Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Venice Surf Co. expects to generate free cash flows (in $ millions) over the next three years of $519, $605, and $786. In addition,

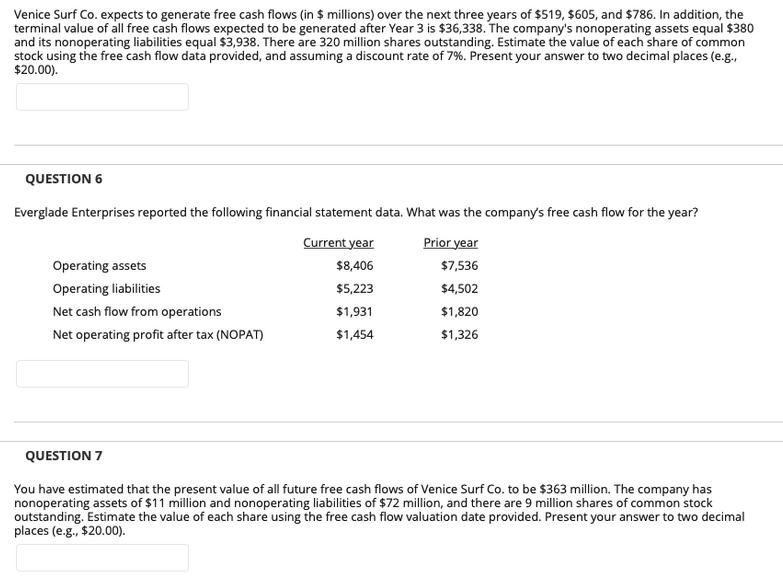

Venice Surf Co. expects to generate free cash flows (in $ millions) over the next three years of $519, $605, and $786. In addition, the terminal value of all free cash flows expected to be generated after Year 3 is $36,338. The company's nonoperating assets equal $380 and its nonoperating liabilities equal $3,938. There are 320 million shares outstanding. Estimate the value of each share of common. stock using the free cash flow data provided, and assuming a discount rate of 7%. Present your answer to two decimal places (e.g., $20.00). QUESTION 6 Everglade Enterprises reported the following financial statement data. What was the company's free cash flow for the year? Prior year $7,536 $4,502 $1,820 $1,326 Operating assets Operating liabilities Net cash flow from operations Net operating profit after tax (NOPAT) Current year $8,406 $5,223 $1,931 $1,454 QUESTION 7 You have estimated that the present value of all future free cash flows of Venice Surf Co. to be $363 million. The company has nonoperating assets of $11 million and nonoperating liabilities of $72 million, and there are 9 million shares of common stock outstanding. Estimate the value of each share using the free cash flow valuation date provided. Present your answer to two decimal places (e.g., $20.00).

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a To estimate the expected return using CAPM for JB HiFi JBH and a hypothetical company with a negative beta of 030 as at 6 December 2019 we ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started