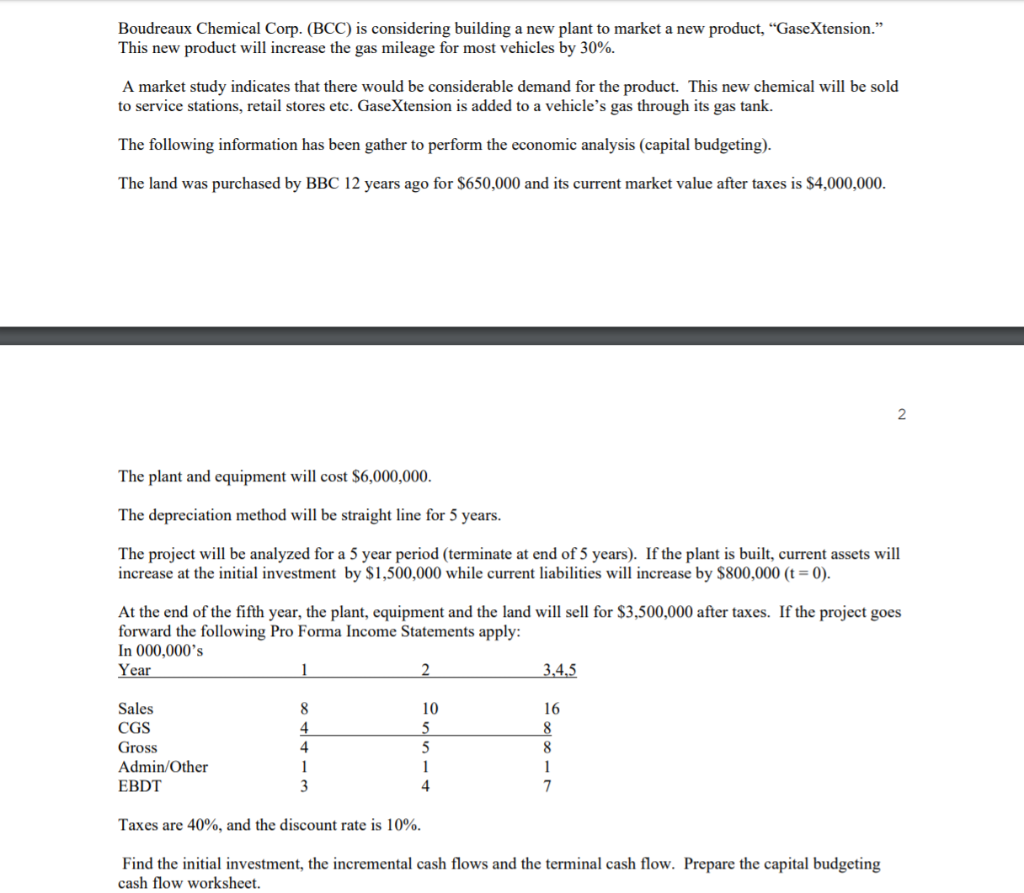

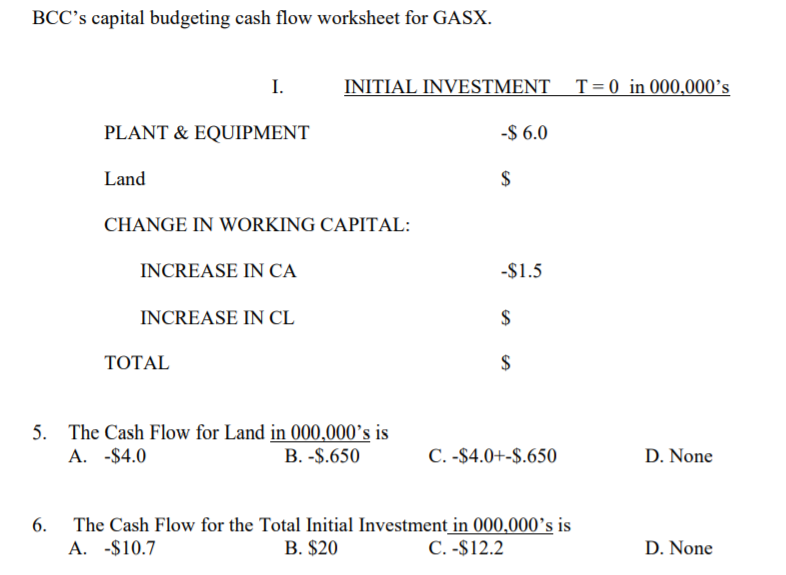

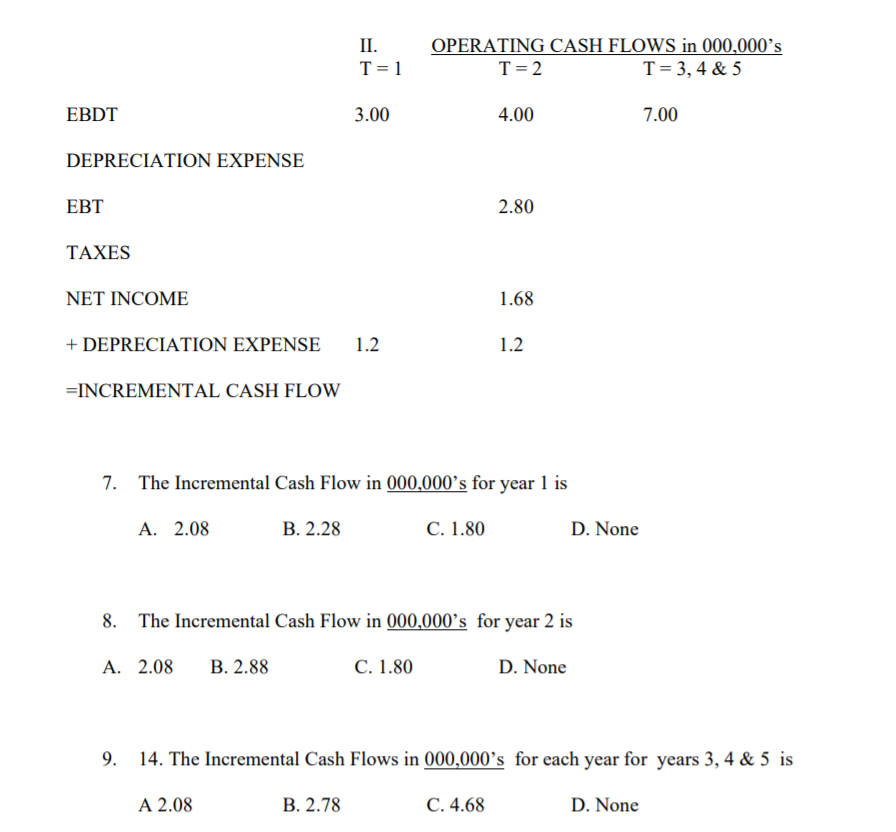

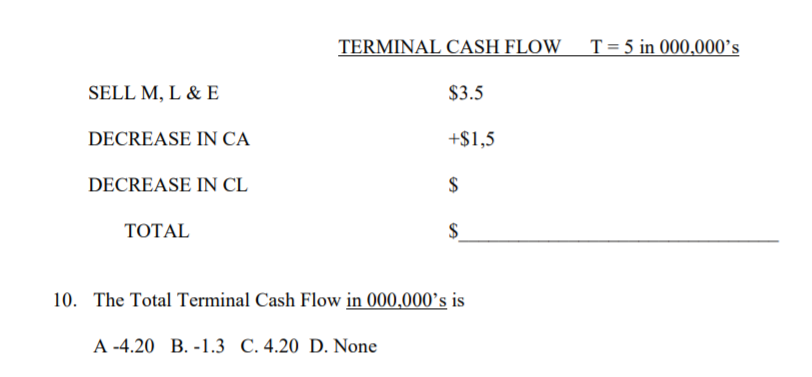

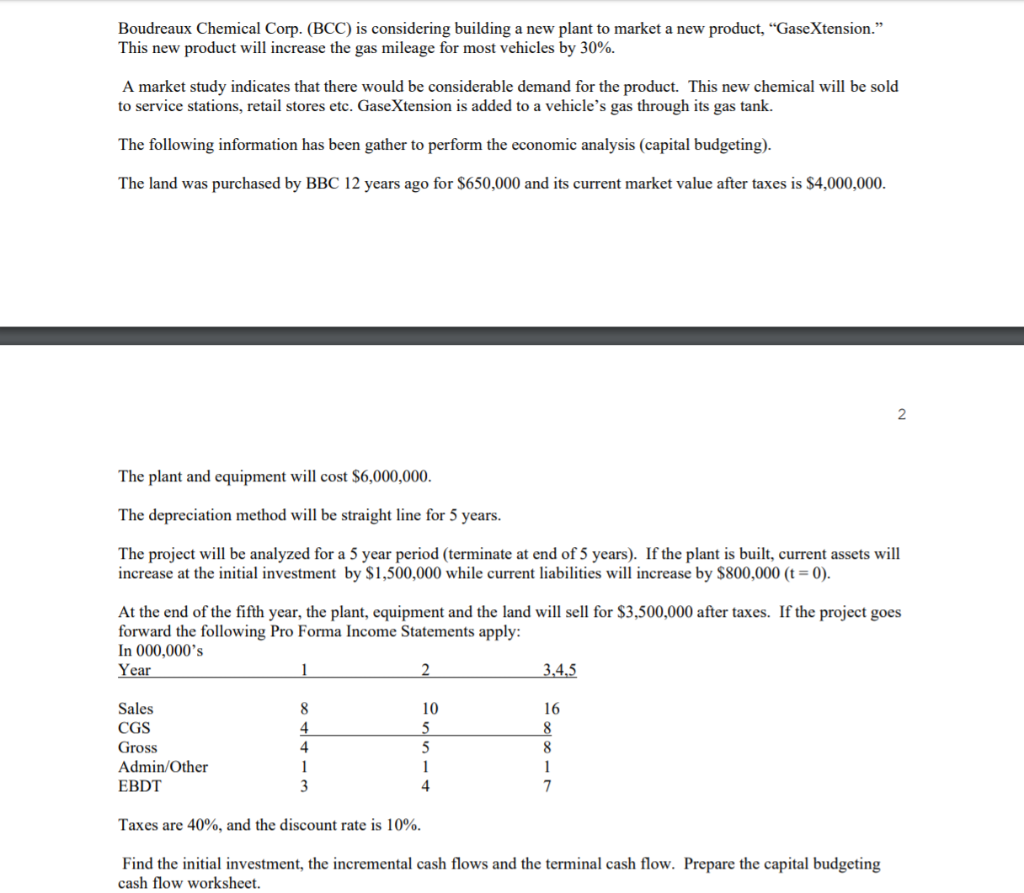

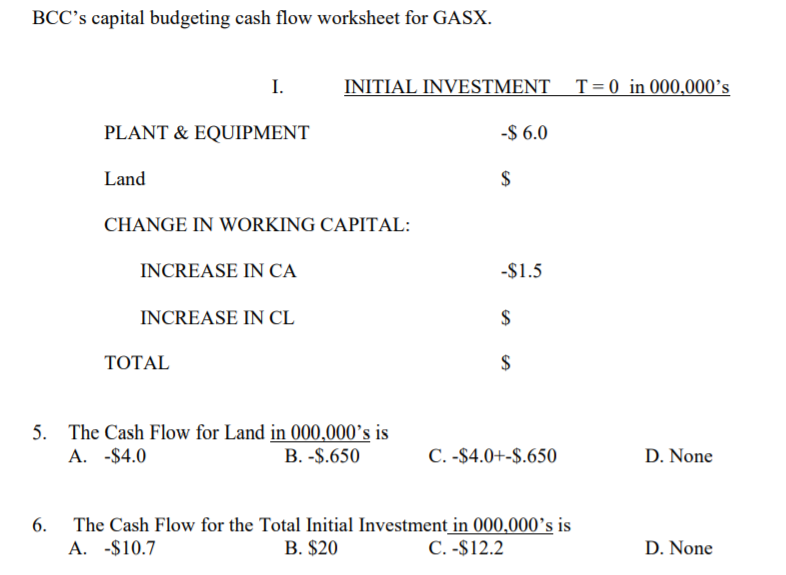

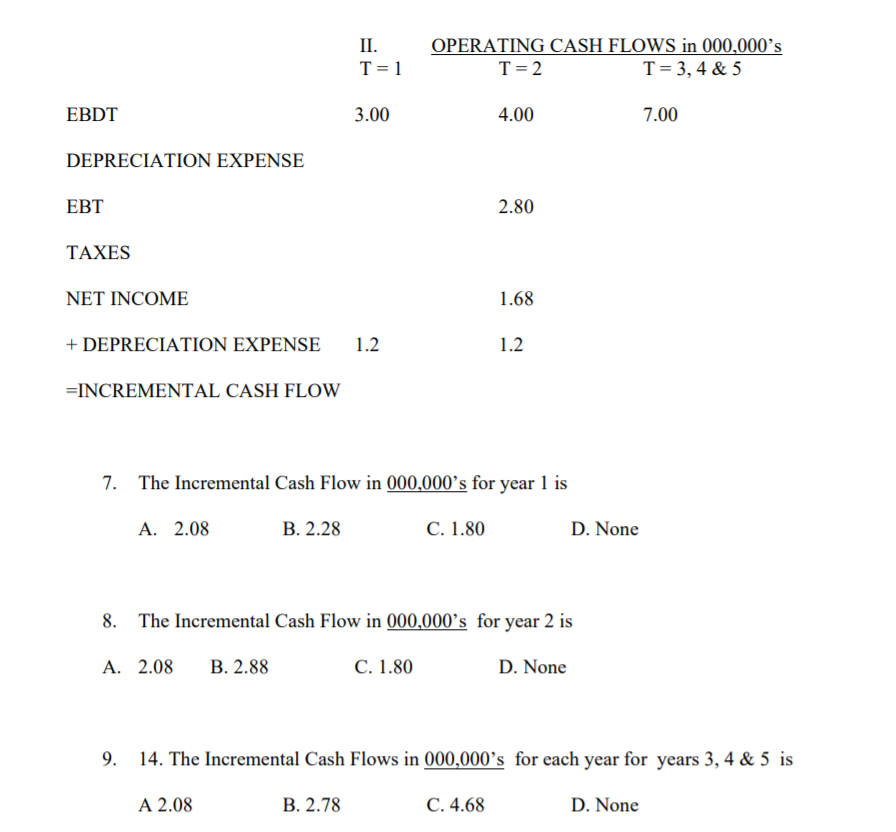

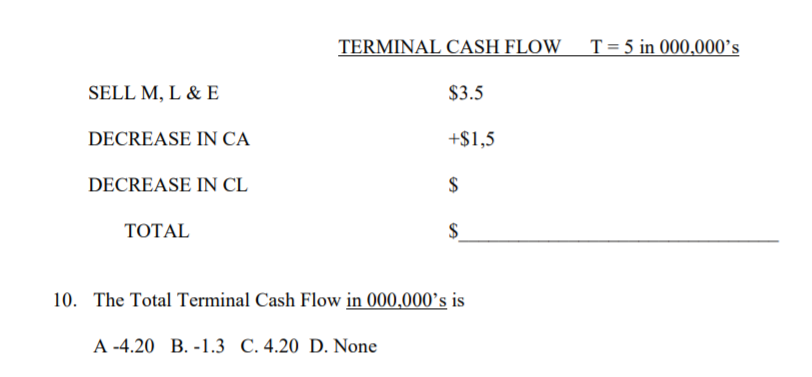

Boudreaux Chemical Corp. (BCC) is considering building a new plant to market a new product, GaseXtension." This new product will increase the gas mileage for most vehicles by 30%. A market study indicates that there would be considerable demand for the product. This new chemical will be sold to service stations, retail stores etc. GaseXtension