Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Borrowers Yash and Zara each are supposed to pay off their loans of $100,000 each next year. The bank which issued the loans has

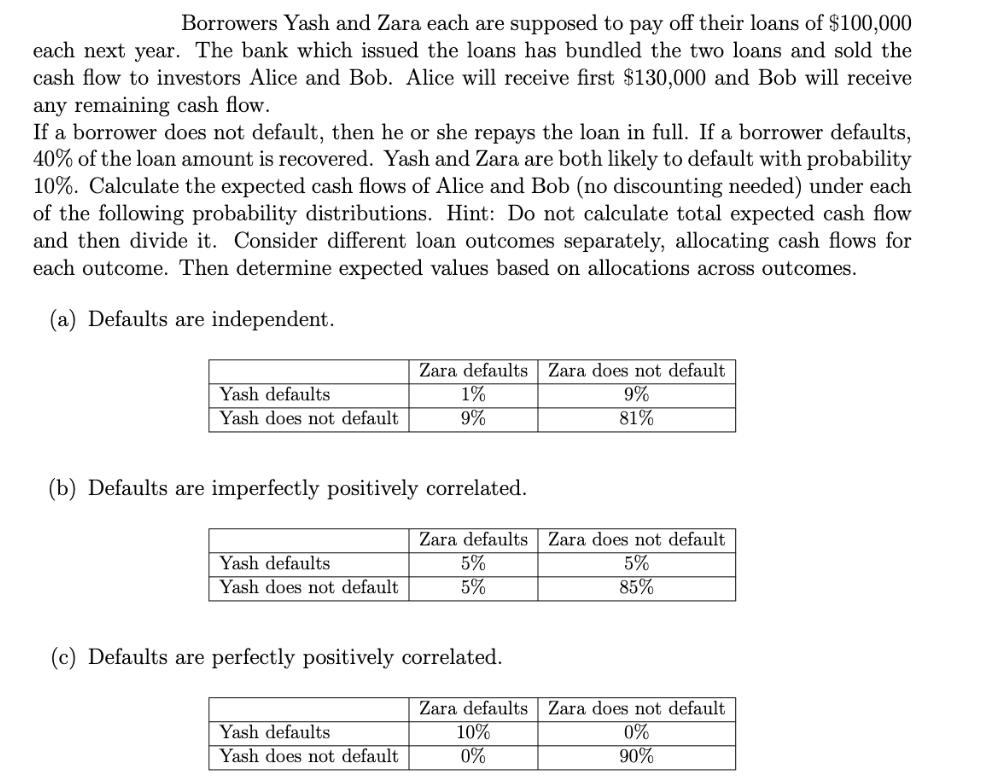

Borrowers Yash and Zara each are supposed to pay off their loans of $100,000 each next year. The bank which issued the loans has bundled the two loans and sold the cash flow to investors Alice and Bob. Alice will receive first $130,000 and Bob will receive any remaining cash flow. If a borrower does not default, then he or she repays the loan in full. If a borrower defaults, 40% of the loan amount is recovered. Yash and Zara are both likely to default with probability 10%. Calculate the expected cash flows of Alice and Bob (no discounting needed) under each of the following probability distributions. Hint: Do not calculate total expected cash flow and then divide it. Consider different loan outcomes separately, allocating cash flows for each outcome. Then determine expected values based on allocations across outcomes. (a) Defaults are independent. Yash defaults Yash does not default Yash defaults Yash does not default Zara defaults Zara does not default 9% 81% 1% (b) Defaults are imperfectly positively correlated. Yash defaults Yash does not default 9% Zara defaults Zara does not default 5% 85% 5% 5% (c) Defaults are perfectly positively correlated. Zara defaults Zara does not default. 10% 0% 0% 90%

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

In this question Yash and Zara are borrowers who pay off their loans of 100000 each to a bank The bank has sold the cash flow to investors Alice and B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started