Answered step by step

Verified Expert Solution

Question

1 Approved Answer

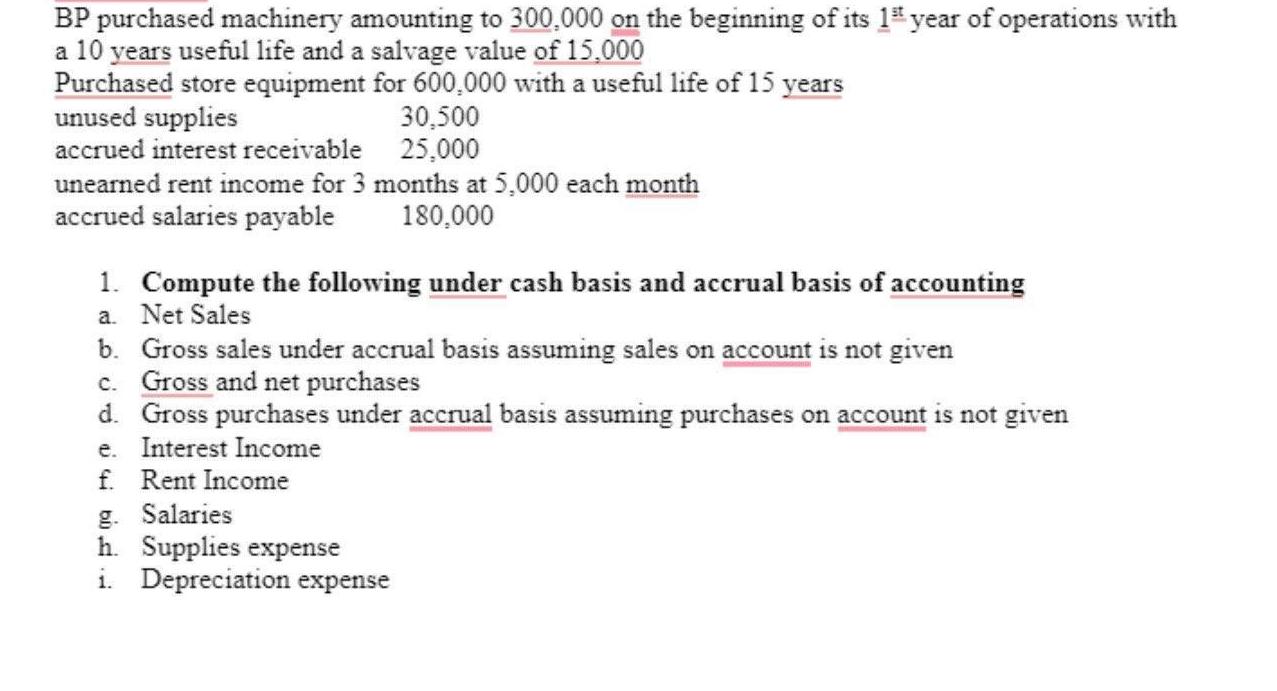

BP purchased machinery amounting to 300,000 on the beginning of its 1st year of operations with a 10 years useful life and a salvage

