Answered step by step

Verified Expert Solution

Question

1 Approved Answer

borrows enough cash using a short-term note to reach the minimum. Short-term notes require an interest payment of 1% at each month-end (before any

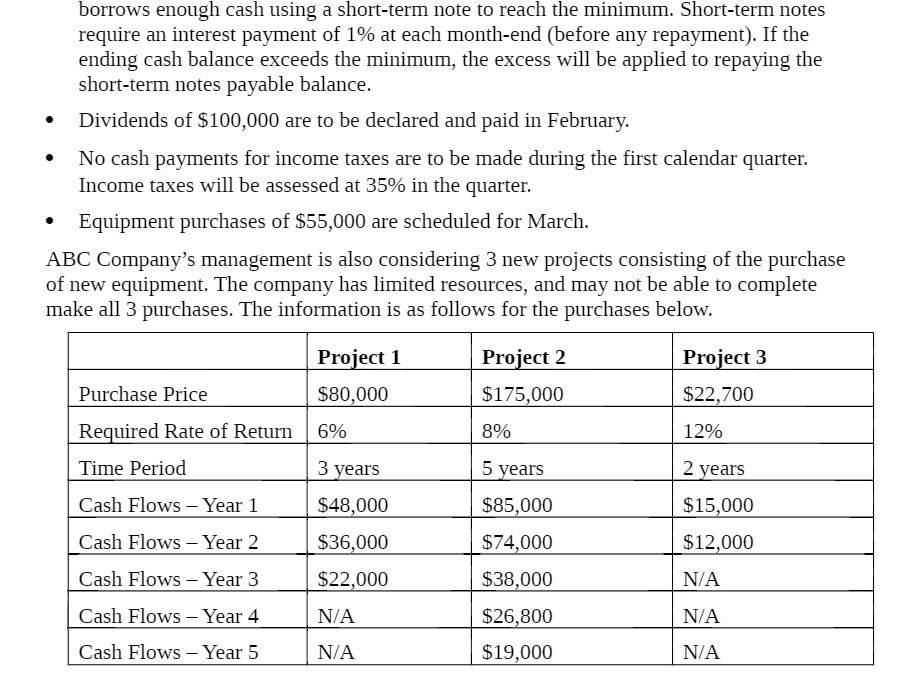

borrows enough cash using a short-term note to reach the minimum. Short-term notes require an interest payment of 1% at each month-end (before any repayment). If the ending cash balance exceeds the minimum, the excess will be applied to repaying the short-term notes payable balance. Dividends of $100,000 are to be declared and paid in February. No cash payments for income taxes are to be made during the first calendar quarter. Income taxes will be assessed at 35% in the quarter. Equipment purchases of $55,000 are scheduled for March. ABC Company's management is also considering 3 new projects consisting of the purchase of new equipment. The company has limited resources, and may not be able to complete make all 3 purchases. The information is as follows for the purchases below. Purchase Price Project 1 $80,000 Project 2 Project 3 $175,000 $22,700 Required Rate of Return 6% 8% 12% Time Period 3 years 5 years 2 years Cash Flows - Year 1 $48,000 $85,000 $15,000 Cash Flows Year 2 $36,000 $74,000 $12,000 Cash Flows Year 3 $22,000 $38,000 N/A Cash Flows - Year 4 N/A $26,800 N/A Cash Flows Year 5 N/A $19,000 N/A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the information and provide detailed solutions for each aspect of ABC Companys financial situation and decisionmaking process 1 ShortTerm Notes and Cash Management ABC Company needs to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started