Question

Bower Corporation has the following shares outstanding: 15,000 shares L of $50 par value, eight percent preferred stock and 50,000 shares of $5 par

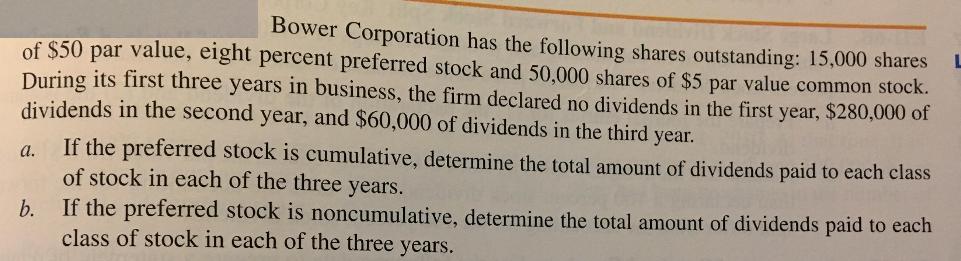

Bower Corporation has the following shares outstanding: 15,000 shares L of $50 par value, eight percent preferred stock and 50,000 shares of $5 par value common stock. During its first three years in business, the firm declared no dividends in the first year, $280,000 of dividends in the second year, and $60,000 of dividends in the third year. If the preferred stock is cumulative, determine the total amount of dividends paid to each class of stock in each of the three years. a. b. If the preferred stock is noncumulative, determine the total amount of dividends paid to each class of stock in each of the three years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Ell1B Determination of Total Amount of Dividend paid to each class of stock in each of the three yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: J. David Spiceland, Wayne Thomas, Don Herrmann

3rd edition

9780077506902, 78025540, 77506901, 978-0078025549

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App