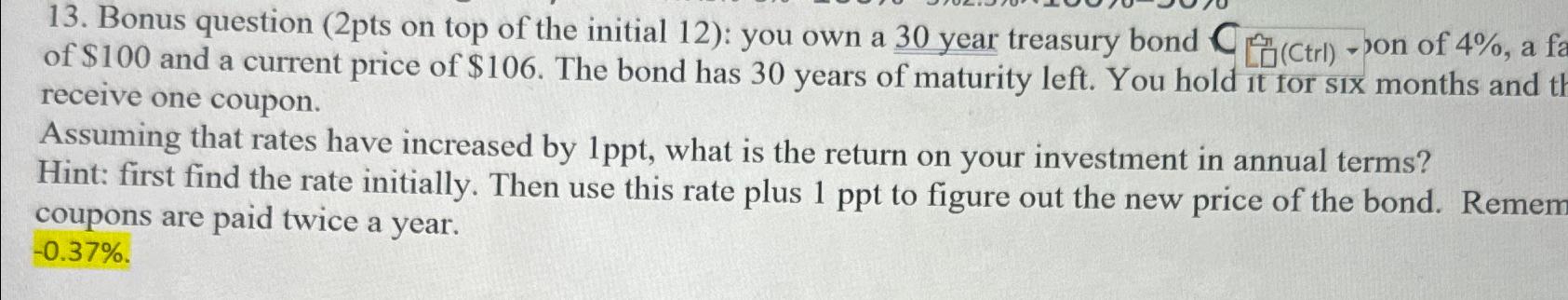

Bonus question (2pts on top of the initial 12): you own a 30 year treasury bond on of 4% , a f of $100 and

Bonus question (2pts on top of the initial 12): you own a 30 year treasury bond on of

4%, a f of

$100and a current price of

$106. The bond has 30 years of maturity left. You hold it for six months and tl receive one coupon.\ Assuming that rates have increased by

1ppt, what is the return on your investment in annual terms? Hint: first find the rate initially. Then use this rate plus 1 ppt to figure out the new price of the bond. Remem coupons are paid twice a year.\

-0.37%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started