Answered step by step

Verified Expert Solution

Question

1 Approved Answer

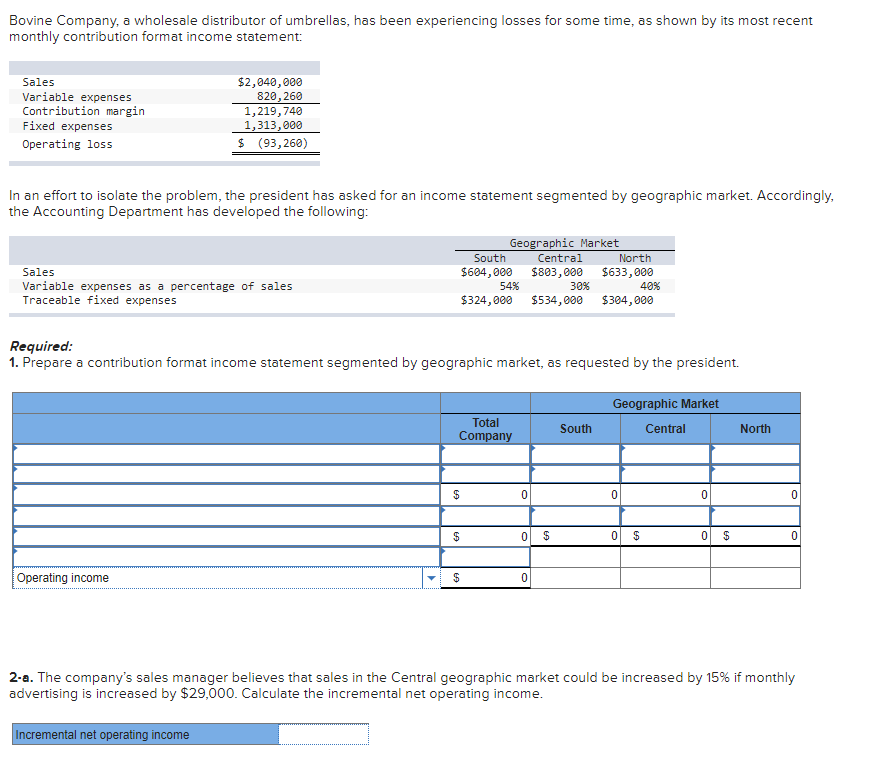

Bovine Company, a wholesale distributor of umbrellas, has been experiencing losses for some time, as shown by its most recent monthly contribution format income

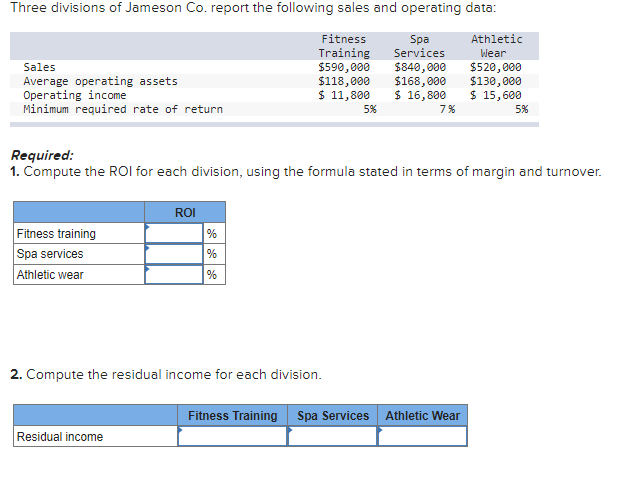

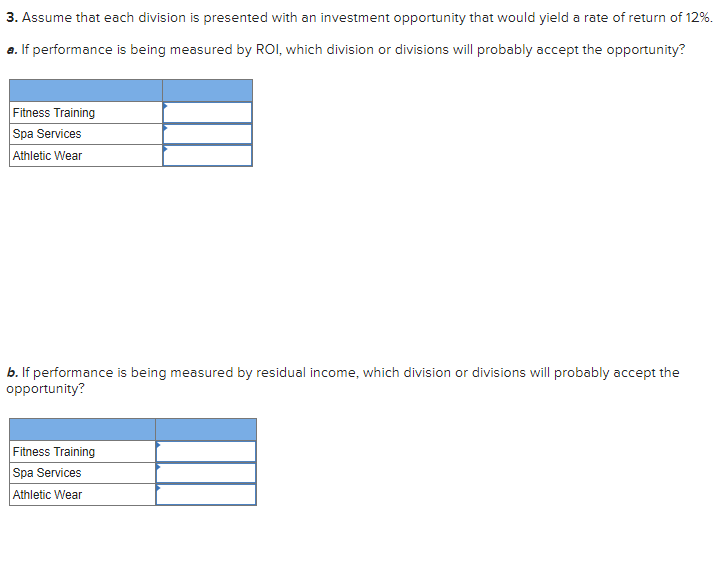

Bovine Company, a wholesale distributor of umbrellas, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement: Sales Variable expenses Fixed expenses Operating loss Contribution margin $2,040,000 820,260 1,219,740 1,313,000 $ (93,260) In an effort to isolate the problem, the president has asked for an income statement segmented by geographic market. Accordingly, the Accounting Department has developed the following: Sales Variable expenses as a percentage of sales Traceable fixed expenses Geographic Market South $604,000 54% $324,000 Central $803,000 $633,000 30% $534,000 $304,000 North 40% Required: 1. Prepare a contribution format income statement segmented by geographic market, as requested by the president. Operating income Geographic Market Total Company South Central North $ 0 0 0 0 $ 0 $ 0 $ 0 $ 0 $ 0 2-a. The company's sales manager believes that sales in the Central geographic market could be increased by 15% if monthly advertising is increased by $29,000. Calculate the incremental net operating income. Incremental net operating income Three divisions of Jameson Co. report the following sales and operating data: Fitness Training Spa Services Athletic Sales $590,000 $840,000 Wear $520,000 Average operating assets $118,000 $168,000 $130,000 Operating income $ 11,800 $ 16,800 $ 15,600 Minimum required rate of return 5% 7% 5% Required: 1. Compute the ROI for each division, using the formula stated in terms of margin and turnover. Fitness training ROI % Spa services % Athletic wear % 2. Compute the residual income for each division. Fitness Training Spa Services Athletic Wear Residual income 3. Assume that each division is presented with an investment opportunity that would yield a rate of return of 12%. a. If performance is being measured by ROI, which division or divisions will probably accept the opportunity? Fitness Training Spa Services Athletic Wear b. If performance is being measured by residual income, which division or divisions will probably accept the opportunity? Fitness Training Spa Services Athletic Wear

Step by Step Solution

There are 3 Steps involved in it

Step: 1

3 Assume that each division is presented with an investment opportunity that would yi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started