Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 The Bearing Division operates in the energy sector and consists of a number of business units, nearly all of which are involved

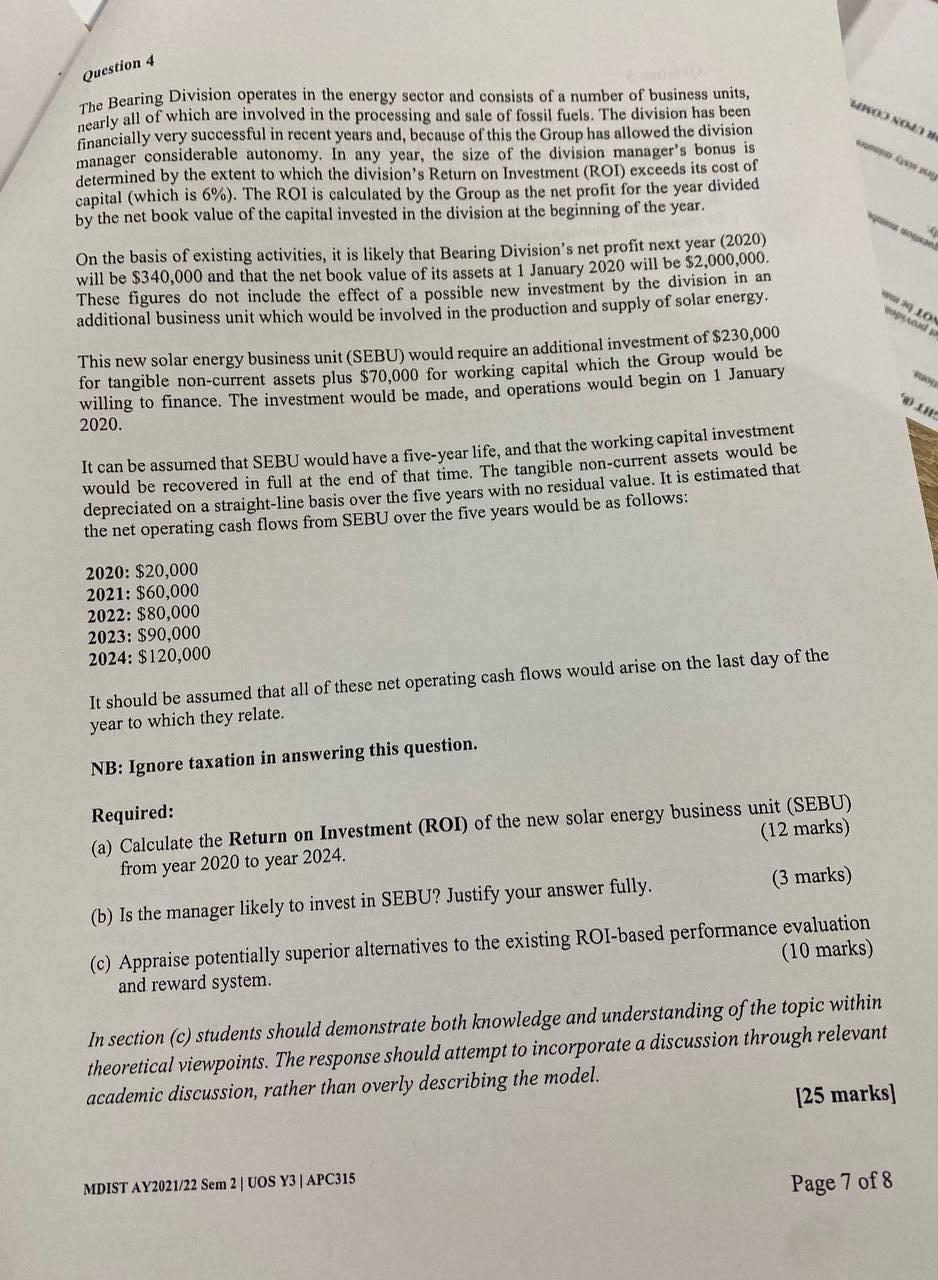

Question 4 The Bearing Division operates in the energy sector and consists of a number of business units, nearly all of which are involved in the processing and sale of fossil fuels. The division has been financially very successful in recent years and, because of this the Group has allowed the division manager considerable autonomy. In any year, the size of the division manager's bonus is determined by the extent to which the division's Return on Investment (ROI) exceeds its cost of capital (which is 6%). The ROI is calculated by the Group as the net profit for the year divided by the net book value of the capital invested in the division at the beginning of the year. On the basis of existing activities, it is likely that Bearing Division's net profit next year (2020) will be $340,000 and that the net book value of its assets at 1 January 2020 will be $2,000,000. These figures do not include the effect of a possible new investment by the division in an additional business unit which would be involved in the production and supply of solar energy. This new solar energy business unit (SEBU) would require an additional investment of $230,000 for tangible non-current assets plus $70,000 for working capital which the Group would be willing to finance. The investment would be made, and operations would begin on 1 January 2020. It can be assumed that SEBU would have a five-year life, and that the working capital investment would be recovered in full at the end of that time. The tangible non-current assets would be depreciated on a straight-line basis over the five years with no residual value. It is estimated that the net operating cash flows from SEBU over the five years would be as follows: 2020: $20,000 2021: $60,000 2022: $80,000 2023: $90,000 2024: $120,000 It should be assumed that all of these net operating cash flows would arise on the last day of the year to which they relate. NB: Ignore taxation in answering this question. MRO NOMB Required: (a) Calculate the Return on Investment (ROI) of the new solar energy business unit (SEBU) from year 2020 to year 2024. (12 marks) (b) Is the manager likely to invest in SEBU? Justify your answer fully. (3 marks) (10 marks) (c) Appraise potentially superior alternatives to the existing ROI-based performance evaluation and reward system. MDIST AY2021/22 Sem 2 | UOS Y3 | APC315 4 gaina sopsand In section (c) students should demonstrate both knowledge and understanding of the topic within theoretical viewpoints. The response should attempt to incorporate a discussion through relevant academic discussion, rather than overly describing the model. [25 marks] way www.LON popsanud p Page 7 of 8 suop @LH

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a The return on investment ROI for the new solar energy business unit SEBU from year 2020 to yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d6b53e4e39_175428.pdf

180 KBs PDF File

635d6b53e4e39_175428.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started