Question

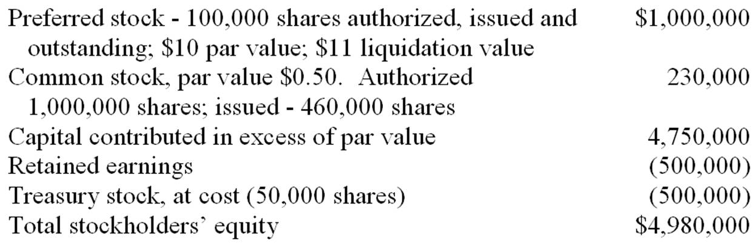

Book Value per share The following information was taken from Wicom's financial statements as of December 31, 2006. a. Calculate book value per share of

| Book Value per share The following information was taken from Wicom's financial statements as of December 31, 2006. Please show work so I can process the information throughly thnk you |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started

a. Calculate book value per share of common stock. b. Assume that the company also had $1,000,000 worth of convertible bonds. The bonds are convertible at one $1,000 bond into 150 shares of stock. There are also stock options to buy 120,000 shares at a price of $5 per share. The stock is currently trading at $30 per share. Recalculate your answer to part a) taking into account dilutive effects of the above.

a. Calculate book value per share of common stock. b. Assume that the company also had $1,000,000 worth of convertible bonds. The bonds are convertible at one $1,000 bond into 150 shares of stock. There are also stock options to buy 120,000 shares at a price of $5 per share. The stock is currently trading at $30 per share. Recalculate your answer to part a) taking into account dilutive effects of the above.