is added to a vehicle's gas through its gas tank. The following information has been gather to perform the economic analysis (capital budgeting). The land was purchased by BBC 12 years ago for $650,000 and its current market value after taxes is $4,000,000. The plant and equipment will cost $6,000,000. The depreciation method will be straight line for 5 years. The project will be analyzed for a 5 year period (terminate at end of 5 years). If the plant is built, current assets will increase at the initial investment by $1,500,000 while current liabilities will increase by $800,000 (t = 0). At the end of the fifth year, the plant, equipment and the land will sell for $3,500,000 after taxes. If the project goes forward the following Pro Forma Income Statements apply: In 000,000's Year 3,4,5 Sales CGS Gross Admin/Other EBDT Taxes are 40%, and the discount rate is 10%. Find the initial investment, the incremental cash flows and the terminal cash flow. Prepare the capital budgeting cash flow worksheet. BCC's capital budgeting cash flow worksheet for GASX. I. INITIAL INVESTMENT T = 0 in 000,000's PLANT & EQUIPMENT -$ 6.0 Land CHANGE IN WORKING CAPITAL: INCREASE IN CA -$1.5 INCREASE IN CL TOTAL 5. The Cash Flow for Land in 000,000's is A. -$4.0 B. -$.650 C. -$4.0+-$.650 D. None 6. The Cash Flow for the Total Initial Investment in 000,000's is A. -$10.7 B. $20 C. -$12.2 D. None II. T=1 OPERATING CASH FLOWS in 000,000's T= 2 T= 3, 4 & 5 EBDT 3.00 4.00 7.00 DEPRECIATION EXPENSE EBT 2.80 TAXES NET INCOME 1.68 + DEPRECIATION EXPENSE 1.2 1.2 =INCREMENTAL CASH FLOW 7. The Incremental Cash Flow in 000,000's for year 1 is A. 2.08 B. 2.28 C. 1.80 D. None 8. The Incremental Cash Flow in 000,000's for year 2 is A. 2.08 B. 2.88 C. 1.80 D. None 9. 14. The Incremental Cash Flows in 000,000's for each year for years 3, 4 & 5 is A 2.08 B. 2.78 C. 4.68 D. None TERMINAL CASH FLOW T = 5 in 000,000's SELL M, L & E $3.5 DECREASE IN CA +$1,5 DECREASE IN CL TOTAL 10. The Total Terminal Cash Flow in 000,000's is A -4.20 B.-1.3 C. 4.20 D. None