Answered step by step

Verified Expert Solution

Question

1 Approved Answer

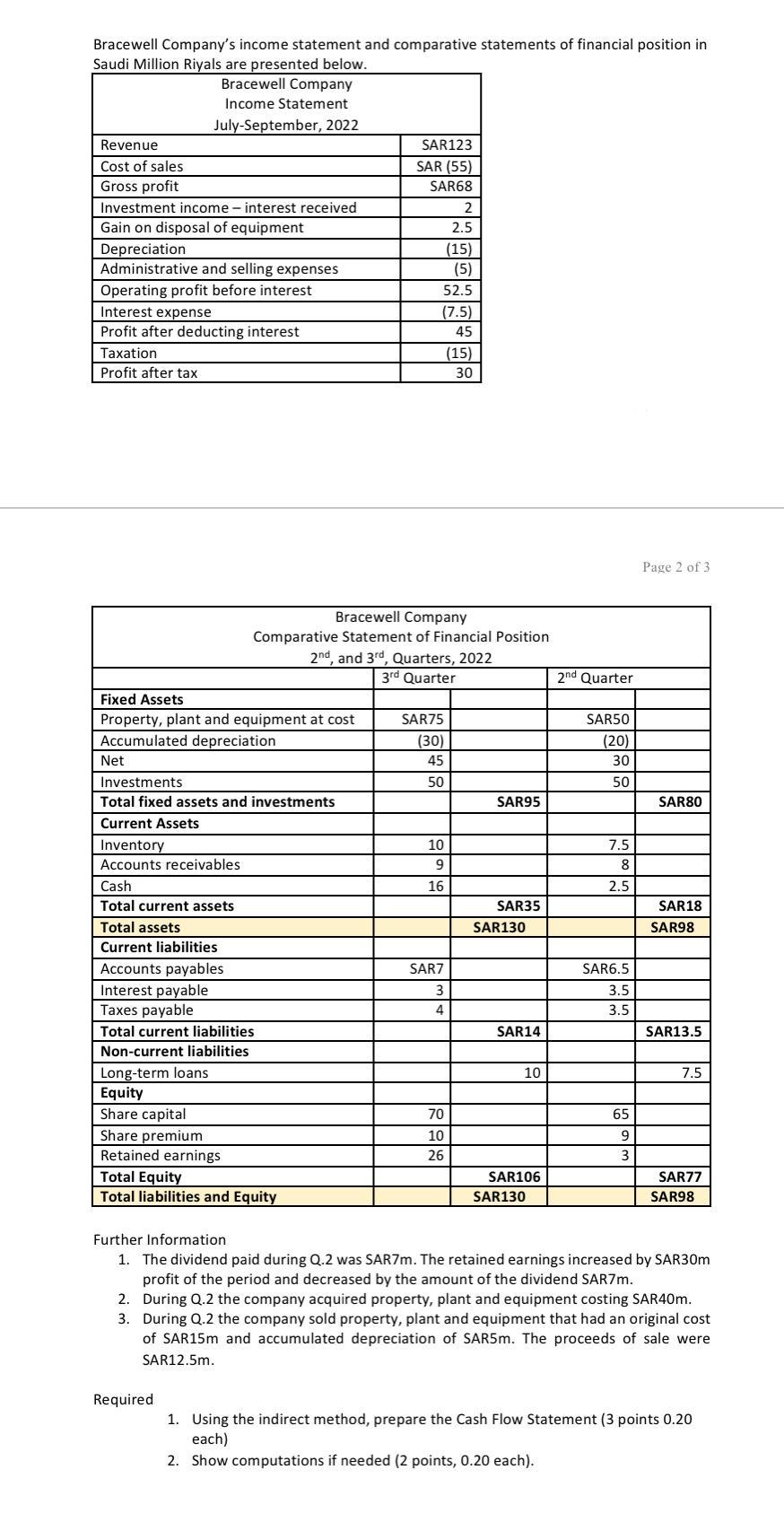

Bracewell Company's income statement and comparative statements of financial position in Saudi Million Riyals are presented below. Revenue Cost of sales Gross profit Investment

Bracewell Company's income statement and comparative statements of financial position in Saudi Million Riyals are presented below. Revenue Cost of sales Gross profit Investment income interest received Gain on disposal of equipment Bracewell Company Income Statement July-September, 2022 Depreciation Administrative and selling expenses Operating profit before interest Interest expense Profit after deducting interest Taxation Profit after tax Net Fixed Assets Property, plant and equipment at cost Accumulated depreciation Investments Total fixed assets and investments Current Assets Inventory Accounts receivables: Cash Total current assets Total assets Current liabilities Accounts payables Interest payable Taxes payable Total current liabilities Non-current liabilities Long-term loans Equity Share capital Share premium Retained earnings Bracewell Company Comparative Statement of Financial Position 2nd, and 3rd, Quarters, 2022 3rd Quarter Total Equity Total liabilities and Equity Required SAR123 SAR (55) SAR68 2 2.5 (15) (5) 52.5 (7.5) 45 SAR75 (30) 45 50 10 9 16 SAR7 3 4 (15) 30 70 10 26 SAR95 SAR35 SAR130 SAR14 10 SAR106 SAR130 2nd Quarter SAR50 (20) 30 50 7.5 8 2.5 SAR6.5 3.5 3.5 65 9 3 Page 2 of 3 SAR80 SAR18 SAR98 SAR13.5 7.5 SAR77 SAR98 Further Information 1. The dividend paid during Q.2 was SAR7m. The retained earnings increased by SAR30m profit of the period and decreased by the amount of the dividend SAR7m. 2. During Q.2 the company acquired property, plant and equipment costing SAR40m. 3. During Q.2 the company sold property, plant and equipment that had an original cost of SAR15m and accumulated depreciation of SAR5m. The proceeds of sale were SAR12.5m. 1. Using the indirect method, prepare the Cash Flow Statement (3 points 0.20 each) 2. Show computations if needed (2 points, 0.20 each).

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

CASH FLOW FROM OPERATING ACTIVITY 4...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started