Answered step by step

Verified Expert Solution

Question

1 Approved Answer

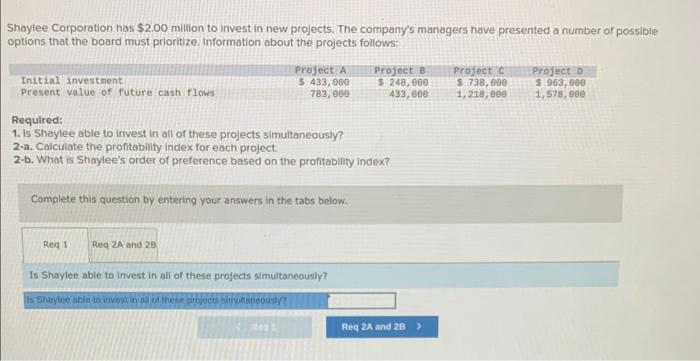

both parts please, its one question. Shaylee Corporation has $2.00 million to invest in new projects. The company's managers have presented a number of possible

both parts please, its one question.

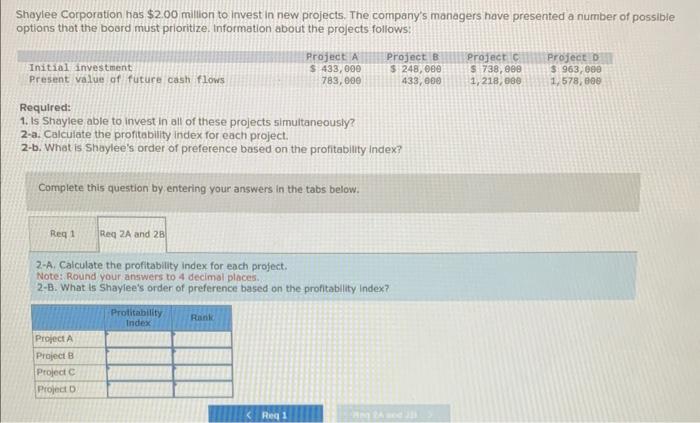

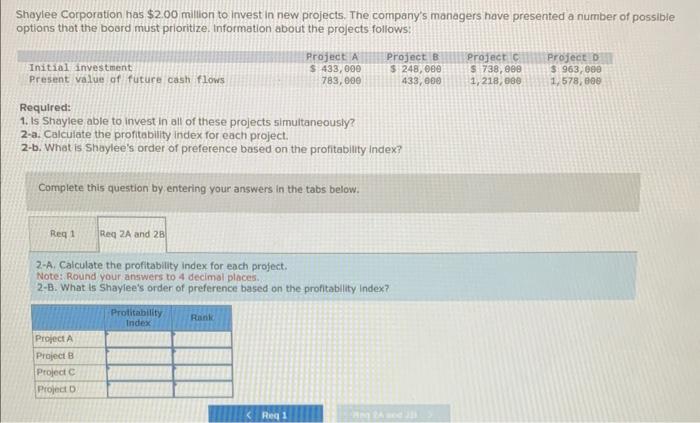

Shaylee Corporation has $2.00 million to invest in new projects. The company's managers have presented a number of possible options that the board must prioritize. Information about the projects follows: Required: 1. Is Shaylee able to invest in all of these projects simultaneously? 2-a. Calculate the profitability index for each project. 2-b. What is Shaylee's order of preference based on the profitability index? Complete this question by entering your answers in the tabs below. 15 Shaylee able to invest in all of these projects simultaneously? Shaylee Corporation has $2.00 million to invest in new projects. The company's managers have presented a number of possib options that the board must prioritize. Information about the projects follows: Required: 1. Is Shaylee able to invest in all of these projects simultaneously? 2-a. Calculate the profitability index for each project. 2-b. What is Shaylee's order of preference based on the profitability index? Complete this question by entering your answers in the tabs below. 2-A. Calculate the profitability index for each project. Note: Round your answers to 4 decimal places. 2-B. What is shaylee's order of preference based on the profitability Index

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started