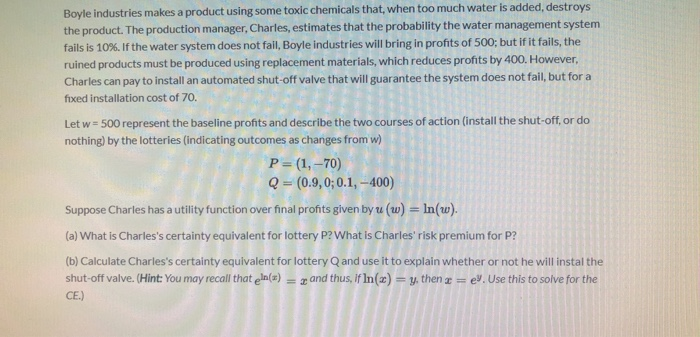

Boyle industries makes a product using some toxic chemicals that when too much water is added, destroys the product. The production manager, Charles, estimates that the probability the water management system fails is 10%. If the water system does not fail, Boyle industries will bring in profits of 500; but if it fails, the ruined products must be produced using replacement materials, which reduces profits by 400. However, Charles can pay to install an automated shut-off valve that will guarantee the system does not fail, but for a fixed installation cost of 70. Let w = 500 represent the baseline profits and describe the two courses of action (install the shut-off, or do nothing) by the lotteries (indicating outcomes as changes from w) P= (1, -70) Q=0.9,0;0.1, -400) Suppose Charles has a utility function over final profits given by u (w) = ln(w). (a) What is Charles's certainty equivalent for lottery P? What is Charles' risk premium for P? (b) Calculate Charles's certainty equivalent for lottery Q and use it to explain whether or not he will instal the shut-off valve. (Hint: You may recall that eln(x) = x and thus, if In(x) = y, then x = ey. Use this to solve for the CE) Boyle industries makes a product using some toxic chemicals that when too much water is added, destroys the product. The production manager, Charles, estimates that the probability the water management system fails is 10%. If the water system does not fail, Boyle industries will bring in profits of 500; but if it fails, the ruined products must be produced using replacement materials, which reduces profits by 400. However, Charles can pay to install an automated shut-off valve that will guarantee the system does not fail, but for a fixed installation cost of 70. Let w = 500 represent the baseline profits and describe the two courses of action (install the shut-off, or do nothing) by the lotteries (indicating outcomes as changes from w) P= (1, -70) Q=0.9,0;0.1, -400) Suppose Charles has a utility function over final profits given by u (w) = ln(w). (a) What is Charles's certainty equivalent for lottery P? What is Charles' risk premium for P? (b) Calculate Charles's certainty equivalent for lottery Q and use it to explain whether or not he will instal the shut-off valve. (Hint: You may recall that eln(x) = x and thus, if In(x) = y, then x = ey. Use this to solve for the CE)