Answered step by step

Verified Expert Solution

Question

1 Approved Answer

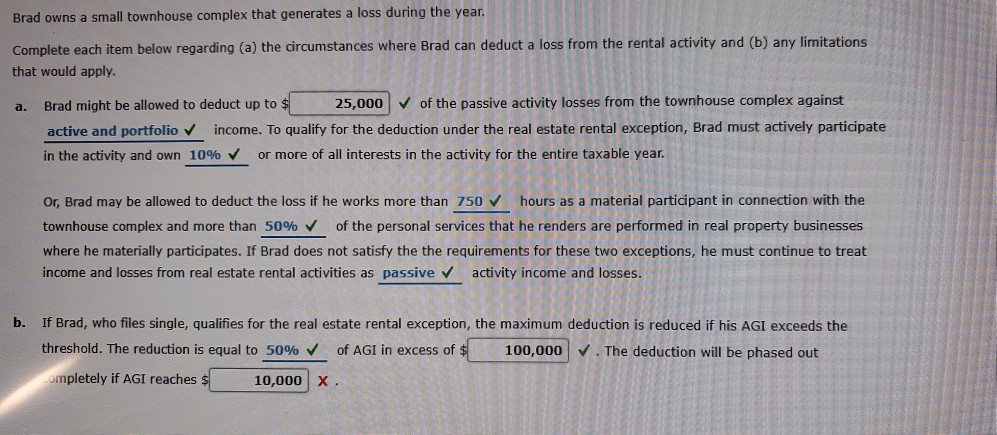

Brad owns a small townhouse complex that generates a loss during the year. Complete each item below regarding (a) the circumstances where Brad can deduct

Brad owns a small townhouse complex that generates a loss during the year. Complete each item below regarding (a) the circumstances where Brad can deduct a loss from the rental activity and (b) any limitations that would apply. a. Brad might be allowed to deduct up to $ 25,000 of the passive activity losses from the townhouse complex against active and portfolio income. To qualify for the deduction under the real estate rental exception, Brad must actively participate in the activity and own 10% or more of all interests in the activity for the entire taxable year. Or, Brad may be allowed to deduct the loss if he works more than 750 hours as a material participant in connection with the townhouse complex and more than 50% of the personal services that he renders are performed in real property businesses where he materially participates. If Brad does not satisfy the the requirements for these two exceptions, he must continue to treat income and losses from real estate rental activities as passive activity income and losses. b. If Brad, who files single, qualifies for the real estate rental exception, the maximum deduction is reduced if his AGI exceeds the threshold. The reduction is equal to 50% of AGI in excess of $ 100,000 V. The deduction will be phased out completely if AGI reaches $ 10,000 x X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started