Answered step by step

Verified Expert Solution

Question

1 Approved Answer

both these come from the same values ans number set. please answer them both! Shows what is correct or incorrect for the work you have

both these come from the same values ans number set. please answer them both!

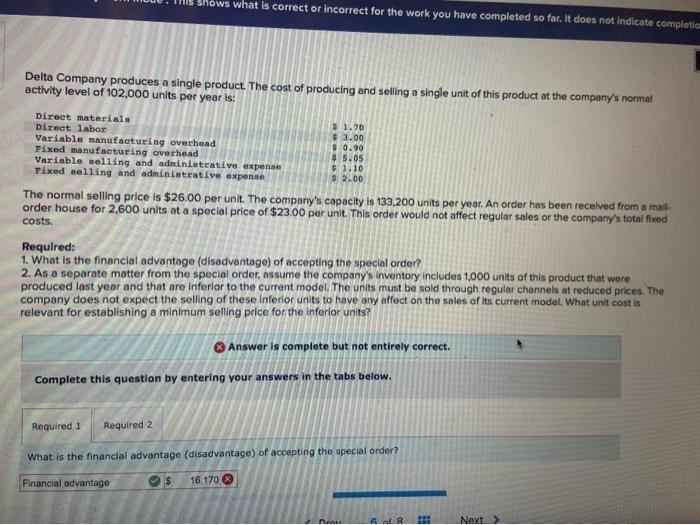

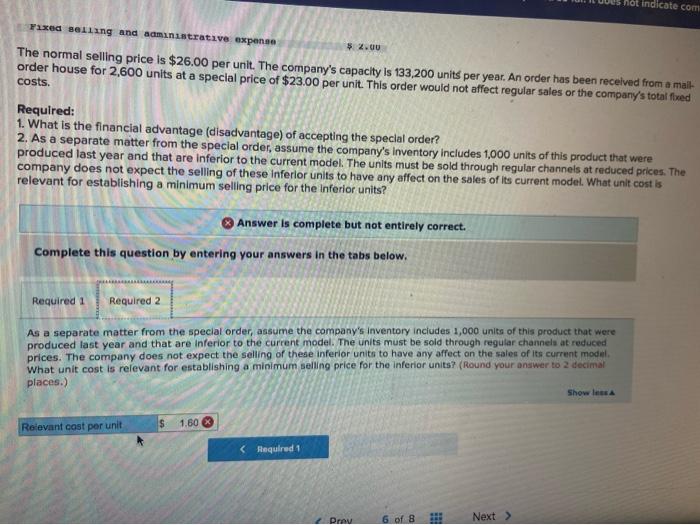

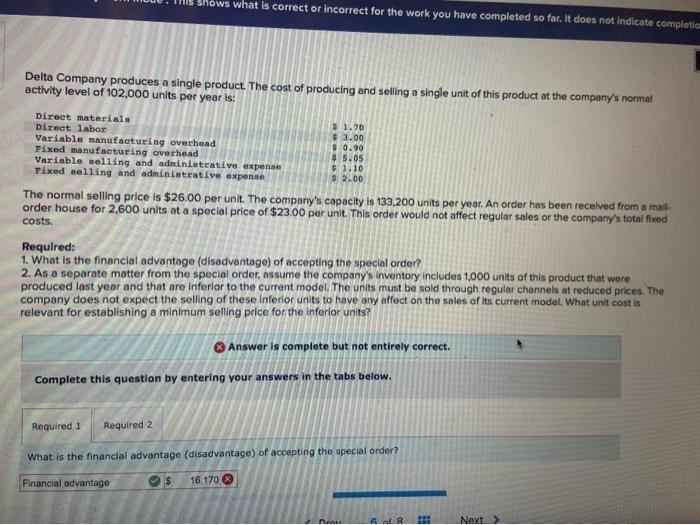

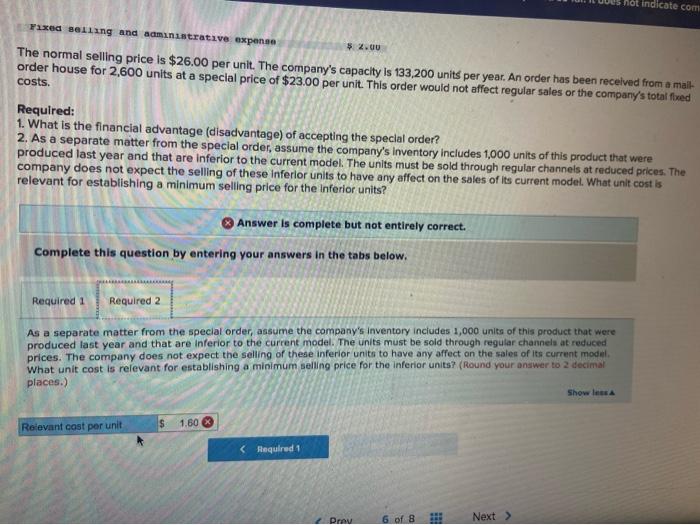

Shows what is correct or incorrect for the work you have completed so far. It does not indicate completio Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 102,000 units per year is: Direct materials 1.70 Direct labor $ 3.00 Variable manufacturing overhead $ 0.90 Pixed manufacturing overhead $ 5.05 Variable selling and administrative expense $ 1.10 Fixed selling and administrative expense $ 2.00 The normal selling price is $26.00 per unit. The company's capacity is 133,200 units per year. An order has been received from a mail order house for 2,600 units at a special price of $23.00 per unit. This order would not affect regular sales or the company's total food costs. Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's inventory includes 1,000 units of this product that were produced last year and that are inferior to the current model. The units must be sold through regular channels at reduced prices. The company does not expect the selling of these inferior units to have any affect on the sales of its current model. What unit cost is relevant for establishing a minimum selling price for the inferior units? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the financial advantage (disadvantage) of accepting the special order? Financial advantage os 16,170 HE Next > not indicate com $ 2.00 Yaxed selling and administrative expense The normal selling price is $26.00 per unit. The company's capacity is 133,200 units per year. An order has been received from a mail- order house for 2,600 units at a special price of $23.00 per unit. This order would not affect regular sales or the company's total fived costs. Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's inventory includes 1,000 units of this product that were produced last year and that are inferior to the current model. The units must be sold through regular channels at reduced prices. The company does not expect the selling of these inferior units to have any affect on the sales of its current model. What unit cost is relevant for establishing a minimum selling price for the inferior units? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 As a separate matter from the special order, assume the company's inventory Includes 1,000 units of this product that were produced last year and that are inferior to the current model. The units must be sold through regular channels at reduced prices. The company does not expect the selling of these inferior units to have any affect on the sales of its current model What unit cost is relevant for establishing a minimum selling price for the inferior units? (Round your answer to 2 decimal places.) Show less S 1.60 Relevant cost per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started