Question

Bourbon Barrel Industries is trying to decide whether to replace their 50-year old barrel machine (which still requires a lot of hand labor and skill)

Bourbon Barrel Industries is trying to decide whether to replace their 50-year old barrel machine (which still requires a lot of hand labor and skill) with a new computer-aided, fully automatic machine. The existing machine has a zero book value, but could be sold to a more traditional barrel maker for $10,000. If used another 5 years it would be completely worn out and worth nothing.

The new machine has a cost of $100,000 (including installation) and would be depreciated over 5 years to a zero salvage value. In reality, the machine would still have a value of approximately $30,000 at the end of 5 years. The new machine wouldn't change revenue, but would reduce labor and maintenance expense by $22,500 per year. The firm's tax rate is 35% and the required rate of return on the project is 11%. What should the firm do

How are the x Pv Factors calculated at the problem at 11%? I am confused about how the rest of the factors were found

How are the x Pv Factors calculated at the problem at 11%? I am confused about how the rest of the factors were found

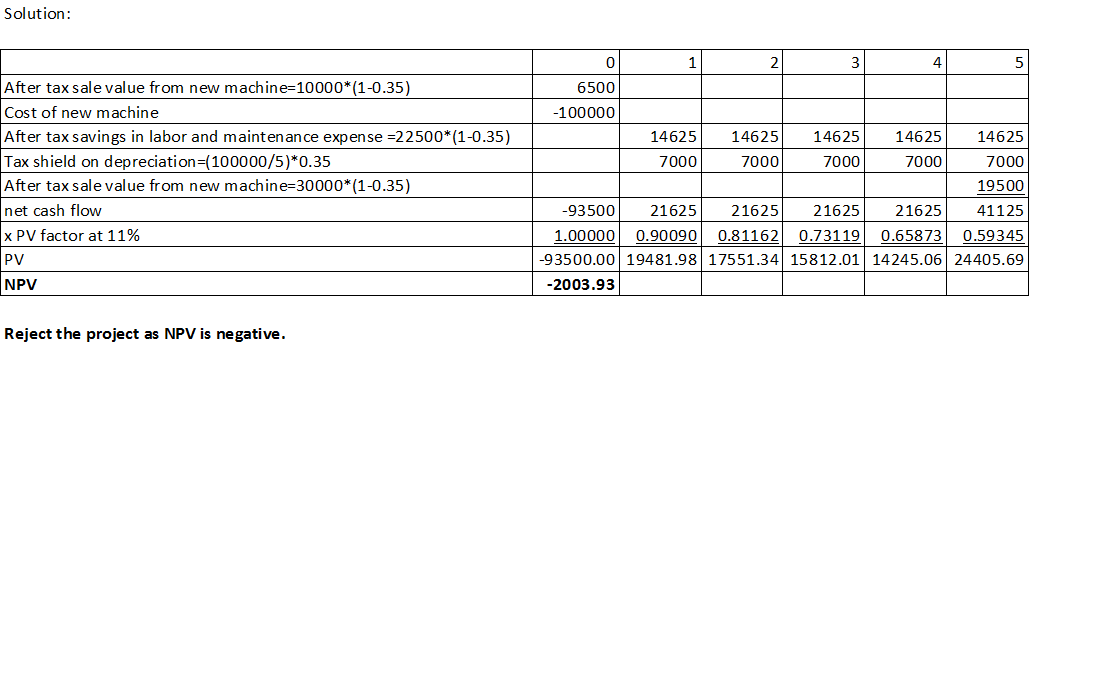

Solution: After tax sale value from new machine=10000*(1-0.35) 10000*(1-0.35) Cost of new machine After tax savings in labor and maintenance expense =22500*(1-0.35) Tax shield on depreciation=100000/5)*0.35 After tax sale value from new machine=30000*(1-0.35) net cash flow x PV factor at 11% 0 1 2 3 4 5 6500 -100000 1462514625146251462514625 7000 7000 7000 7000 7000 19500 -93500216252162521625 21625 41125 1.00000 0.90090 0.81162 0.73119 0.65873 0.59345 -93500.00 19481.98 17551.34 15812.01 14245.06 24405.69 -2003.93 PV NPV Reject the project as NPV is negative

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started