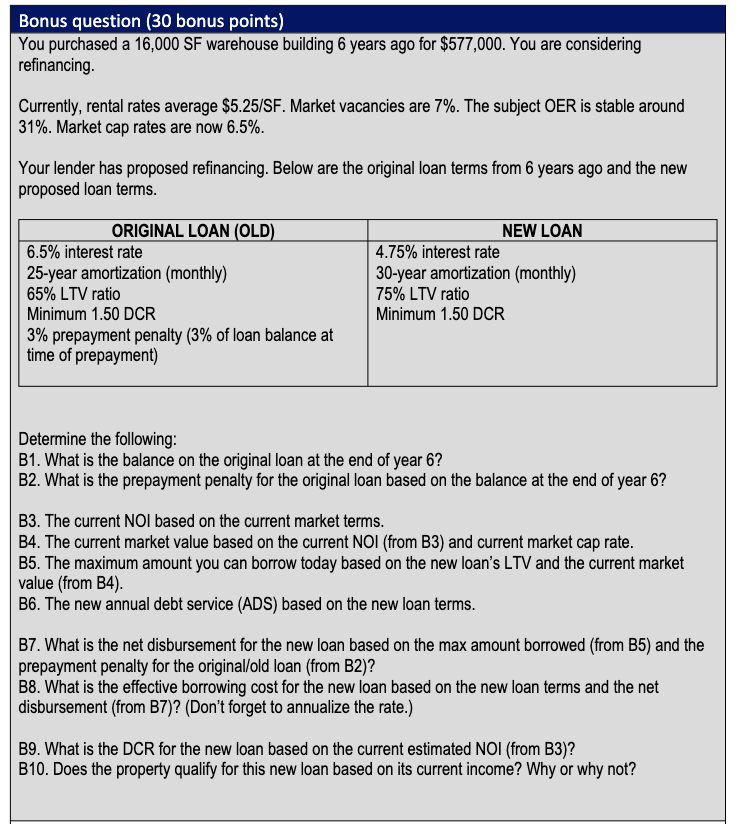

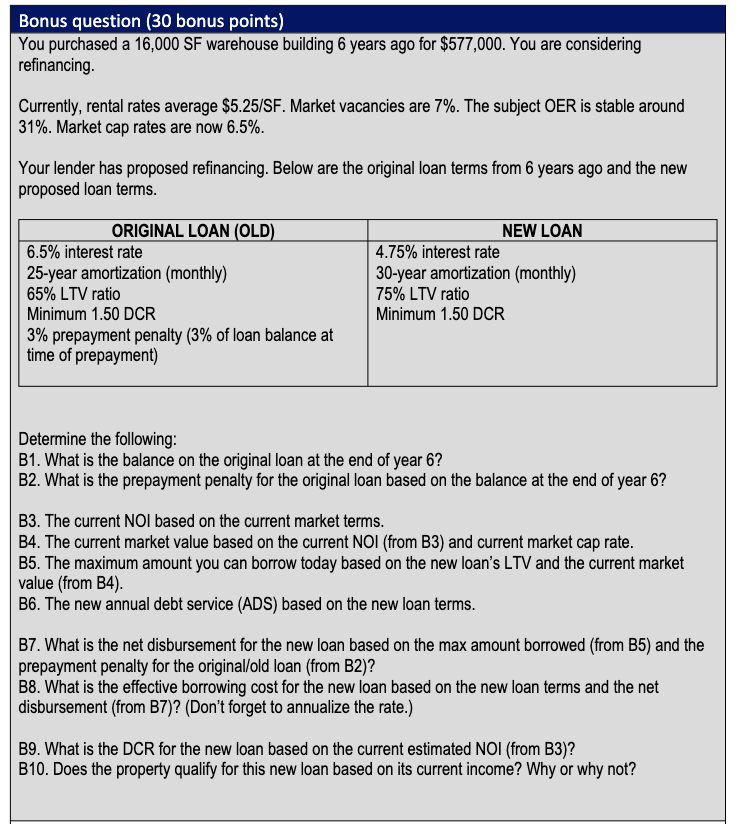

Bonus question (30 bonus points) You purchased a 16,000 SF warehouse building 6 years ago for $577,000. You are considering refinancing Currently, rental rates average $5.25/SF. Market vacancies are 7%. The subject OER is stable around 31%. Market cap rates are now 6.5%. Your lender has proposed refinancing. Below are the original loan terms from 6 years ago and the new proposed loan terms. ORIGINAL LOAN (OLD) 6.5% interest rate 25-year amortization (monthly) 65% LTV ratio Minimum 1.50 DCR 3% prepayment penalty (3% of loan balance at time of prepayment) NEW LOAN 4.75% interest rate 30-year amortization (monthly) 75% LTV ratio Minimum 1.50 DCR Determine the following: B1. What is the balance on the original loan at the end of year 6? B2. What is the prepayment penalty for the original loan based on the balance at the end of year 6? B3. The current NOI based on the current market terms. B4. The current market value based on the current NOI (from B3) and current market cap rate. B5. The maximum amount you can borrow today based on the new loan's LTV and the current market value (from B4). B6. The new annual debt service (ADS) based on the new loan terms. B7. What is the net disbursement for the new loan based on the max amount borrowed (from B5) and the prepayment penalty for the original/old loan (from B2)? B8. What is the effective borrowing cost for the new loan based on the new loan terms and the net disbursement (from B7)? (Don't forget to annualize the rate.) B9. What is the DCR for the new loan based on the current estimated NOI (from B3)? B10. Does the property qualify for this new loan based on its current income? Why or why not? Bonus question (30 bonus points) You purchased a 16,000 SF warehouse building 6 years ago for $577,000. You are considering refinancing Currently, rental rates average $5.25/SF. Market vacancies are 7%. The subject OER is stable around 31%. Market cap rates are now 6.5%. Your lender has proposed refinancing. Below are the original loan terms from 6 years ago and the new proposed loan terms. ORIGINAL LOAN (OLD) 6.5% interest rate 25-year amortization (monthly) 65% LTV ratio Minimum 1.50 DCR 3% prepayment penalty (3% of loan balance at time of prepayment) NEW LOAN 4.75% interest rate 30-year amortization (monthly) 75% LTV ratio Minimum 1.50 DCR Determine the following: B1. What is the balance on the original loan at the end of year 6? B2. What is the prepayment penalty for the original loan based on the balance at the end of year 6? B3. The current NOI based on the current market terms. B4. The current market value based on the current NOI (from B3) and current market cap rate. B5. The maximum amount you can borrow today based on the new loan's LTV and the current market value (from B4). B6. The new annual debt service (ADS) based on the new loan terms. B7. What is the net disbursement for the new loan based on the max amount borrowed (from B5) and the prepayment penalty for the original/old loan (from B2)? B8. What is the effective borrowing cost for the new loan based on the new loan terms and the net disbursement (from B7)? (Don't forget to annualize the rate.) B9. What is the DCR for the new loan based on the current estimated NOI (from B3)? B10. Does the property qualify for this new loan based on its current income? Why or why not