Question

Boof Pty Ltd (Boof) is an Australian resident company that sells office equipment to businesses and the public. Boof consistently has an aggregated turnover of

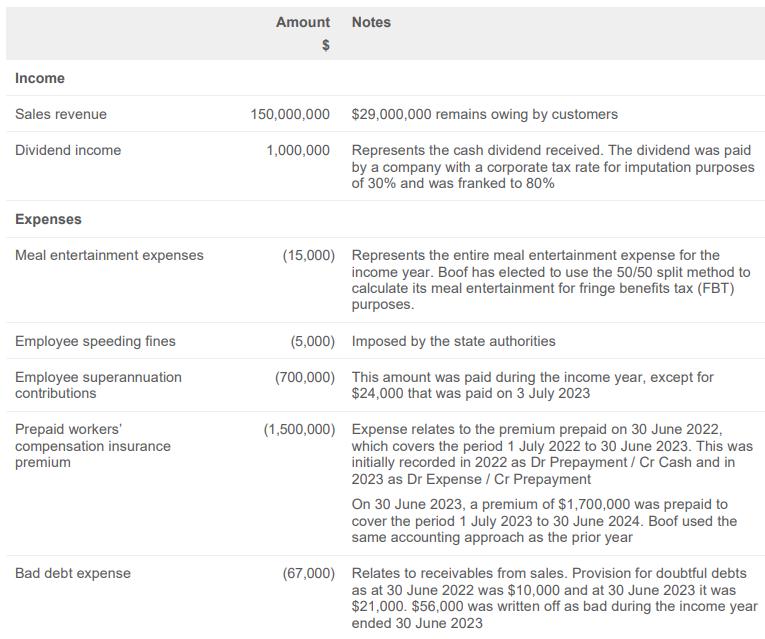

Boof Pty Ltd (Boof) is an Australian resident company that sells office equipment to businesses and the public. Boof consistently has an aggregated turnover of more than $50 million. For the income year ended 30 June 2023, Boof has an accounting profit of $1,600,000. The following amounts are included in its statement of profit and loss for the income year ended 30 June 2023:

Assume that the amounts in the table above are the only amounts that may require adjustments when preparing Boof’s tax reconciliation.

Required:

Calculate Boof’s taxable income for the income year ended 30 June 2023 by preparing a reconciliation from accounting profit to taxable income and calculating the correct tax adjustment/s.

Income Sales revenue Dividend income Expenses Meal entertainment expenses Employee speeding fines Employee superannuation contributions Prepaid workers' compensation insurance premium Bad debt expense Amount Notes 150,000,000 $29,000,000 remains owing by customers 1,000,000 Represents the cash dividend received. The dividend was paid by a company with a corporate tax rate for imputation purposes of 30% and was franked to 80% (15,000) Represents the entire meal entertainment expense for the income year. Boof has elected to use the 50/50 split method to calculate its meal entertainment for fringe benefits tax (FBT) purposes. Imposed by the state authorities This amount was paid during the income year, except for $24,000 that was paid on 3 July 2023 (5,000) (700,000) (1,500,000) Expense relates to the premium prepaid on 30 June 2022, which covers the period 1 July 2022 to 30 June 2023. This was initially recorded in 2022 as Dr Prepayment / Cr Cash and in 2023 as Dr Expense / Cr Prepayment On 30 June 2023, a premium of $1,700,000 was prepaid to cover the period 1 July 2023 to 30 June 2024. Boof used the same accounting approach as the prior year (67,000) Relates to receivables from sales. Provision for doubtful debts as at 30 June 2022 was $10,000 and at 30 June 2023 it was $21,000. $56,000 was written off as bad during the income year ended 30 June 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Boof Pty Ltds taxable income for the income year ended 30 June 2023 we need to make adj...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started