Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BOP= balance of payments OSB= official settlements balance CAB=current account balance pFAB= autonomous financial account balance or private financial account balance f 10. (12 points)

BOP= balance of payments

OSB= official settlements balance

CAB=current account balance

pFAB= autonomous financial account balance or private financial account balance

f

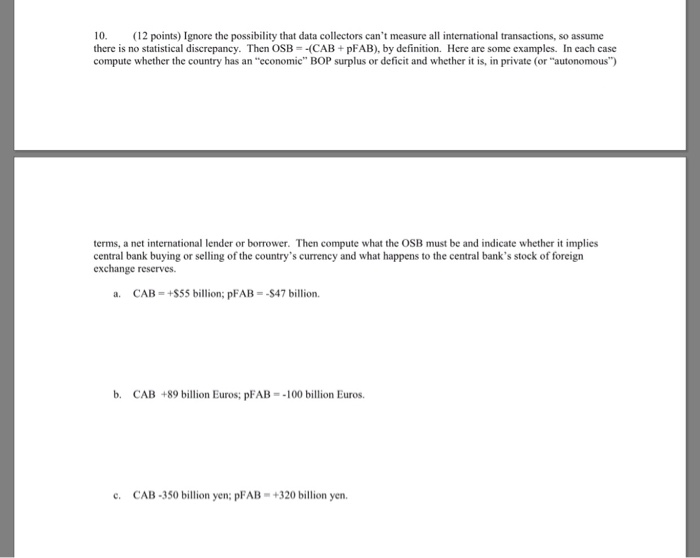

10. (12 points) Ignore the possibility that data collectors can't measure all international transactions, so assume casc compute whether the country has an "cconomic" BOP surplus or deficit and whether it is, in private (or "autonomous") terms, a net international lender or borrower. Then compute what the OSB must be and indicate whether it implies central bank buying or selling of the country's currency and what happens to the central bank's stock of foreign exchange reserves. CAB-+S55 billion; pFAB S47 billion. a. b. CAB +89 billion Euros; pFAB-100 billion Euros. c. CAB-350 billion yen; pFAB-+320 billion yen. 10. (12 points) Ignore the possibility that data collectors can't measure all international transactions, so assume casc compute whether the country has an "cconomic" BOP surplus or deficit and whether it is, in private (or "autonomous") terms, a net international lender or borrower. Then compute what the OSB must be and indicate whether it implies central bank buying or selling of the country's currency and what happens to the central bank's stock of foreign exchange reserves. CAB-+S55 billion; pFAB S47 billion. a. b. CAB +89 billion Euros; pFAB-100 billion Euros. c. CAB-350 billion yen; pFAB-+320 billion yen

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started