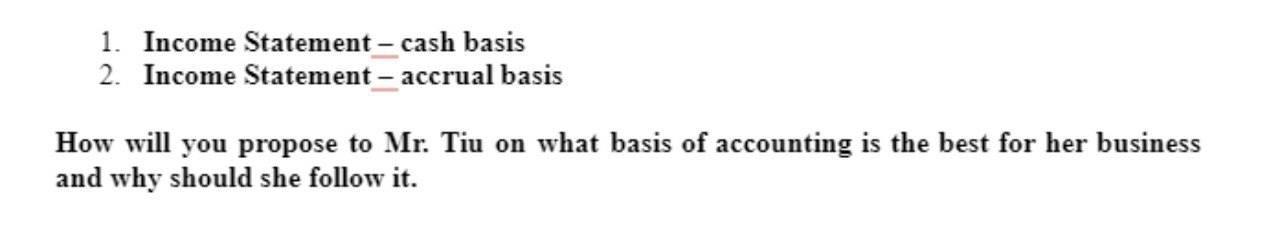

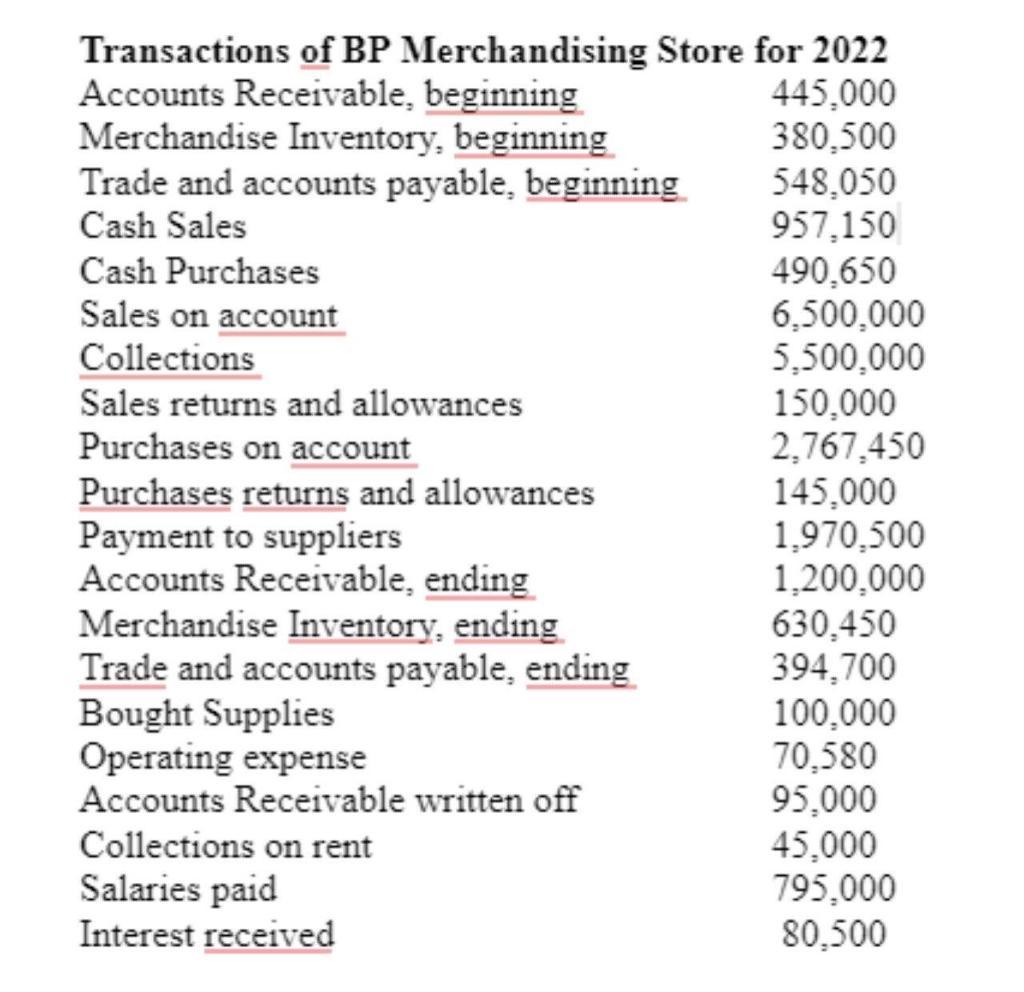

BP purchased machinery amounting to 300,000 on the beginning of its 1st year of operations with a 10 years useful life and a salvage value of 15,000 Purchased store equipment for 600,000 with a useful life of 15 years unused supplies accrued interest receivable 30,500 25,000 unearned rent income for 3 months at 5,000 each month accrued salaries payable 180,000 1. Compute the following under cash basis and accrual basis of accounting a. Net Sales b. Gross sales under accrual basis assuming sales on account is not given c. Gross and net purchases d. Gross purchases under accrual basis assuming purchases on account is not given e. Interest Income f. Rent Income g. Salaries h. Supplies expense i. Depreciation expense 1. Income Statement - cash basis 2. Income Statement - accrual basis How will you propose to Mr. Tiu on what basis of accounting is the best for her business and why should she follow it. Transactions of BP Merchandising Store for 2022 Accounts Receivable, beginning Merchandise Inventory, beginning 445,000 380,500 Trade and accounts payable, beginning Cash Sales Cash Purchases Sales on account Collections Sales returns and allowances Purchases on account Purchases returns and allowances Payment to suppliers Accounts Receivable, ending Merchandise Inventory, ending Trade and accounts payable, ending Bought Supplies Operating expense Accounts Receivable written off Collections on rent Salaries paid Interest received 548,050 957,150 490,650 6,500,000 5,500,000 150,000 2,767,450 145,000 1,970,500 1,200,000 630,450 394,700 100.000 70,580 95,000 45,000 795,000 80,500

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a Net Sales Cash basis Net sales 300000 600000 30500 25000 15000 1075500 Accru...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started