Answered step by step

Verified Expert Solution

Question

1 Approved Answer

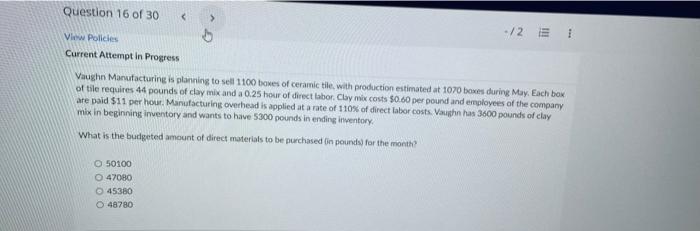

Both plz, thanks! Question 16 of 30 View Policies 12 E Current Attempt in Progress Vaughn Manufacturing is planning to sell 1100 boxes of ceramic

Both plz, thanks!

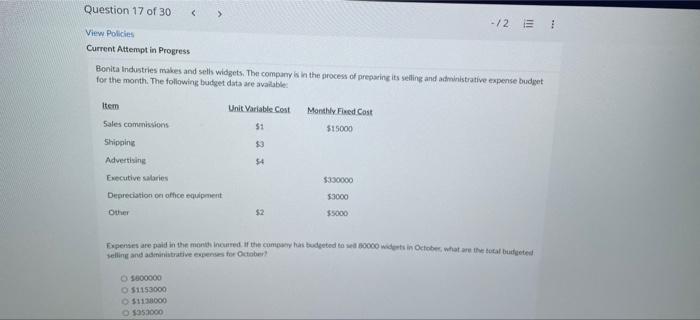

Question 16 of 30 View Policies 12 E Current Attempt in Progress Vaughn Manufacturing is planning to sell 1100 boxes of ceramic tile with production estimated at 1070 boxes during May. Each box of tile requires 44 pounds of clay mix and a 0.25 hour of direct labor. Clay mix costs $0.60 per pound and employees of the company are paid $11 per hour. Manufacturing overhead is applied at a rate of 110% of direct labor costs. Vaughn has 3500 pounds of clay mix in beginning inventory and wants to have 5300 poundsin ending inventory What is the budgeted amount of direct materials to be purchased in pounds for the month 50100 047080 45380 48780 Question 17 of 30 > -/ 21 View Policies Current Attempt in Progress Bonita Industries makes and sell widgets. The company in the process of preparing its selling and administrative expense budget for the month. The following budget data are available Item Unit Variable Cost Monthly Fixed Cost Sales commissions $1 515000 Shipping $3 Advertising $4 Executive sabores $330000 Depreciation on office equipment 53000 Other $2 Expenses are paid in the month incurred if the company has budgeted to do widents in October, what are total budgeted selling and administrative expenses for October 5000000 O $1153000 $118000 1953000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started