Answered step by step

Verified Expert Solution

Question

1 Approved Answer

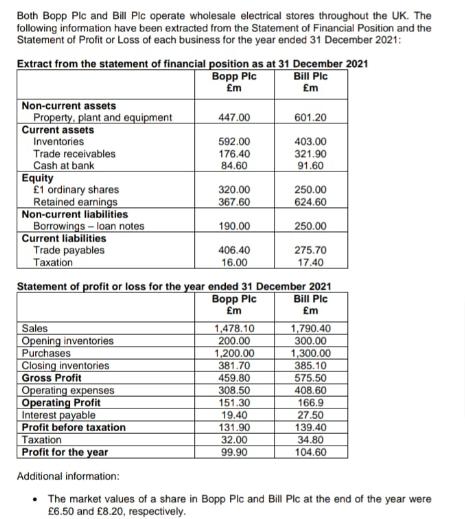

Both Bopp Plc and Bill Plc operate wholesale electrical stores throughout the UK. The following information have been extracted from the Statement of Financial

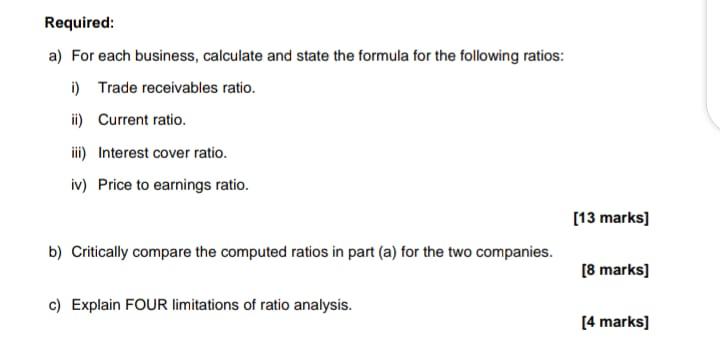

Both Bopp Plc and Bill Plc operate wholesale electrical stores throughout the UK. The following information have been extracted from the Statement of Financial Position and the Statement of Profit or Loss of each business for the year ended 31 December 2021: Extract from the statement of financial position as at 31 December 2021 Bopp Pic m Bill Pic m Non-current assets Property, plant and equipment Current assets Inventories Trade receivables Cash at bank Equity 1 ordinary shares Retained earnings Non-current liabilities Borrowings-loan notes Current liabilities Trade payables Taxation Sales Opening inventories Purchases Closing inventories Gross Profit Operating expenses Operating Profit 447.00 592.00 176.40 84.60 Interest payable Profit before taxation 320.00 367.60 190.00 406.40 16.00 Statement of profit or loss for the year ended 31 December 2021 Bill Plc Bopp Plc Em Em 1,478.10 200.00 1,200.00 381.70 459.80 601.20 308.50 151.30 19.40 131.90 32.00 99.90 403.00 321.90 91.60 250.00 624.60 250.00 275.70 17.40 1,790.40 300.00 1,300.00 385.10 575.50 408.60 166.9 27.50 139.40 34.80 104.60 Taxation Profit for the year Additional information: The market values of a share in Bopp Plc and Bill Plc at the end of the year were 6.50 and 8.20, respectively. Required: a) For each business, calculate and state the formula for the following ratios: i) Trade receivables ratio. ii) Current ratio. iii) Interest cover ratio. iv) Price to earnings ratio. b) Critically compare the computed ratios in part (a) for the two companies. c) Explain FOUR limitations of ratio analysis. [13 marks] [8 marks] [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started