Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BPPB is a British MNC in the resource extraction industry. The firm has a AUD1,971,670 obligation to a supplier that must be paid exactly

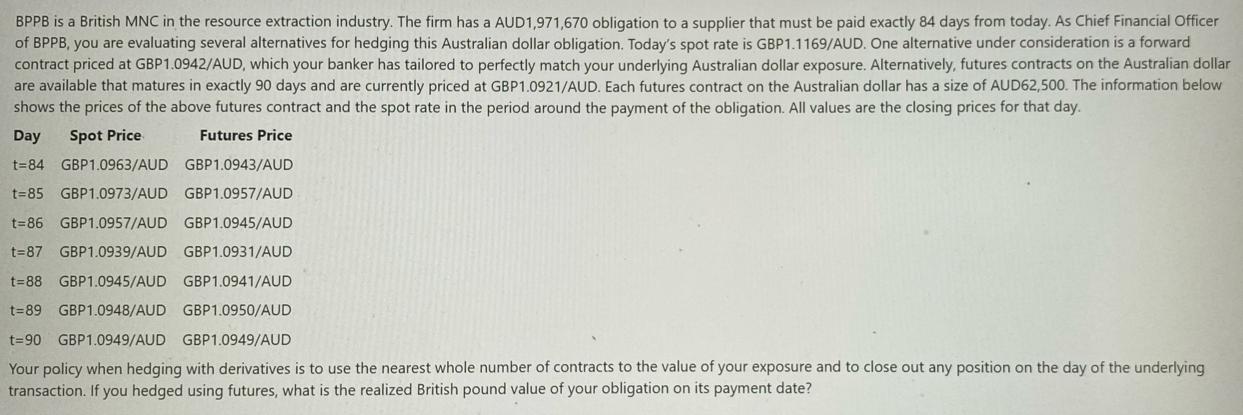

BPPB is a British MNC in the resource extraction industry. The firm has a AUD1,971,670 obligation to a supplier that must be paid exactly 84 days from today. As Chief Financial Officer of BPPB, you are evaluating several alternatives for hedging this Australian dollar obligation. Today's spot rate is GBP1.1169/AUD. One alternative under consideration is a forward contract priced at GBP 1.0942/AUD, which your banker has tailored to perfectly match your underlying Australian dollar exposure. Alternatively, futures contracts on the Australian dollar are available that matures in exactly 90 days and are currently priced at GBP1.0921/AUD. Each futures contract on the Australian dollar has a size of AUD62,500. The information below shows the prices of the above futures contract and the spot rate in the period around the payment of the obligation. All values are the closing prices for that day. Spot Price Day Futures Price t=84 GBP1.0963/AUD GBP 1.0943/AUD t=85 GBP1.0973/AUD GBP1.0957/AUD t=86 GBP1.0957/AUD GBP1.0945/AUD t=87 GBP1.0939/AUD GBP1.0931/AUD t=88 GBP 1.0945/AUD GBP1.0941/AUD t=89 GBP 1.0948/AUD GBP1.0950/AUD t=90 GBP1.0949/AUD GBP 1.0949/AUD Your policy when hedging with derivatives is to use the nearest whole number of contracts to the value of your exposure and to close out any position on the day of the underlying transaction. If you hedged using futures, what is the realized British pound value of your obligation on its payment date?

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the realized British pound value of the obligation on its payment date we need to compa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started