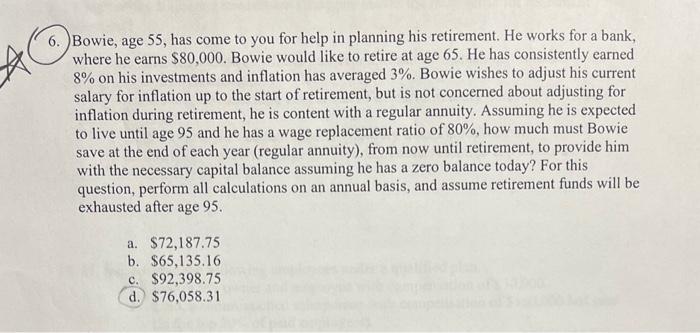

Question

Bowie, age 55, has come to you for help in planning his retirement. He works for a bank, where he earns $80,000. Bowie would like

Bowie, age 55, has come to you for help in planning his retirement. He works for a bank, where he earns $80,000. Bowie would like to retire at age 65. He has consistently earned 8% on his investments and inflation has averaged 3%. Bowie wishes to adjust his current salary for inflation up to the start of retirement, but is not concerned about adjusting for inflation during retirement, he is content with a regular annuity. Assuming he is expected to live until age 95 and he has a wage replacement ratio of 80%, how much must Bowie save at the end of each year (regular annuity), from now until retirement, to provide him with the necessary capital balance assuming he has a zero balance today? For this question, perform all calculations on an annual basis, and assume retirement funds will be exhausted after age 95.

a. $72,187.75

b. $65,135.16

C. $92,398.75

d. $76,058.31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started