Question

Booming economy's consumptic X BG Course Materials-2023 Spring 1 x 16 Welcome, Akinbobola-Blackbox education.wiley.com/was/ui/v2/assessment-player/index.html?launchld-9e2ee55e-a1e1-484c-a8ee-290d1c532b17#/question/0 w Microeconomics, E... Welcome, Akinbob... Bonds Payable Alt+Q Ariva My Home

Booming economy's consumptic X BG Course Materials-2023 Spring 1 x 16 Welcome, Akinbobola-Blackbox education.wiley.com/was/ui/v2/assessment-player/index.html?launchld-9e2ee55e-a1e1-484c-a8ee-290d1c532b17#/question/0 w Microeconomics, E... Welcome, Akinbob... Bonds Payable Alt+Q Ariva My Home 61F Rain showers WP WileyPLUS Question 1 of 2 View Policies Current Attempt in Progress (a) Click here to view factor tables. 1. 4. Q Search On June 30, 2025, Kenneth Clark Company issued $4,180,000.00 face value of 13%, 20-year bonds at $4,494,460.00, a yield of 12%. Clark uses the effective-interest method to amortize bond premium or discount. The bonds pay semiannual interest on June 30 and - December 31. w Bonds Payable Mail-AKINBOBOL... P Pearson Sign In Connect Prepare the journal entries to record the following transactions. (Round answer to 2 decimal places, e.g. 38,548.25. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Sya The issuance of the bonds on June 30, 2025. The payment of interest and the amortization of the premium on December 31, 2025. The payment of interest and the amortization of the premium on June 30, 2026. The payment of interest and the amortization of the premium on December 31, 202 Classes HA NWP Assessment Player Ul Appli x H Your Sets | Quizlet YouTube Spotify M Gmail -/50 = + : 0 X Update 9:11 PM 5/7/2023

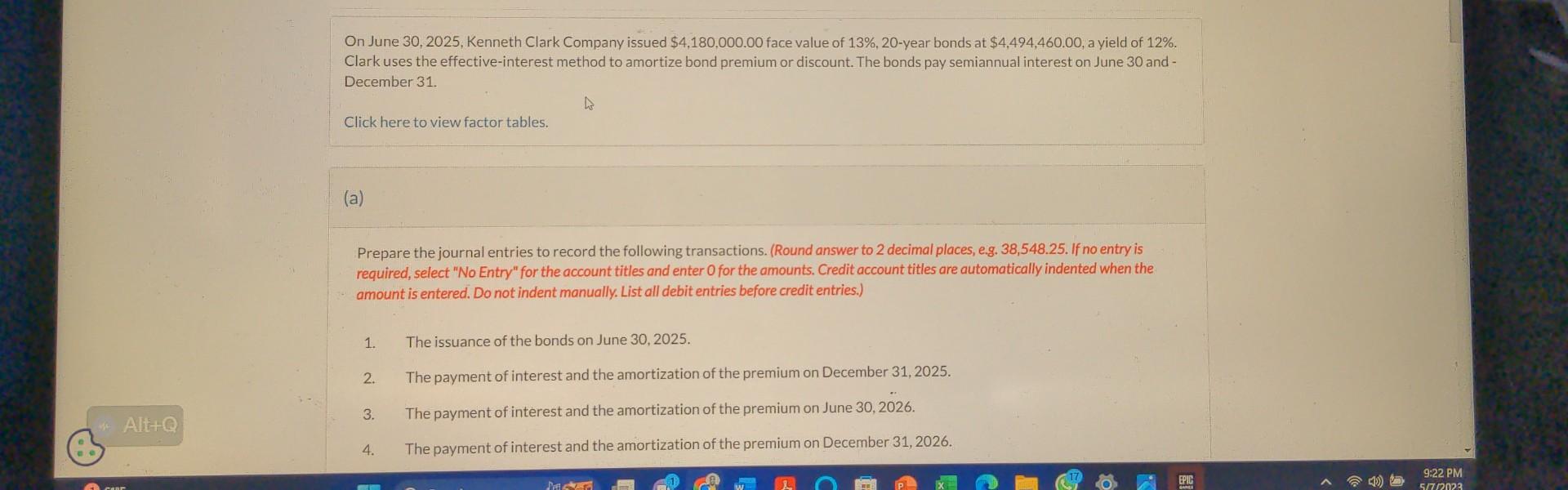

On June 30,2025 , Kenneth Clark Company issued $4,180,000.00 face value of 13%,20-year bonds at $4,494,460.00, a yield of 12%. Clark uses the effective-interest method to amortize bond premium or discount. The bonds pay semiannual interest on June 30 and December 31. Click here to view factor tables. (a) Prepare the journal entries to record the following transactions. (Round answer to 2 decimal places, e.g. 38,548.25. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) 1. The issuance of the bonds on June 30,2025. 2. The payment of interest and the amortization of the premium on December 31,2025. 3. The payment of interest and the amortization of the premium on June 30,2026. 4. The payment of interest and the amortization of the premium on December 31,2026. 1. 2. 3. 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started